Automobilka Stellantis v pátek oznámila, že výroba jejího městského elektromobilu Fiat 500 bude pozastavena až do 20. ledna, což potvrdily odbory. Dočasné zastavení montážních linek v továrně Mirafiori v severní Itálii začalo v prosinci kvůli nízké poptávce po elektromobilech v Evropě. Stellantis na jednání se zástupci odborů rovněž prozradil, že výroba dvou malosériových modelů sportovních vozů Maserati bude zastavena do 3. února. Automobilka tak tento týden představila italské vládě plán na oživení výroby v Itálii, ačkoli podle šéfa evropských operací Jeana-Philippa Imparata se očekávané efekty tohoto plánu projeví až v roce 2026. Prognózy svazu FIM-Cisl odhadují, že celková výroba automobilů v Itálii, včetně osobních a dodávkových vozů, klesne v letošním roce pod 500 000 vozidel, což je nejnižší úroveň od roku 1958.

Canada's gross domestic product rose 0.6% in January, the strongest growth since January 2023, while the preliminary estimate of February GDP points to a growth of 0.4%. In addition, first quarter economic activity is tracking a rise of 3.5% q/q. The economic recovery is notably ahead of the Bank of Canada's estimate and may have an impact on the central bank's rate plans, as stronger economic growth removes the need to ease financial conditions.

The Bank of Canada assumed that the first half of the year would be weak, so it focused on inflation - a slowdown in price growth was the main condition for the start of a rate-cutting cycle. The reality turned out to be different, and now the Bank of Canada has no need to do anything and can resist the pressure to lower rates.

The Manufacturing PMI index rose to 49.8 in March from 49.7 the month before, a minor change and still in negative territory, but there are obvious upsides here - a sharp pullback from the lows of late last year, confidence in the 12-month growth outlook has increased significantly, and new orders are at a 13-month high.

This means that the loonie has the opportunity to strengthen, but other factors must play a role, primarily the state of the U.S. economy, Canada's largest trading partner. If U.S. demand remains strong, supporting Canada's exports, the trade-weighted CAD exchange rate will increase, stimulating demand for the currency.

Canada's March labor market report will be released on Friday. Unexpectedly strong economic growth is expected to be one of the drivers of the labor market as well, employment has already increased by 80k in Jan-Feb (compared to a 100k increase in the last 4 months).

It may seem that the situation works in favor of the loonie and that we can expect USD/CAD to fall, but this is a deceptive impression. All the aforementioned positive aspects will have an impact in the coming months, but the Fed's stance and the economic growth in the US is more important. If it remains steady, it will have a positive impact on the dollar's strength, and other currencies, especially commodity currencies, can only benefit from a sustained rise in commodity prices and an increase in global demand, which there are serious doubts about. In any case, we must wait for new data before adjusting forecasts.

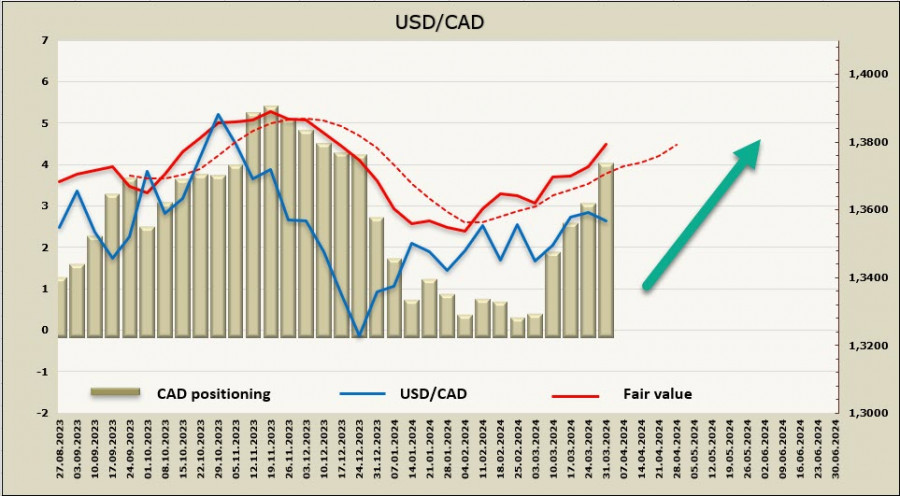

The net short CAD position increased by 964 million to -3.7 billion during the reporting week, positioning is bearish, the price is steadily moving upwards.

Since January, USD/CAD has been trading predominantly in a sideways range with a slight bullish bias. The growth of short positions reflects the position of long-term investors, who see the threat of yield spread growth in favor of the dollar. The pair is getting close to the resistance zone at 1.3610/20, so we should expect an attempt to climb towards the local high of 1.3897.

LINKS RÁPIDOS