Bitcoin v pátek vzrostl a směřoval k silným týdenním ziskům, podpořen prudkým oživením na začátku týdne po signálech, že americký prezident Donald Trump může zaujmout mírnější postoj k obchodním clům.

Investoři však zůstali opatrní kvůli smíšeným signálům ohledně možných jednání o clech mezi USA a Čínou, což vedlo k obchodování v omezeném rozmezí během předchozích dvou seancí.

Největší kryptoměna světa vzrostla o 1,8 % na 94 484,0 USD v 15:39 SEČ.

Bitcoin by měl tento týden posílit o přibližně 10 %, poté co ve středu překonal hranici 94 000 USD a dosáhl nejvyšší úrovně od začátku března.

US equity markets closed yesterday with their biggest gains in recent weeks. The S&P 500 climbed 0.83%, while the Nasdaq 100 advanced 0.88%. The Dow Jones Industrial Average rose 0.77%.

The rally on Wall Street carried over into Asia, as fresh signs of a cooling labor market reinforced expectations that the Federal Reserve will cut interest rates this month. Rate cut anticipation typically boosts demand for risk assets, with lower borrowing costs making equities more attractive.

Asian indices rose by 1%, including in Japan, following President Donald Trump's signing of an executive order to implement a trade agreement with Japan. S&P 500 futures advanced 0.2% after the index closed at a record high, while Nasdaq 100 futures rose 0.4%.

US Treasuries stabilized after Thursday's rally, with the yield on two-year notes—sensitive to policy changes—hovering near a one-year low. Money markets are now almost fully pricing in a Fed rate cut and are forecasting at least two cuts by year-end. The dollar weakened against other major currencies.

Today, markets await employment reports and jobless claims data, which are expected to show the weakest period of US job growth since the start of the pandemic. Softer demand, rising costs, and unpredictable trade policy under Trump have slowed hiring, intensifying pressure on the Federal Reserve as it looks to support the labor market.

It is clear that many investors are firmly hoping for a Fed rate cut, but it is important to keep expectations in check. Data indicating a slight slowdown—but not a dire labor market—may not have as much impact as many expect. Only a sharp deterioration in the numbers could push the Fed toward further easing. The consensus forecast calls for a 75,000 increase in nonfarm payrolls in August, marking a fourth consecutive month of growth below 100,000. Unemployment is projected to reach 4.3%, its highest since 2021.

In commodities, oil prices have declined for a third straight day, heading for a weekly loss ahead of the OPEC+ meeting, where the group may endorse another increase in supply.

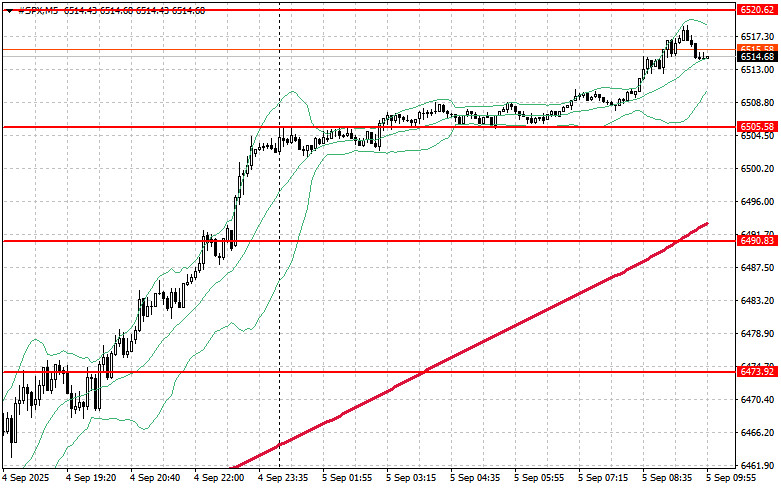

As for the technical outlook on the S&P 500, the main task for buyers today will be to overcome initial resistance at $6,520. Clearing this level could set the stage for a move up to $6,537. Gaining control above $6,552 remains equally important and would further strengthen the bulls' position. If prices retreat on falling risk appetite, buyers will need to defend the $6,505 area. A break below this level would quickly send the index back to $6,490 and open the way to $6,473.

PAUTAN SEGERA