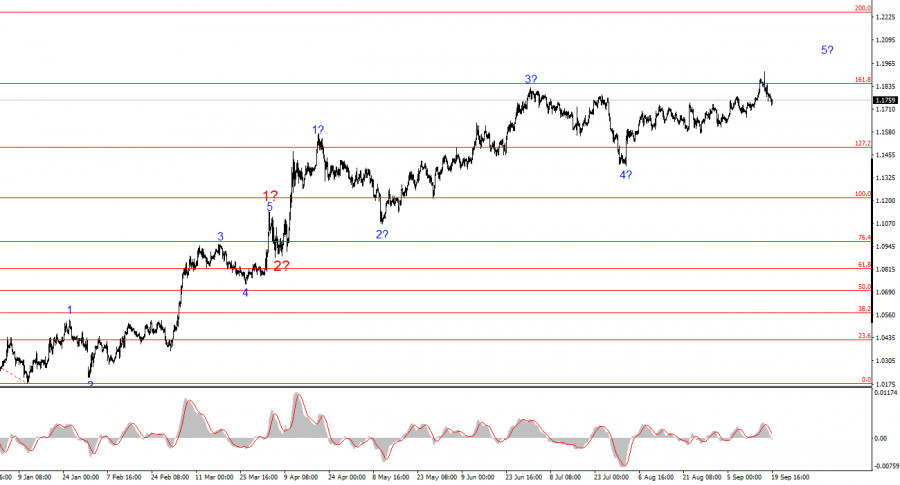

The wave pattern on the 4-hour chart for EUR/USD has remained unchanged for several months, which is very encouraging. Even when corrective waves form, the structure's integrity is preserved, allowing for accurate forecasts. Recall that wave structures do not always look like textbook examples. At present, however, the pattern looks very good.

The upward segment of the trend continues to develop, while the news background largely does not support the dollar. The trade war initiated by Donald Trump continues. The confrontation with the Fed continues. Market expectations for Fed rate cuts are becoming more dovish. The market's assessment of Trump's first 6–7 months in office is very low, even though Q2 economic growth reached 3%.

At the moment, it can be assumed that an impulsive wave 5 is still developing, with potential targets extending as far as the 1.25 area. Inside this wave, the structure is somewhat complex due to the sideways movement observed in the last month. Nevertheless, the first and second waves can be identified. Therefore, I believe the instrument will continue rising, as the impulsive wave is not yet complete.

The EUR/USD pair fell by 30 basis points during Friday. This would not be a big deal if the euro had not lost about 80 points on Wednesday and Thursday. A total of 110 points in less than three days is quite a lot, given the news background. Let's be honest: if the market had continued buying the euro after the Fed meeting, would anyone have been surprised? Last week's ECB meeting showed market participants that the regulator does not intend to continue cutting rates. Inflation has effectively been defeated, so the need for further monetary easing could only arise if the CPI falls further below the 2% target. According to Christine Lagarde, a slight increase in inflation is possible in the near term, so easing this year should not be expected.

The situation with the Fed is different. This week, the FOMC decided to cut rates, but this was not a one-off concession to market participants and Trump, who in 2025 openly demanded monetary easing. It is only the beginning of a prolonged cycle. Just last week, the market expected two cuts by year-end; now it expects three. Thus, dovish expectations have strengthened, and Jerome Powell, in his regular speech, did not deny that such a scenario is possible.

Based on all the above, I see no strong reasons for a significant decline in the pair or for changing the current wave pattern. The presumed wave 3 of 5 has taken on a five-wave structure, so the market may now be forming wave 4 of 5, a corrective wave. Accordingly, I expect the resumption of growth next week.

Based on EUR/USD analysis, I conclude that the instrument continues to build an upward segment of the trend. The wave structure still fully depends on the news background tied to Trump's decisions and the domestic and foreign policy of the new US administration. The targets of the current segment may extend up to the 1.25 level. The news background remains unchanged, so I continue to stay in long positions, despite the first target around 1.1875 (161.8% Fibonacci) already being reached. By year-end, I expect the euro to rise to 1.2245, which corresponds to the 200.0% Fibonacci level.

On a smaller scale, the entire upward trend segment is visible. The wave pattern is not the most standard, as corrective waves differ in size. For example, the larger wave 2 is smaller than the internal wave 2 of 3. But this happens. Let me remind you: it is best to identify clear structures on charts rather than tie oneself to every single wave. At present, the upward structure leaves little room for doubt.

Key principles of my analysis:

فوری رابطے