One cannot chase technology and artificial intelligence stocks forever. Sooner or later, it becomes clear that they are overbought. Two days of decline do not yet constitute a trend, but the drop in the S&P 500 shows that investors are not confident in the continuation of the rally. Still, as long as the crowd keeps buying the dips, the broad stock index is unlikely to sink too deeply.

NVIDIA triggered the pullback of the S&P 500 from record highs. A bad example is contagious. The following day, other tech giants, led by Apple, followed suit. Apple's stock fell 2%. Overall, eight issuers with market capitalizations of 1 trillion dollars or more closed in the red. This pulled the broad index lower, despite gains in 7 out of 11 sectors.

The P/E ratio for tech giants fell from 31 at the end of July to 29.6. The figure is still high. For market veterans, the situation is starting to resemble the 1990s, when a combination of inflated valuations, ultra-low volatility, and the Federal Reserve's willingness to save the U.S. economy by cutting the federal funds rate triggered a stock market crisis—known as the dot-com crash. Could NVIDIA and other tech companies take the place of that episode?

Investors don't think so. The crowd is still inclined to buy the dip, while asset managers are struggling to keep up with the S&P 500 rally. Their net long positions diverge from the broad index's chart. A serious driver is needed for profit-taking and a shift to short positions. Could Jerome Powell's speech at Jackson Hole become that trigger?

Donald Trump is so eager to see the Fed ease monetary policy that he sometimes takes rash steps. The U.S. President called on FOMC member Lisa Cook to resign over alleged mortgage fraud. This happened just before the central bankers' meeting in Wyoming.

Perhaps Powell was preparing to deliver a dovish speech, but a reminder of unprecedented pressure from the White House will likely hold the Fed Chair back. He does not want to go down in history the way one of his predecessors did. In the 1970s, Arthur Burns yielded to then-President Richard Nixon and cut rates, which led to a double recession in the U.S. economy.

Markets are eagerly awaiting Jackson Hole. Will Powell's speech trigger a correction in the broad stock index?

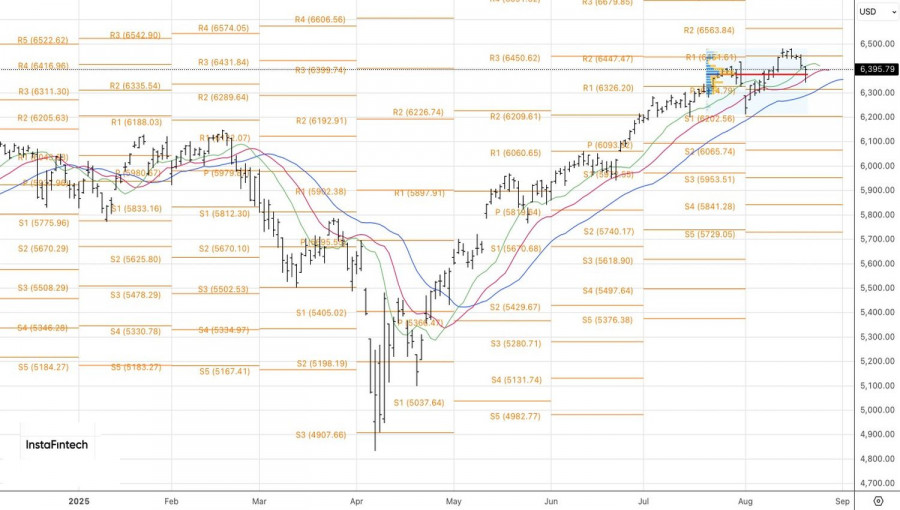

Technically, on the daily S&P 500 chart, a rebound from fair value at 6375 formed a pin bar with a long lower shadow. A breakout above its upper boundary near 6407 may serve as a basis for buying. Failure by the bulls would allow traders to return to short positions.

RÁPIDOS ENLACES