The market stepped back ahead of the announcement of the September FOMC meeting results. Some investors chose to lock in profits, as the meeting's outcome could spark volatility in the S&P 500. For the first time since 1988, there may be three dissenters voting for an immediate 50 bp rate cut—the very move Donald Trump is demanding. At the same time, a single misstep or slip of the tongue by Jerome Powell at the press conference could cause turmoil.

Nearly thirty record highs in the S&P 500 are drawing investors back to the US stock market, which still looks expensive from a fundamental perspective.

It's no joke that the "Magnificent Seven" stocks trade at 43x their expected 12-month earnings, and the recent disruptor Oracle commands a P/E of 67.

The S&P 500 Information Technology sector index has gained 27% over the past year on the back of 26.9% earnings growth. By contrast, the S&P ex-tech has gained just 13% and its earnings have grown only 6.4%. If there's a bubble in US stocks, it's definitely outside Big Tech. Strong sector results have masked problems in other companies. The tip of the iceberg looks great—but what lies beneath?

US equities continue to attract investors. According to a Bank of America survey, asset managers hold their highest portfolio overweight in equities since February. Yet a record 58% see US stocks as overvalued.

Twelve percent now cite global trade war as the biggest risk for the S&P 500, down from 80% in April. Twenty-six percent fear inflation, while 24% worry about the Fed's loss of independence under pressure from President Trump, which could further weaken the US dollar. In other words, when it rains, it pours.

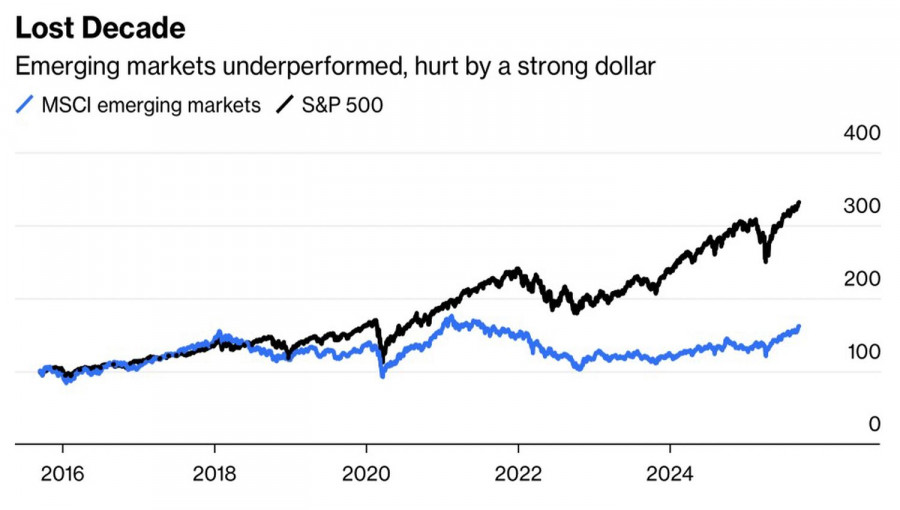

The strengthening of the USD index in 2022–2024 caused emerging market equities to lag. Now, as the idea of US exceptionalism fades and the greenback falls, emerging markets can come back to life.

Investors are increasingly putting money into Mexico and Brazil, and eyeing Asia. Without hedging for US dollar weakness, investing in the US is risky.

There's a parallel to Japan under Shinzo Abe's "Three Arrows" policy, when the yen lost 50% of its value in the first three years. Donald Trump is pushing for an even more radical overhaul of the system. None of this bodes well for the dollar.

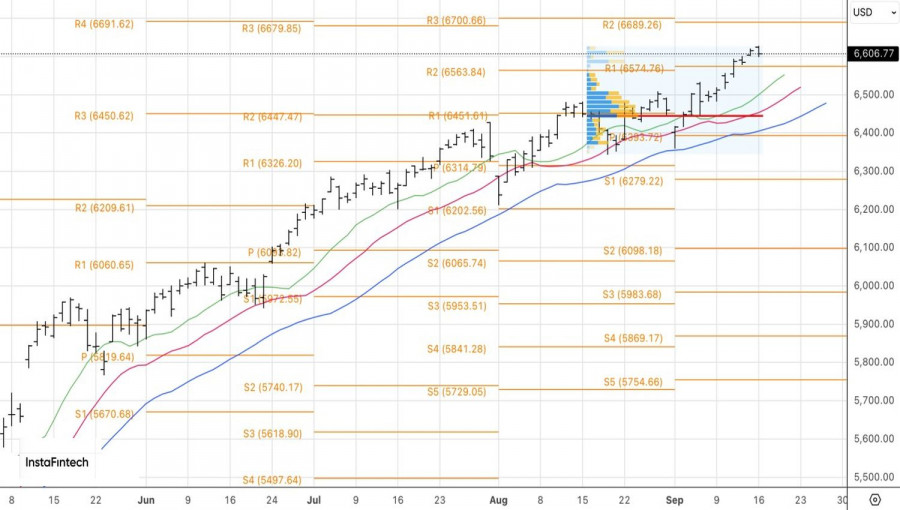

Technically, the daily S&P 500 chart shows a steady uptrend. Key supports are the cluster of pivot levels near 6570 and the moving averages near 6500. A bounce from these zones would be grounds to initiate or add to long positions in the broader stock index.

QUICK LINKS