On Monday, the EUR/USD currency pair traded lower, despite the absence of any macroeconomic or fundamental reasons for such movement. However, the dollar did have technical grounds for a minor correction. About a week ago, an approximately month-long downward trend, which was itself a correction on the daily timeframe, came to an end. A local upward trend is now forming, which may become part of the broader uptrend that began at the start of the year. Therefore, small downward pullbacks are simply retracements. Today, the US will release an important inflation report, which may provoke a market reaction. We do not believe this report will have any real impact, as the Federal Reserve is already almost certain to lower the key rate at its next meeting. Thus, even if inflation rises, we still expect monetary policy easing by the Fed, which is yet another bearish factor for the dollar.

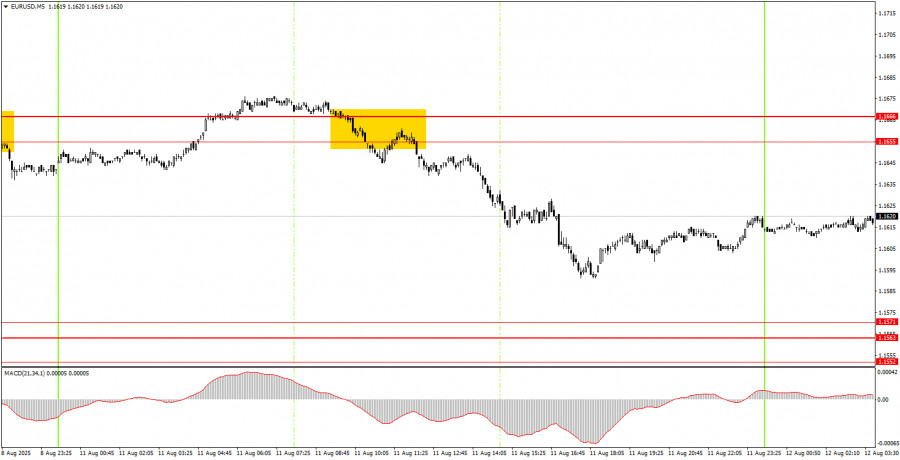

On the 5-minute timeframe on Monday, only one trading signal was generated. At the start of the European session, the price consolidated below the 1.1655–1.1666 area, after which it moved down by about 50 pips. Since no other signals formed for the rest of the day, novice traders could have closed the short position at any point — it would have been profitable regardless.

On the hourly timeframe, EUR/USD has every chance to continue the uptrend that has been forming since the start of this year. The US dollar's "house of cards" collapsed the Friday before last. Since then, we have seen a series of developments that have created additional problems for the dollar. We have previously warned that there are no long-term factors supporting the US currency's growth, and we have also questioned the "optimism" surrounding Trump's policies and their economic results. The latest data and events have confirmed that the problems are indeed real.

On Tuesday, EUR/USD may move in either direction, as it is currently positioned precisely between two important areas. Therefore, trading signals should be sought near these areas — they could be either rebounds or breakouts.

On the 5-minute timeframe, the following levels should be considered: 1.1198–1.1218, 1.1267–1.1292, 1.1354–1.1363, 1.1413, 1.1455–1.1474, 1.1527, 1.1552–1.1563–1.1571, 1.1655–1.1666, 1.1740–1.1745, 1.1808, 1.1851, 1.1908.

For Tuesday, only completely secondary reports are scheduled in the Eurozone, and there will be few of them. In the US, an important headline report — the Consumer Price Index — is expected. The market reaction could be significant, but it will not influence the Fed's stance.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

QUICK LINKS