Brno – Česká firma LPP holding vyvinula a vyrábí drony řízené umělou inteligencí (AI), které jsou odolné vůči nepřátelským rušičkám. Na Ukrajinu jich firma dodala už stovky. Zájem o ně projevila i česká armáda, řekl dnes ČTK na veletrhu IDET spolumajitel společnosti Radim Petráš. Firma drony dnes představila na brněnském výstavišti.

Investors took the lawsuit against Jerome Powell in stride, allowing the S&P 500 to hit a new record high

Fear is often exaggerated. Concerns that the suit could ignite a renewed "sell America" trade over threats to Fed independence—if the central bank, at the White House's behest, began aggressively loosening policy, leading to runaway inflation and a double?dip recession—did not materialize in market panic. In practice, the broad index reacted fairly calmly to the threat.

The Fed's independence remains sacrosanct for equity markets. Investors understand that several months remain before Jerome Powell would leave the Fed chairmanship. The suit against him matters less than the court verdict in the Lisa Cook case on January 21. If the White House succeeds in removing the FOMC governor, it would set a precedent. Donald Trump's chances of flooding the Committee with "doves" would rise, along with the probability of aggressive federal funds rate cuts.

Dynamics of US Stock Indices

Former Fed chairs backed Jerome Powell. Alan Greenspan, Ben Bernanke, and Janet Yellen warned that White House intervention in monetary policy would end badly. Experience in other, mainly emerging, economies proves the point: Argentina, Turkey, and many others tried fiscal dominance and ended up ruined. Their economies were shaken by sky?high inflation and currency crises.

Markets do not believe this could happen in the United States. The Fed is not a one?man show, and decisions are made collectively. Moreover, attacks on Powell could backfire. After his term as chair expires, he could remain on the FOMC, as the law allows.

According to JP Morgan, investors are not easily frightened. Any escalation of conflict between the White House and the Fed, the bank says, is a good excuse to buy the S&P 500 on a pullback. Small?caps look even better at the start of the year.

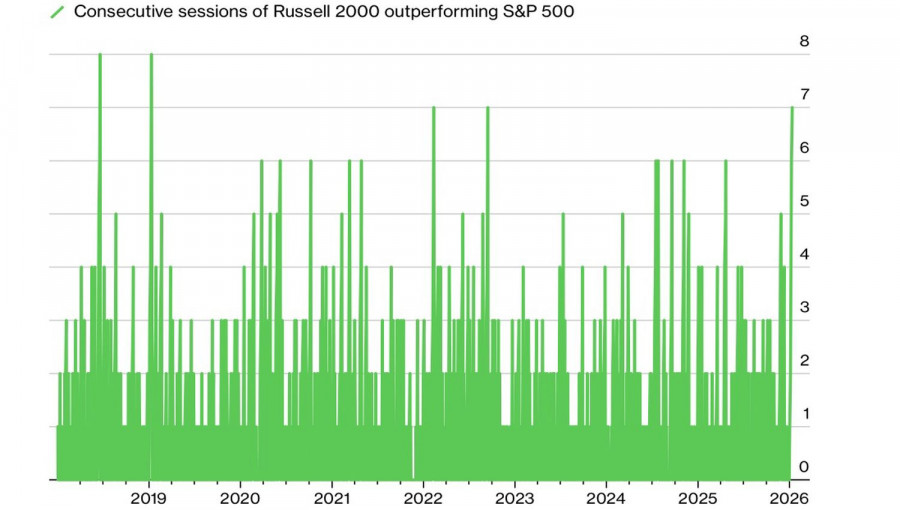

Russell 2000 Lead Days vs S&P 500

Russell 2000 has outperformed the broad index for seven consecutive days, something not seen since early 2019. Then the US market was recovering from late?2018 sell?offs. Today, rotation is in full swing. Investors are shedding mega?cap tech names and buying sectors sensitive to the health of the US economy.

The market is preparing for the release of December inflation data in the US, which will clarify the Fed's stance.

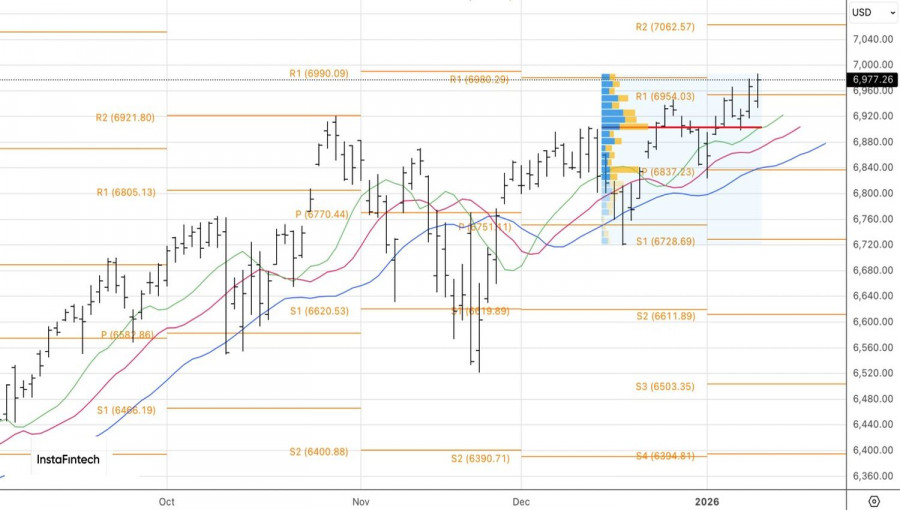

Technically, the daily chart shows that the S&P 500 continues an uphill march. Long positions opened at 6,931 and below should be held and occasionally increased. As long as the broad index trades above fair value at 6,900, sentiment remains bullish.

SZYBKIE LINKI