NEW YORK (Reuters) – Snížení ratingu USA agenturou Moody’s prohloubilo obavy investorů ohledně hrozící dluhové bomby, která by mohla podnítit strážce dluhopisového trhu, kteří požadují větší fiskální disciplínu ze strany Washingtonu.

Ratingová agentura v pátek snížila bezchybný rating USA o jeden stupeň a stala se tak poslední z velkých ratingových agentur, která snížila rating této země, a to s odkazem na obavy z rostoucího dluhu ve výši 36 bilionů dolarů.

The US stock market is driven by two parallel narratives: monetary policy history and the monetization of artificial intelligence. Within the market, there are both skeptics and optimists. The former discuss inflated fundamental valuations and the billions of dollars wasted on AI technologies. The latter view the current decline in the S&P 500 as a healthy correction and an opportunity to establish and increase long positions. For them, the Magnificent Seven is a sacred cow that has generated and will continue to generate money.

Unfortunately, nothing lasts forever under the moon. During the dot-com boom in the 1990s, the market also seemed too perfect. In 2000, then-CEO of internet darling Cisco Systems, John Chambers, claimed that the industrial revolution was just the beginning. In August of that same year, his company reported revenue growth of over 60%. Within 12 months, American stock indices had collapsed by 67%.

Dynamics of Daily S&P 500 Changes of 1% or More

Thus, in addition to the common trait of overinflated fundamental valuations shared by the internet companies of that era and today's tech giants, several other similarities arise. A few days ago, NVIDIA CEO Jensen Huang stated that there is no artificial intelligence bubble. Shortly thereafter, the world's largest company delighted with its financial results. Is the story repeating itself with Cisco Systems? Pessimists are sure it is. Optimists, however, find reasons for joy.

In particular, since 1957, there have been only 8 instances when the S&P 500 opened up more than 1%, only to close deep in the red. A week after such occurrences, the broad stock index gained an average of 2.3%, and a month later, it increased by 4.7%. On November 20, it also surged high before crashing. Why wouldn't the stock market support bulls this time?

Moreover, there are reasons for optimism. New York Federal Reserve President John Williams stated that the federal funds rate could be lowered soon. Following such a dovish speech, the futures market boosted the chances of monetary policy easing in December to 67%. Before this, the figure fluctuated between 35-40%. Adding to this is the seasonally strong first month of winter for the S&P 500, known for its Christmas rally, which could alleviate fears.

Dynamics of S&P 500 and Bitcoin

There is a prevailing view in the market that the S&P 500 correction is driven not only by lost illusions regarding the continuation of the Fed's monetary expansion cycle and fears of a bubble in tech companies but also by a sell-off in Bitcoin. The cryptocurrency is perceived as a canary in the coal mine. Its performance is seen as indicative of the fate awaiting risky assets. In this regard, concerns about a return to a crypto winter are also putting pressure on the US stock market.

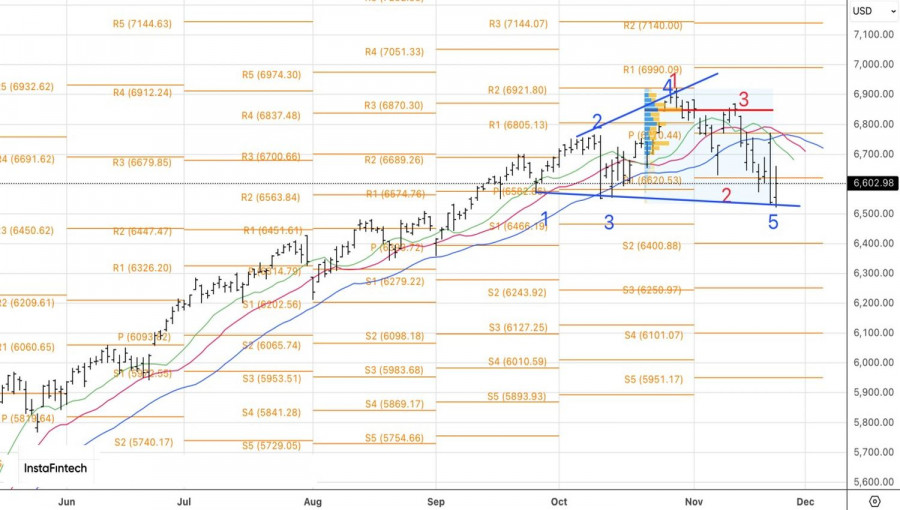

Technically, the S&P 500 daily chart continues to realize the Expanding Wedge pattern. The inability of bulls to push the broad stock index above 6,620, or a retreat from resistance levels at 6,685 and 6,730, serve as signals for selling.