Trouble rarely comes alone. Adding to political turmoil in France, investor disappointment over Germany's fiscal stimulus rollout, and stagnating hopes for peace in Ukraine, EUR/USD is now under pressure from the most rapid oil price surge since the onset of the Israel-Israel conflict in June. As a net oil importer, the euro area was hit hard by the 5% jump in Brent crude prices—a fresh blow to the euro.

Europe is still entangled in the ongoing French budget crisis, and now EUR/USD may lose one of its key advantages—monetary policy divergence. European Central Bank officials continue to insist that current interest rates are appropriate, but this no longer seems to provide meaningful support for the regional currency. Meanwhile, the Forex market is undergoing a shift in expectations regarding U.S. Federal Reserve policy.

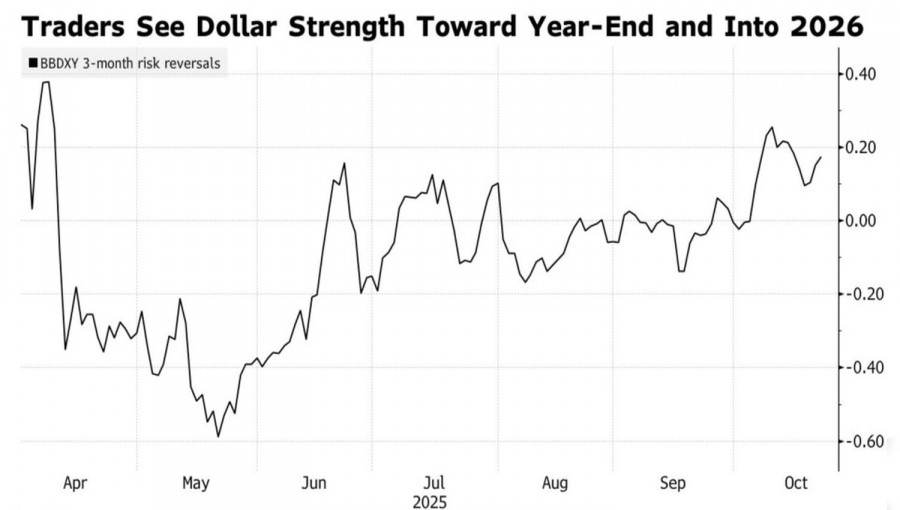

The futures market appears to have overreacted. After the September interest rate cut, derivatives traders projected not only two more Fed cuts in October and December but also as many as three rounds of monetary easing in 2026. In contrast, the FOMC's latest projections call for only one. As the October 28–29 meeting approaches, investors are beginning to realize they may have gotten ahead of themselves.

U.S. inflation for September risks accelerating to 3.1%, the highest level since spring 2024. An early indicator from the Atlanta Fed points to 3.9% GDP growth in Q3. Combine this with a stock market rally, falling bond yields, and a still-weak U.S. dollar relative to the start of the year, and the result is highly accommodative financial conditions. Such a mix could justify a pause in the Fed's rate cuts. If not, inflation could surge again, evoking memories of the 1970s—when the Fed had to reverse course, resulting in recession.

When the market prices in aggressive policy easing and the actual outcome is more conservative, the result is U.S. dollar strength. Current risk dynamics suggest continued upside for the USD Index. According to Standard Chartered Bank, EUR/USD may fall to 1.12 by mid-2026. The firm believes investors are underestimating the risk of a rebound in the greenback. A reevaluation of rate expectations would provide the dollar with renewed momentum.

On the other hand, Danske Bank views recent bearish momentum in EUR/USD as temporary. Over the medium term, the pair is expected to resume its upward trend on the back of improving European asset performance, waning demand for U.S. securities, and a dovish shift in Fed policy.

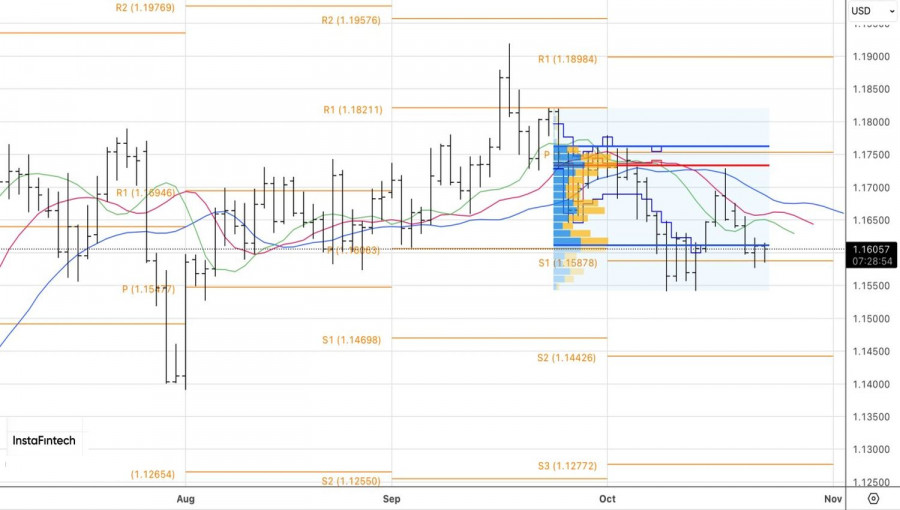

On the daily chart, EUR/USD continues to battle for the lower boundary of its fair value range at 1.1610–1.1760. As long as the bears hold this level, it makes technical sense to maintain short positions initiated from 1.1645. Additionally, the formation of an inside bar provides a setup for placing pending orders at its extremes – 1.1615 to buy and 1.1585 to sell.

QUICK LINKS