Scheduled Maintenance

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

There are very few macroeconomic publications scheduled for Friday, but the volume is still greater than on any previous day this week. The UK will release GDP and industrial production data. These might appear to be important enough to trigger a reaction, but any market response will likely stem from the otherwise empty economic calendar rather than the significance of these reports. The GDP report covers monthly data, not quarterly, so industrial production is likely to carry more weight.

There are no notable fundamental events scheduled for Friday. As mentioned earlier, recent speeches from ECB, Fed, and Bank of England officials have had minimal influence on the market. The monetary policy stance of all three central banks is already clear, leaving little room for interpretation. At present, monetary policy itself has almost no direct impact on currency movements.

The trade war remains the primary concern for markets, and there are still no signs of a resolution. Tensions continue to rise, as President Donald Trump has managed to conclude only three trade agreements so far, one of which is highly questionable. Furthermore, the market sees little reason for optimism while tariffs remain in place. This week, the U.S. president decided once again to increase tariffs on countries reluctant to engage in negotiations with Washington (i.e., nearly all of them), while also raising import duties on copper, pharmaceuticals, and semiconductors. Clearly, the situation is not improving. Therefore, we still see no grounds for sustained U.S. dollar growth.

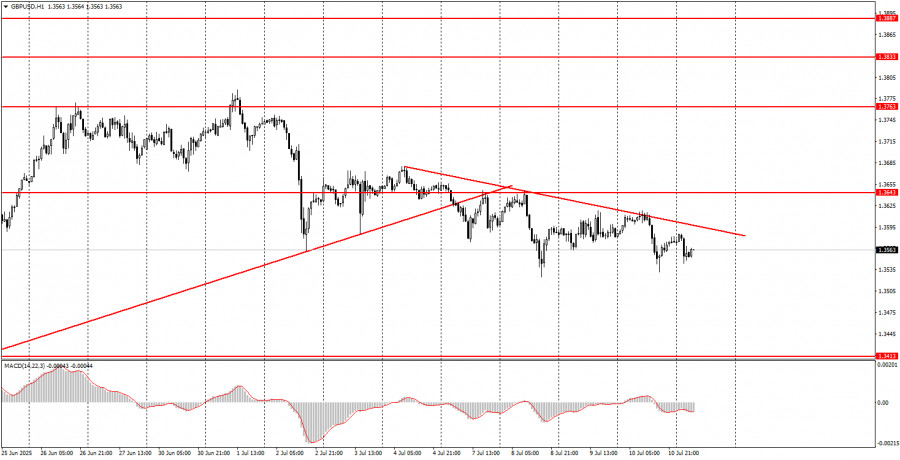

On the final trading day of the week, both major currency pairs may show subdued activity, as no important events or reports are scheduled. The ongoing technical corrections may end at any moment. Both EUR/USD and GBP/USD are trading below descending trendlines; a breakout above these lines would indicate a trend reversal.

Beginner traders should remember that not every trade will be profitable. Developing a clear strategy and sound money management are essential for long-term success in Forex trading.

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

RÁPIDOS ENLACES