The price test at 1.1684 occurred at a time when the MACD indicator had moved significantly above the zero line, limiting the pair's upside potential—especially after the strong downturn seen earlier. For this reason, I did not buy the euro.

Yesterday's trading session showed market participants attempting to exert downward pressure on the euro on the back of political instability in France. However, buyers eventually regained some control, providing temporary support for the single currency. The uncertainty triggered by the resignation of yet another French prime minister and the scheduling of early elections continues to weigh negatively on the euro.

Additional pressure comes from anticipation surrounding future decisions by the European Central Bank. Despite a recent drop in inflation, the ECB's monetary policy outlook remains rather restrictive, which dampens hopes for Eurozone economic growth this year.

Today, we expect several key releases in the first half of the day:

Today, I will primarily follow Buy Scenarios 1 and 2 as outlined below.

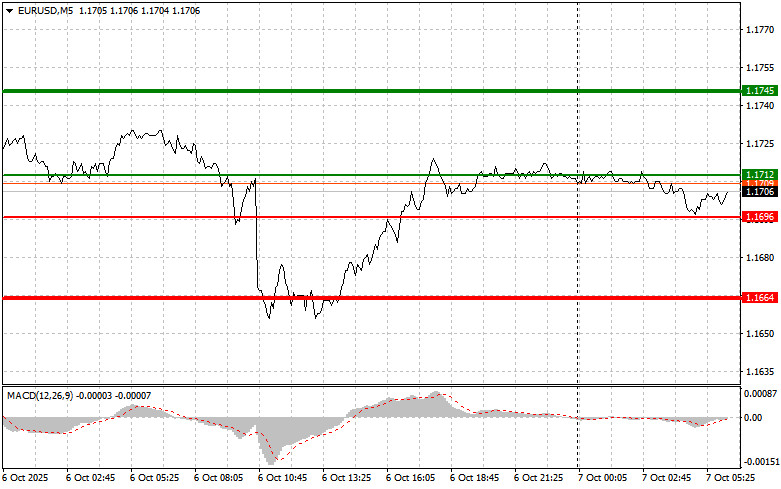

Scenario #1: Buy the euro at a price level near 1.1712 (green line on the chart), aiming for a rise toward 1.1745. At 1.1745, I plan to exit the trade and potentially sell the euro in the opposite direction, expecting a 30–35 pip pullback.

Important: Before buying, ensure the MACD indicator is above the zero line and just beginning to rise from that level.

Scenario #2: Also looking to buy if the price twice tests the 1.1696 level and the MACD is in the oversold area. This would limit the pair's downside potential and may trigger a reversal to the upside, targeting the 1.1712 and 1.1745 levels.

Scenario #1: Sell the euro following a price move to 1.1696 (red line on the chart). Target a drop to 1.1664, where I plan to exit and immediately open a buy position in the opposite direction, expecting a 20–25 pip retracement.

Important: Before selling, confirm the MACD is below the zero line and just beginning to move downward.

Scenario #2: Another opportunity to sell will emerge if the price tests the 1.1712 level twice, while the MACD is in the overbought zone. This would limit the pair's upward potential and may lead to a downward reversal toward the support levels of 1.1696 and 1.1664.

Beginner traders must exercise great caution when making entry decisions in the market—especially before major fundamental data releases. It's often best to stay out of the market during such events to avoid sharp market moves that go against active trades.

If you do choose to trade during news releases, always use stop-loss orders to minimize risk. Trading without a stop-loss, especially with large volumes or poor risk management, can lead to a rapid and complete loss of your trading account.

Remember: successful trading relies on having a clear plan, such as the one outlined above. Making trades based on emotion or reacting impulsively to market movements is a losing strategy, especially for intraday traders.

ĐƯỜNG DẪN NHANH