Gold stepped back ahead of the Fed's verdict. Few doubt that the central bank will cut the federal funds rate by 25 basis points to 4.25%. However, the number of dissenters, signals about future monetary policy, and the dot plot forecast will be critical for XAU/USD. The precious metal had long been rising and reached record highs, but investors chose to play it safe before this key event.

The best environment for gold is stagflation. It has never fallen in the 21st century during periods when U.S. inflation was rising while the Fed was cutting rates. In this regard, the acceleration of consumer prices in August to 2.9% y/y, coupled with expectations of a renewed monetary expansion cycle, is an important source of support for XAU/USD—though not the only one.

China announced an easing of controls on gold imports. In theory, this should boost demand for U.S. dollars, which are used to purchase bullion. Beijing is concerned about the yuan's strength, which is becoming another noose around exporters' necks—alongside high U.S. tariffs. For the precious metal, this is good news. Rising imports from China provide another argument in favor of an XAU/USD rally.

The rally in 2025 has been remarkable. Gold has risen by more than 40%, set three dozen nominal records, and even one inflation-adjusted record that had stood since 1980. Goldman Sachs does not rule out a surge to $5,000 per ounce if even 1% of the U.S. Treasury bond market capital flows into gold. Deutsche Bank also raised its 2026 average price forecast from 3700 to 4000 dollars, citing dollar weakness, strong central bank demand for bullion, and the Fed's aggressive monetary expansion cycle.

The main risks to this scenario include a prolonged pause in rate cuts in 2026, gold's seasonal weakness in the fourth quarter based on 10- and 20-year patterns, and strong U.S. stock market performance. Gold is seen as a safe-haven asset, so rising global risk appetite should, in theory, work against it. In practice, however, the S&P 500 and XAU/USD can rise comfortably together.

Adding to this are ongoing geopolitical tensions in Eastern Europe and the Middle East, threats to Fed independence, and global dedollarization and reserve diversification. Together, these paint a bright outlook for the precious metal.

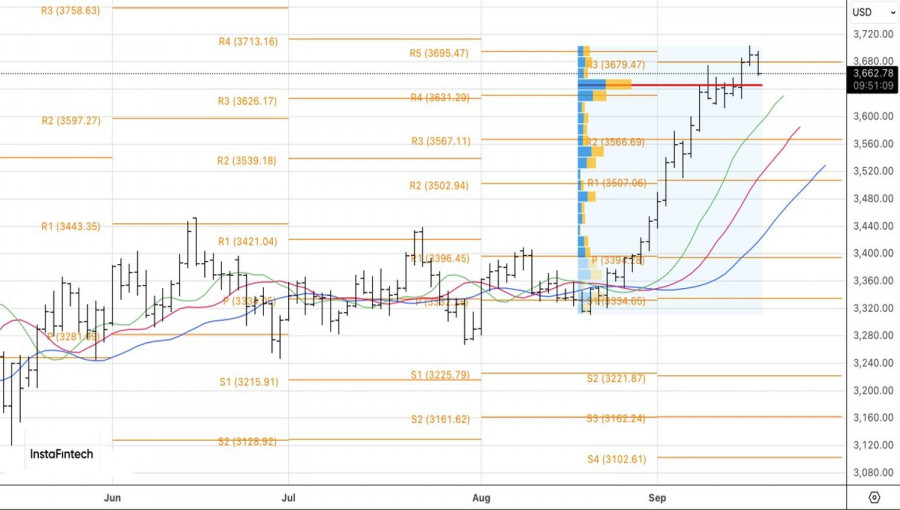

Technically, on the daily chart, gold has so far failed to consolidate above the key pivot level of 3680 dollars per ounce. This may be the first sign of weakness among the bulls. Only a decline below fair value at 3645 and the previous local high bar's low at 3625 would confirm selling potential. That would also trigger an Anti-Turtles pattern. As long as the precious metal trades above these levels, the focus should remain on buying.

QUICK LINKS