WASHINGTON (Reuters) – Američtí představitelé se mají v Saúdské Arábii setkat s vyjednavači Ukrajiny a Ruska, aby projednali podrobnosti navrhovaného 30denního příměří ohledně úderů na energetickou infrastrukturu a také dlouhodobější mírovou dohodu.

Ruští a ukrajinští vyjednavači nebudou ve stejné místnosti. Úředníci vyslaní Kyjevem se mají s americkým týmem setkat v Rijádu v neděli večer. V pondělí by měly následovat rozhovory mezi ruskými a americkými vyjednavači.

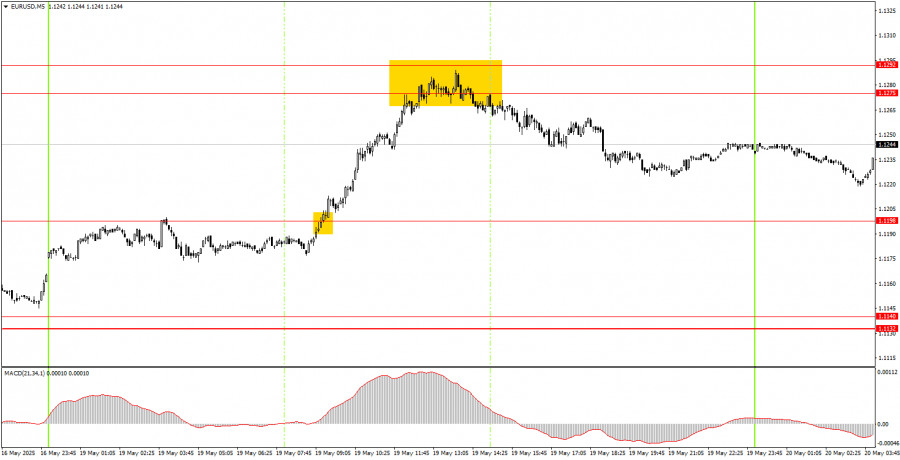

The EUR/USD currency pair surged upward on Monday with renewed strength. But what justified this move, given that Monday's macroeconomic and fundamental backdrop was practically nonexistent? Yes, the second estimate of inflation in the Eurozone was published... but did not differ from the first one. It no longer affects the European Central Bank's monetary policy since the ECB has cut rates seven times and is preparing for an eighth. In any case, monetary easing, which could lead to a decline in inflation, is a bearish factor for the euro, yet the euro rose throughout Monday.

We therefore believe that only the news of the U.S. credit rating downgrade by Moody's could have triggered the renewed dollar sell-off. To be honest, this is a relatively minor headline—other major agencies have previously downgraded the U.S. rating as well. And the U.S. still holds one of the highest credit ratings in the world, so this is merely a formal excuse to sell the dollar that the market eagerly seized upon.

In the 5-minute time frame, Monday generated two nearly perfect trading signals. At the beginning of the upward movement, the price broke through the 1.1198 level, where novice traders could open long positions. The rally ended in the 1.1275–1.1292 zone, from which a clear bounce followed. At this point, longs could be closed and shorts opened. Traders could have earned 60–70 pips from both trades on Monday.

In the 1-hour time frame, the EUR/USD pair has finally begun something resembling a downward trend. Overall, the market remains highly negative toward the U.S. dollar. However, Trump has stepped onto the path of de-escalating the trade conflict, the very one he initiated, which means the dollar could recover in the near term. The strength of the dollar's rise will depend on how many trade deals are signed and how quickly. Also important are Trump's high-impact headlines, such as the firing of Powell or new tariff threats.

On Tuesday, the EUR/USD pair will trade based on technical factors. The macroeconomic background still does not influence price action, so traders should closely monitor the price behavior around 1.1198 and the 1.1275–1.1292 zone.

On the 5-minute TF we should consider the levels of 1,0940-1,0952, 1,1011, 1,1088, 1,1132-1,1140, 1,1198, 1,1275-1,1292, 1,1413-1,1424, 1,1474-1,1481, 1,1513, 1,1548, 1,1571, 1,1607-1,1622. There are no important scheduled events in the Eurozone or the U.S. for Tuesday, so a flat market and low volatility are likely again.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

ລິ້ງດ່ວນ