On Wednesday, the US stock market closed higher, with the S&P 500 gaining 0.27%, the Nasdaq 100 rising 0.09%, and the Dow Jones Industrial Average advancing 0.43%.

However, during Asian trading hours today, futures on US stock indices turned lower, and the US dollar strengthened after President Donald Trump escalated trade tensions by suggesting the possibility of increasing tariffs for most trade partners. Futures contracts on the S&P 500 and European equities fell by 0.2% following Trump's statement that he plans to impose a universal tariff rate of 15% to 20%, up from the current 10%. The Canadian dollar also weakened significantly after Trump announced a 35% tariff on select Canadian imports.

Trump's remarks, which came as a surprise, sent ripples through financial markets, triggering investor anxiety. The proposed broad-based tariffs mark a sharp departure from his earlier commitments and could seriously undermine global economic relationships. Investors worry that such measures could lead to higher import prices, reduced competitiveness for American companies, and an overall slowdown in economic growth.

Meanwhile, Asian indices extended their gains after Goldman Sachs strategists raised their outlook for regional equities—excluding Japan—citing improved macroeconomic conditions and reduced tariff risks.

This week has seen a notable uptick in trade tensions as Trump moved ahead with plans to impose tariffs on various partners in a push to reshape global trade arrangements, which he argues are unfavorable to the US. Nonetheless, investors continued to pour money into stocks, with the S&P 500 closing Thursday at a fresh all-time high. This suggests that market participants are shifting their focus away from concerns about slowing growth and rising inflation, and instead preparing for the upcoming earnings season.

In parallel, Beijing is expected to announce a new round of monetary and fiscal stimulus measures to support China's slowing economy, which is grappling with weak domestic demand, a property sector crisis, and escalating geopolitical tensions. Potential steps include a cut in interest rates by the People's Bank of China to make borrowing cheaper for businesses and consumers. Additional measures under consideration include ramping up government spending on infrastructure projects such as roads, railways, and airports. These investments would not only stimulate economic activity but also create new jobs. Moreover, tax cuts for small and medium-sized enterprises are also being discussed to ease financial pressures and enable reinvestment and production expansion—crucial for China's economic recovery.

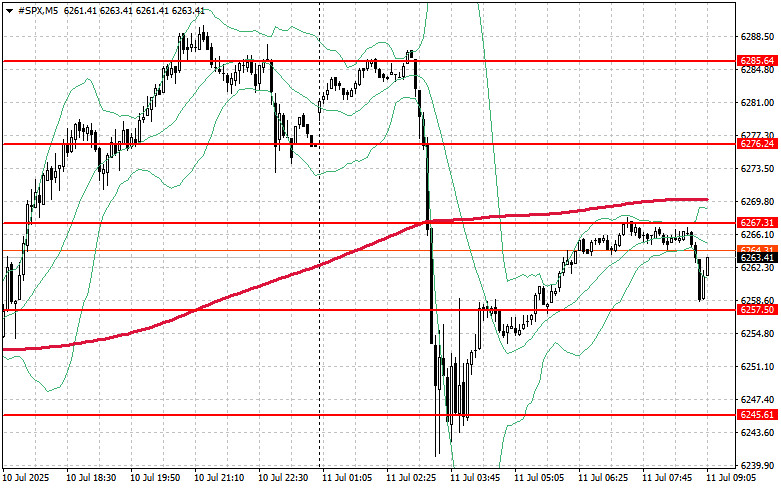

From a technical standpoint, bulls today will aim to break through the nearest resistance level at $6,267. A successful breach would pave the way for a climb toward $6,276, with the next key target being $6,285, which would solidify the buyers' control. On the downside, should risk appetite wane, it is essential for buyers to assert themselves around $6,257. A break below this level would likely drag the index down to $6,245, and potentially further to $6,234.

HIZLI BAĞLANTILAR

show error

Unable to load the requested language file: language/turkish/cookies_lang.php

date: 2025-12-07 12:58:47 IP: 172.18.0.1