The EUR/USD currency pair continued a moderate upward movement on Wednesday, as expected. Let us recall that the recent decline in the pair over the past few weeks seemed illogical, as the fundamental and macroeconomic background for the U.S. dollar has only worsened during this period. Of course, we're not suggesting everything is going perfectly in Europe or the U.K., but in 2025, the United States has been setting records for the number of negative developments. As such, even the dollar's recent strengthening defied the underlying fundamentals.

On the daily timeframe, two clear things stand out: first, the upward trend is intact; second, the market has been in a sideways range for months. Thus, the euro's decline could be attributed purely to technical factors, rather than political turmoil in France. If this is the case, then the 2025 bullish trend should eventually resume—and why not now? Especially when Trump continues to generate headlines that do little to support the dollar.

Just this week, Donald Trump announced 100% tariffs on China, claimed India promised to stop buying Russian oil (after previously raising tariffs on India to 50%), threatened to cut all ties with China, and finally stated he's ready to raise tariffs to 500%. With such a barrage of geopolitical tension coming from Washington, can the dollar realistically expect to rally?

The U.S.–China conflict will only deepen, as Trump tries to force a major global player to yield to his framework. That might work with smaller states anxious to avoid confrontation, but China is built differently. Beijing responds in kind: it raises tariffs, limits exports of rare-earth elements, demands that they cease oil purchases from certain countries, and ignores the requests. In fact, just yesterday, New Delhi made clear that it gave Trump no such promise regarding Russian oil. Once again, the U.S. president has misled a great many people and media outlets.

In short, the American "farce" continues to escalate. China has responded to Trump in a tit-for-tat manner and will continue to do so. The dollar will likely continue to decline because traders no longer see a compelling reason to trust what was once the bedrock of global finance. It's worth noting that the U.S. dollar has been unusually lucky in recent months—based on current fundamental conditions, it should have declined without interruption. However, that's not how the currency market operates. Market makers need time to build new large positions before they drive the market higher again—and that takes time. We believe further dollar depreciation is only a matter of time.

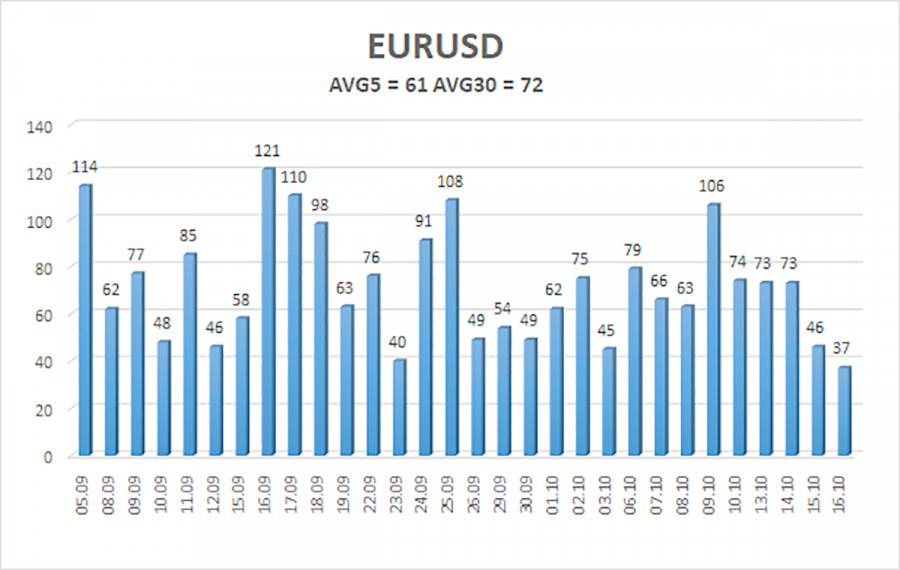

The average EUR/USD volatility over the last five trading days as of October 17 is 61 pips, which qualifies as "average." On Friday, we expect the pair to move within the range bounded by 1.1609 and 1.1731. The long-term linear regression channel remains upward-sloping, indicating a continuing bullish trend. The CCI indicator recently entered the oversold zone, which may trigger the next upward price leg.

S1 – 1.1597

S2 – 1.1536

S3 – 1.1414

R1 – 1.1658

R2 – 1.1719

R3 – 1.1780

The EUR/USD pair remains in a corrective phase, yet the overall uptrend persists—visible across all higher timeframes. The U.S. dollar is still under strong pressure from Donald Trump's aggressive political and economic policies, which show no sign of scaling back. While the dollar has risen in recent days, the fundamental case for that move is questionable. Nonetheless, the sideways range on the daily chart explains the current lack of consistent direction.

If the price is below the moving average, small short positions may be considered with a target of 1.1536, based purely on technical factors. If the price remains above the moving average line, long positions toward 1.1841 and 1.1902 remain valid as part of the larger bullish trend.

QUICK LINKS