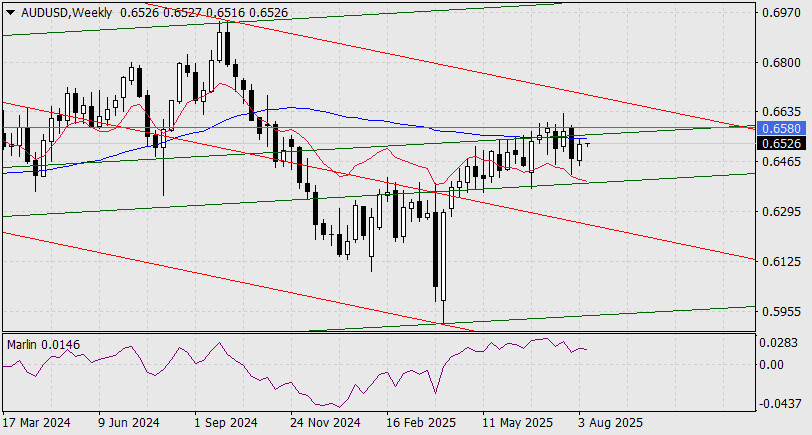

The Australian dollar has reached the daily balance indicator line and started consolidating. At the same time, the Marlin oscillator has moved into positive territory and is also consolidating. Conditions are forming for an upward breakout with an attack on the first target along the MACD line in the area of 0.6580.

However, if we look at the AUD/USD chart without considering the weekly timeframe, we might draw the wrong conclusion. On the weekly chart, we observe that the price has settled below the MACD line, and on Friday, there was a test of this line from below with the upper shadow of the candlestick. Such a pattern often leads to a downward reversal. The Marlin oscillator is declining. Even if the price surpasses last week's high and moves above the MACD line, it will immediately face resistance from the embedded green price channel line. Slightly above this line lies the daily MACD line (0.6580).

The bulls can only take on such a challenging task if they receive strong fundamental support. In the current political turmoil, such support could emerge, but if the price fails to consolidate above 0.6580, it will prove to be false. Therefore, we expect the situation to become clearer by the end of the week. The main scenario remains bearish.

On the four-hour chart, the MACD line is moving horizontally. After relieving tension, the Marlin oscillator has also started moving sideways above the zero line. The price itself is in a neutral state, and this situation may persist for several days.

SZYBKIE LINKI