Scheduled Maintenance

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

The week turned out to be exemplary for analysts and market participants. For the first time in a long while, the dollar did not react to new trade tariffs imposed by Donald Trump. It should be noted that all new tariffs will only come into effect on August 1. Until then, the U.S.'s trade partners still have time to conclude agreements.

In my opinion, these agreements will do little to support the U.S. currency, as Washington is set to maintain the tariffs regardless. This is evident from the already signed deals with China, the United Kingdom, and Vietnam. In all three cases, tariffs remain at no less than 10%, and in the case of Vietnam—at least 20%, and with China—55%. Thus, all the trade deals signed by Trump are essentially part of the same trade war, albeit under the banner of peaceful agreements.

Therefore, I do not believe that even after all 75 agreements, the market will calm down, nor that demand for the U.S. dollar will return to levels seen over the past two decades. In my opinion, the era of the dollar is currently on hold. Trump needs a weak currency to boost exports. Central banks around the world are starting to reduce their dollar reserves. BRICS countries have long sought to abandon the use of the U.S. dollar in settlements. The outlook for the U.S. economy remains uncertain. As for Trump's policies, that's a topic for another day—no forecasts can be made regarding them.

Thus, the future of the EUR/USD currency pair in the upcoming week will depend on how long the market is willing to establish a corrective wave structure. The euro could have ended this week in positive territory, but for the first time in a while, the wave pattern overpowered the news backdrop.

In the Eurozone, only two reports are worth attention: industrial production and inflation. Neither is critical at the moment. The European Central Bank has nearly completed its monetary easing cycle, and inflation in Europe has stabilized around 2%. The Consumer Price Index may start accelerating (there is still no trade deal between the U.S. and the EU), but this is unlikely to lead to policy tightening by the ECB, which cut interest rates at eight consecutive meetings. Currently, inflation is not a major concern in the Eurozone, and no acceleration is expected.

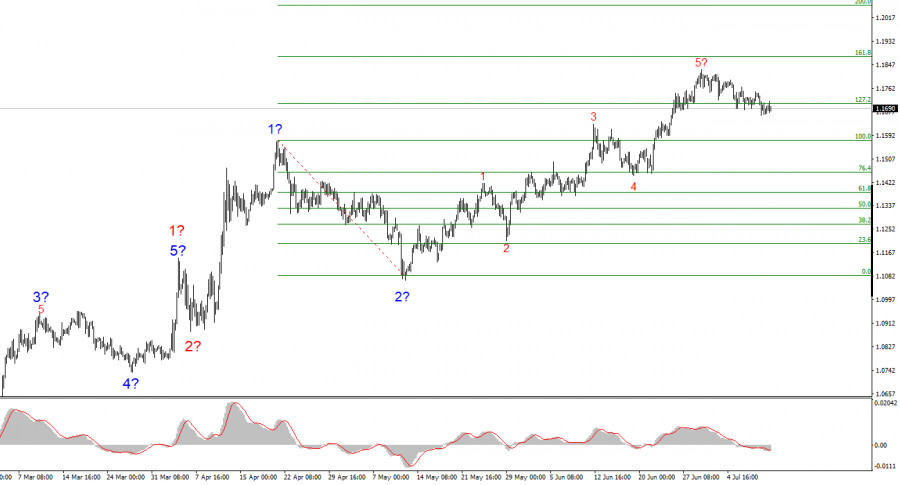

Based on the EUR/USD analysis, I conclude that the instrument continues to build a bullish trend segment. The wave pattern still entirely depends on the news backdrop related to Trump's decisions and U.S. foreign policy, and there are still no positive changes.

The targets of the trend segment may extend to the 1.2500 area. Therefore, I continue to consider buying, with targets around 1.1875, which corresponds to 161.8% Fibonacci. A corrective wave structure is expected to develop soon, so new euro purchases should be considered after its completion.

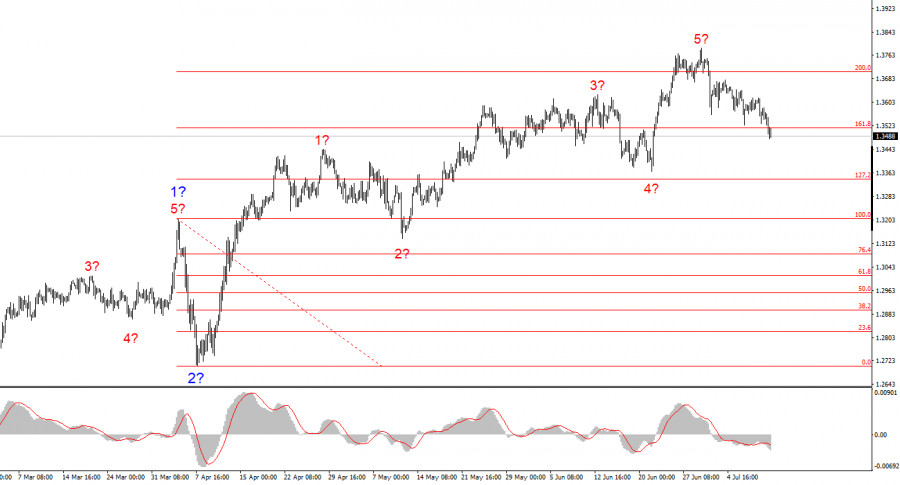

The wave pattern of the GBP/USD instrument remains unchanged. We are dealing with a bullish, impulsive trend segment. Under Trump, the markets may face many more shocks and reversals, which could seriously affect the wave structure, but for now, the working scenario remains intact.

The targets of the bullish trend are now located around 1.4017, which corresponds to 261.8% Fibonacci of the assumed global wave 2. A corrective wave structure is now presumably forming. Classically, it should consist of three waves.

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

PAUTAN SEGERA