The GBP/USD currency pair continued to trade relatively quietly on Tuesday, but with an upward bias. In just a week, the highly anticipated Fed meeting will take place—a market event awaited as eagerly as the NFP or unemployment figures. In principle, there is no intrigue left, as the latest labor market and unemployment reports showed no improvement. So, with a 99.9% probability, the Fed is expected to cut the key rate by 0.25%. Why not more?

The answer is simple but requires explanation. In short, because Jerome Powell remains Chair, the FOMC committee composition is still independent. Donald Trump is doing everything possible to ensure that Powell and all his colleagues who refuse to vote for a rate cut leave their posts as soon as possible, but even the US president can't solve this "problem" in just a few weeks. So, Trump will have to wait regardless.

While he waits, Powell and his team will stick closely to the plan set at the start of the year. Recall that since January, all "dot-plot" projections have indicated two rate cuts for this year. The Fed still maintains independence from Trump and will not turn a blind eye to inflation. Therefore, nobody is going to rush and cut rates headlong. Two rounds of easing through the end of 2025 look like the base scenario.

Over the summer, the macroeconomic data situation changed, and now inflation is no longer the Fed's priority. More precisely, the Fed simply can't achieve both maximum employment and low inflation at the same time. However, the Fed's mandates should be properly understood: it is mandated to AIM for maximum employment and price stability. And that's exactly what the US central bank will continue to do.

To keep inflation in check, the rate shouldn't be cut too much or too often. To stimulate the labor market, the rate needs to be cut. Thus, the Fed is 99% likely to choose an intermediate option where the labor market is revived from its "knockdown," but inflation is not allowed to float freely. And the market had a chance to price in two rounds of policy easing since the start of the year. Therefore, the dollar isn't likely to see another collapse across the market just because of this factor.

But if we reassess the whole fundamental backdrop, it becomes clear—the dollar will keep falling. It's unlikely to be as rapid as in the first half of 2025, but it will keep falling regardless. On the daily timeframe, the technical picture is fairly clear. We saw a minor correction, and now a new round of the uptrend has started. Accordingly, we have little doubt that by year-end, the pound sterling could reach $1.40—something it hasn't done since 2021.

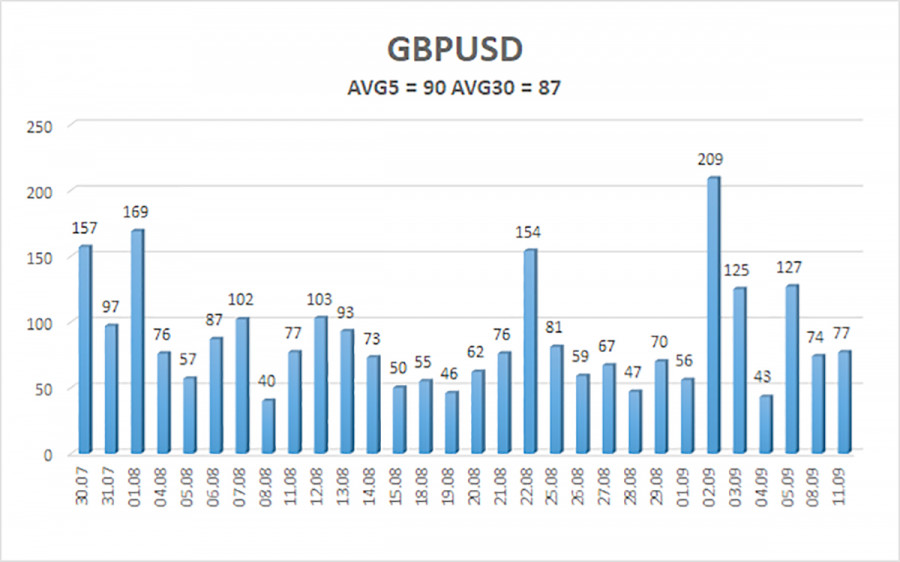

The average volatility for GBP/USD over the last five trading days is 90 pips, considered "average" for the pair. On Wednesday, September 10, we expect movement within a range limited by levels 1.3448 and 1.3628. The linear regression channel's upper band is pointing upward, indicating a clear uptrend. The CCI indicator again entered the oversold area, warning once more of an uptrend's resumption.

S1 – 1.3489

S2 – 1.3428

S3 – 1.3367

R1 – 1.3550

R2 – 1.3611

R3 – 1.3672

The GBP/USD pair is once again seeking to resume its uptrend. In the medium term, Trump's policies are likely to keep putting pressure on the dollar, so we do not expect the dollar to rise. Thus, long positions with targets at 1.3611 and 1.3672 remain much more relevant while the price is above the moving average. If the price falls below the moving average, small shorts can be considered on strictly technical grounds. The US currency occasionally shows corrections, but it will need clear signs of the end of the global trade war or other major positive factors for any trend reversal.

RÁPIDOS ENLACES