Trade Analysis and Advice on the Euro

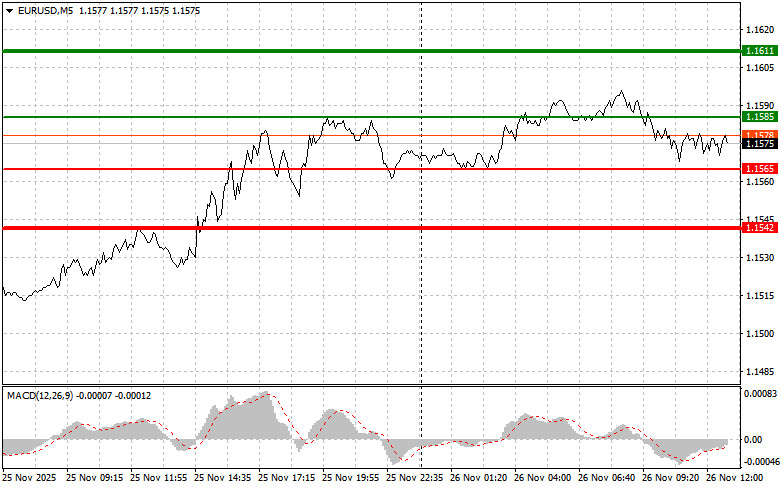

A price test of 1.1583 occurred at the moment when the MACD indicator had just started moving down from the zero line, confirming a valid entry point for selling the euro. As a result, the pair fell by only 15 points.

Due to a lack of economic indicators from the Eurozone, the euro's decline against the US dollar was minimal. Market participants adopted a wait-and-see approach, analyzing possible future directions of monetary policy by the European Central Bank and the Federal Reserve.

During the US trading session, particular attention will be paid to the release of weekly initial jobless claims, changes in durable goods orders, and the Chicago PMI index.

These economic indicators are important signals reflecting the condition of the world's leading economy. The jobless claims data will allow traders to assess the current state of the US labor market. Durable goods orders are a key indicator of the manufacturing sector: rising orders suggest higher business investment and positive expectations for economic growth, which generally supports the dollar. The Chicago PMI reflects business activity in the Chicago region. A reading above 50 indicates expansion, whereas below 50 signals contraction. This indicator may influence investor sentiment and, consequently, the dollar's movement.

Regarding the intraday strategy, I will primarily rely on scenarios #1 and #2.

Buy Signal

Scenario #1: Buy the euro today when the price reaches around 1.1585 (green line on the chart) with a target at 1.1611. At 1.1611, I plan to exit the market and also open a short position, expecting a 30–35-point move from the entry point. Counting on euro growth today is only reasonable after weak US data. Important! Before buying, ensure the MACD indicator is above the zero line and has just started rising from it.

Scenario #2: I will also buy the euro if the price tests 1.1565 twice in a row while the MACD is in oversold territory. This will limit the pair's downward potential and trigger a reversal upward. Growth to 1.1585 and 1.1611 can then be expected.

Sell Signal

Scenario #1: I plan to sell the euro after the price reaches 1.1565 (red line on the chart). The target is 1.1542, where I will exit and immediately buy in the opposite direction (expecting a 20–25-point retracement). Pressure on the pair will return if statistics are strong. Important! Before selling, ensure that the MACD is below the zero line and has just started declining from it.

Scenario #2: I also plan to sell the euro if the price tests 1.1585 twice while the MACD indicator is in overbought territory. This will limit the pair's upward potential and lead to a reversal downward. A drop to 1.1565 and 1.1542 can then be expected.

Chart Guide

Important for Beginners

Forex beginners must be extremely cautious when choosing entry points. Before major fundamental announcements, it is best to stay out of the market to avoid sharp volatility. If you choose to trade during news releases, always set stop-loss orders to minimize losses. Without them, you may quickly lose your entire deposit, especially if you ignore money management and trade large volumes.

Always remember: successful trading requires a clear, well-defined trading plan—just like the one presented above. Spontaneous decisions based on the current market situation are inherently a losing strategy for intraday traders.

PAUTAN SEGERA