Washington – Spojené státy začínají vybírat základní desetiprocentní clo při dovozu zboží ze všech zemí světa. Clo na prakticky veškeré zboží vyhlásil ve středu americký prezident Donald Trump.

On Monday, the EUR/USD pair rebounded from the 127.2% Fibonacci retracement level at 1.1712 and rose toward the next level at 1.1802. A rebound from this level would favor the US dollar and lead to a slight decline toward 1.1712. A breakout and close above 1.1802 would support further growth toward the next Fibonacci level at 1.1888. The bullish trend remains intact and continues almost daily.

The wave structure on the hourly chart remains simple and clear. The last completed downward wave broke the previous low, while the new upward wave broke the previous high. As a result, the trend has once again turned bullish. The lack of real progress in US-China and US-EU negotiations, the Fed meeting, and the Middle East conflict have all failed to support the dollar. As expected, the recent bearish trend did not turn out to be strong or prolonged.

On Monday, the news background had little impact on traders. The market continued to offload the unwanted dollar amid Donald Trump's tariff policies and his ongoing confrontation with the Federal Reserve. Frankly speaking, Trump has very slim chances of defeating the Fed, but traders are likely pricing in the most pessimistic scenario—namely, further monetary policy easing in both 2025 and 2026, when a new Fed Chair will be appointed. Despite Jerome Powell and most of his colleagues continuing to argue against rate cuts at this time, the market is once again expecting a dovish scenario. Thus, the dollar, which is already under significant pressure, faces additional negative factors. The situation continues to deteriorate, and the US currency remains in a downward trend.

On the 4-hour chart, the pair has risen and consolidated above the 1.1680 level, which supports further growth toward the next Fibonacci retracement level at 1.1851. A rebound from 1.1851 would favor the US dollar and trigger a slight decline, but within the boundaries of the ongoing ascending trend channel. No emerging divergences are observed on any indicators today.

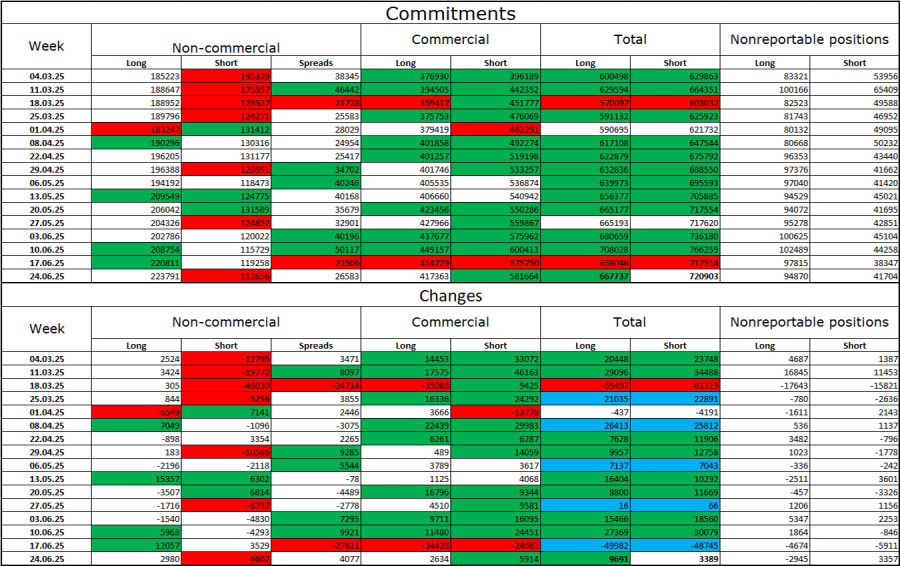

Commitments of Traders (COT) Report:

During the last reporting week, professional traders opened 2,980 long positions and closed 6,602 short positions. The sentiment among the "Non-commercial" group remains bullish thanks to Donald Trump—and it continues to strengthen over time. The total number of long positions held by speculators now stands at 224,000, while short positions total 112,000. With few exceptions, this gap continues to widen. This indicates strong demand for the euro, while the dollar remains out of favor. The situation remains unchanged.

For 21 consecutive weeks, large market participants have been reducing short positions and increasing long ones. Despite a significant divergence in monetary policy between the ECB and the Fed, Donald Trump's policies are seen as a more influential factor by traders, as they may trigger a US recession and bring long-term, structural problems for the American economy.

Economic Calendar for the US and Eurozone:

The July 1 economic calendar is packed with important releases. Therefore, the news background may strongly influence market sentiment throughout the day on Tuesday.

EUR/USD Forecast and Trader Recommendations:

Selling the pair today should only be considered in case of a rebound from the 1.1802 level on the hourly chart, with a target at 1.1712. I previously recommended buying from the rebound off 1.1454, with targets at 1.1574, 1.1645, 1.1712, and 1.1802. All those targets have been reached. New buy positions may be considered upon a confirmed breakout above 1.1802, with a target at 1.1888.

Fibonacci level grids are drawn from 1.1574–1.1066 on the hourly chart and from 1.1214–1.0179 on the 4-hour chart.

RÁPIDOS ENLACES