(Reuters) – Společnost Capital One souhlasila, že zaplatí 425 milionů dolarů na urovnání celostátního sporu, v němž byla obviněna z toho, že podvedla vkladatele spořicích účtů o mnohem vyšší úrokové sazby tím, že jim neřekla, že mohou své peníze převést na výnosnější účty.

Oznámení o předběžném urovnání bylo podáno v pátek večer u federálního soudu v Alexandrii ve Virginii. Dohoda musí být schválena soudcem.

Vkladatelé tvrdili, že společnost Capital One (NYSE:COF) falešně slibovala vysoké úrokové sazby na svých spořicích účtech 360 Savings, zatímco novým zákazníkům tiše nabízela mnohem lepší sazby na podobně pojmenovaných účtech 360 Performance Savings.

Vkladatelé na účtech 360 Savings uvedli, že společnost Capital One zmrazila jejich úrokové sazby na 0,3 %, zatímco vkladatelům na účtech 360 Performance Savings nabízela sazby, které na začátku loňského roku dosáhly až 4,35 %. Účty s vyšším výnosem nyní přinášejí výnos 3,6 %.

Trade Analysis and Recommendations for the Japanese Yen

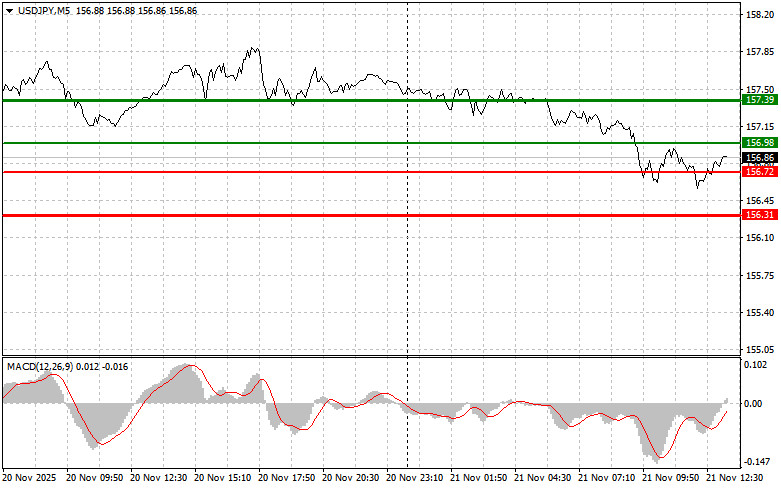

The test of the 156.96 price occurred when the MACD indicator had already moved far below the zero mark, which limited the pair's downward potential. For this reason, I did not sell the dollar.

In the second half of the day, a number of important U.S. economic indicators are expected to be released: the Manufacturing and Services PMIs, as well as the Composite PMI. In addition, the results of the University of Michigan consumer sentiment survey and data on inflation expectations will be published. Traders closely monitor these reports because they provide important information about the current state of the U.S. economy. The manufacturing activity index reflects activity in the manufacturing sector, while the services PMI indicates the health of the services sector, which plays a significant role in the U.S. economy. The composite PMI combines data from these two sectors to give an overall picture of economic activity. Readings above 50 indicate growth, while readings below 50 point to contraction. The Michigan consumer sentiment index is an important indicator of consumer spending, as consumer spending makes up a large portion of U.S. GDP. The inflation expectations included in the report are also important because they can influence the Federal Reserve's decisions regarding interest rates.

Overall, the release of these data may cause fluctuations in the USD/JPY currency pair, but only if the actual figures differ significantly from economists' forecasts.

As for the intraday strategy, I will rely more on implementing Scenarios No. 1 and No. 2.

Buy Signal

Scenario No. 1: I plan to buy USD/JPY today if the price reaches the entry point around 156.98 (green line on the chart), targeting growth to the 157.39 level (thicker green line on the chart). Around 157.39, I will exit long positions and open short positions in the opposite direction (expecting a 30–35 point move in the opposite direction from that level). Growth in the pair can be expected as the bullish market continues. Important! Before buying, make sure the MACD indicator is above the zero line and only beginning to rise from it.

Scenario No. 2: I also plan to buy USD/JPY today in the event of two consecutive tests of the 156.72 price at a moment when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a market reversal upward. You can expect growth toward the opposite levels of 156.98 and 157.39.

Sell Signal

Scenario No. 1: I plan to sell USD/JPY today after the price breaks below 156.72 (red line on the chart), which will lead to a rapid decline in the pair. Sellers' key target will be the 156.31 level, where I will exit short positions and immediately open long positions in the opposite direction (expecting a 20–25 point move from the level in the opposite direction). Pressure on the pair is unlikely to return today. Important! Before selling, make sure the MACD indicator is below the zero line and only beginning to decline from it.

Scenario No. 2: I also plan to sell USD/JPY today in the event of two consecutive tests of the 156.98 price at a moment when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. A decline toward the opposite levels of 156.72 and 156.31 can be expected.

Chart Explanation:

Important: Beginning Forex traders must be very careful when making market entry decisions. Before major fundamental reports are released, it is best to stay out of the market to avoid sharp price fluctuations. If you decide to trade during news releases, always place stop orders to minimize losses. Without stop orders, you can very quickly lose your entire deposit—especially if you do not use money management and trade large volumes.

And remember: for successful trading, you must have a clear trading plan, like the one presented above. Spontaneous trading decisions based solely on the current market situation are inherently a losing strategy for an intraday trader.

PAUTAN SEGERA