The macroeconomic calendar was filled with statistical data, and it is important to highlight the main events. Preliminary data on inflation in the European Union showed a slowdown to 6.1% from 7.0%, which was below the expected value of 6.5%. This may indicate a possible pause in the European Central Bank's (ECB) cycle of interest rate hikes. However, it is worth noting that the minutes of the latest ECB meeting, also published on Thursday, indicate the inclination of the regulator's representatives to continue raising rates.

Also, ADP employment data for the private sector in the United States was released, showing a growth of 278,000 jobs, surpassing expectations. However, attention should be paid to the U.S. Department of Labor report, to be released on June 2, as this information can be very valuable for assessing the labor market situation.

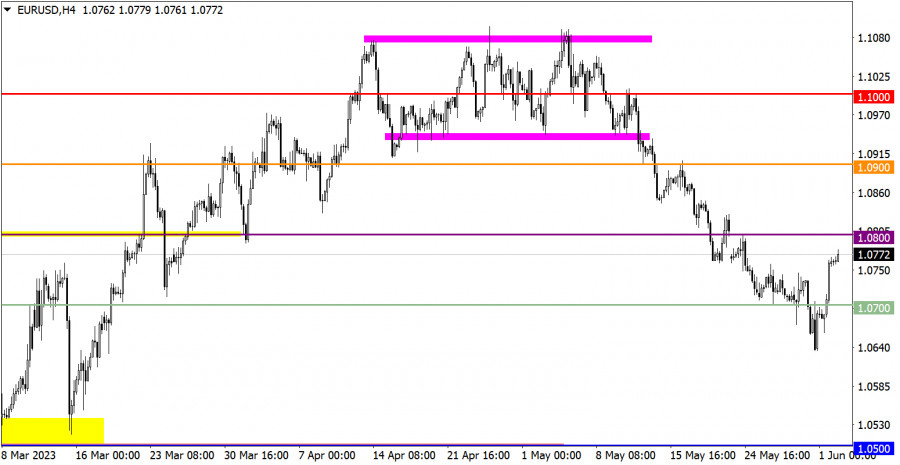

EUR/USD is transitioning from a correction phase to a recovery phase after a recent decline. Currently, only a small portion of the price has been recovered, but the market has sent a primary technical signal of the euro's recovery.

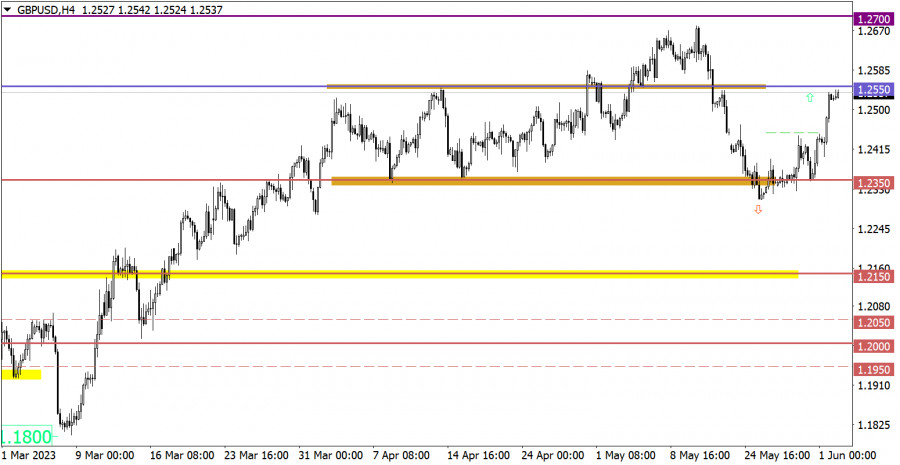

GBP/USD is experiencing an intense upward movement, surpassing the 1.2500 level. This is a primary technical signal of the pound's course recovery after a recent corrective decline.

A dynamic week will end with an important economic event—the publication of the U.S. Department of Labor report, which is likely to have an impact on the market and speculators.

Unemployment rate is expected to rise from 3.4% to 3.5%, and the number of new non-farm payroll jobs may reach only 180,000, compared to 253,000 in the previous month. Such a result may lead to a weakening of the dollar's positions in the market. This is an important moment for investors and traders who may take this information into account in their trading decisions.

Time targeting:

U.S. Department of Labor report - 12:30 UTC

To strengthen long positions, the exchange rate should remain above the 1.0800 level. In this case, further growth towards the range of 1.0900–1.1000 is possible. It is important to note that sharp price changes can lead to overbought conditions for the euro in the short term. As a result of the recovery, there may be a repositioning of trading forces, which can manifest as stagnation or a pullback.

In this situation, the sharp price change that occurred the previous day gave a technical signal of overbought conditions for the pound in the intraday and short-term periods. However, the target level is set at 1.2550, to which the upward cycle has slowed its development, leading to a reduction in the volume of long positions and the emergence of stagnation. However, if the price continues to hold steadily above the 1.2550 level, speculators may ignore the technical signal of overbought conditions. In this case, further growth towards the medium-term trend high is possible.

The candlestick chart type is white and black graphic rectangles with lines above and below. With a detailed analysis of each individual candle, you can see its characteristics relative to a particular time frame: opening price, closing price, intraday high and low.

Horizontal levels are price coordinates, relative to which a price may stop or reverse its trajectory. In the market, these levels are called support and resistance.

Circles and rectangles are highlighted examples where the price reversed in history. This color highlighting indicates horizontal lines that may put pressure on the asset's price in the future.

The up/down arrows are landmarks of the possible price direction in the future.

PAUTAN SEGERA