Previously, I already drew an allegory between the events surrounding the U.S. Bureau of Statistics and Donald Trump and George Orwell's novel 1984. In my view, Trump has read this novel very attentively (ironically) and is an ardent admirer of the Ministry of Truth. What is the Ministry of Truth in the novel? It's a state institution responsible for all information flows delivered to the public. Simply put, it covered newspapers, official statements, and statistics. The Ministry of Truth not only delivered information favorable to the government to the masses but also blatantly manipulated facts, distorted statistics, and falsified real data. Many economists fear that the U.S. Bureau of Statistics may soon suffer the same fate.

For example, Elias Haddad, an analyst at the London bank Brown Brothers Harriman, believes that MacEntarfer's dismissal will undermine market trust in the reliability of economic data. Honestly, this is an undeniable conclusion. If Trump is willing to fire the director of the Bureau of Statistics for "unfavorable" data, it's clear he wants to control the information reaching the public and markets. And if he wants control, then he'll likely also want to "improve" certain figures. Statistics, like accounting, may seem like a precise science at first glance, but there are plenty of loopholes and ambiguous ways to interpret a given indicator. Trump has found many ways to bypass U.S. laws, so "manually improving" statistics shouldn't pose a problem for him.

From now on, market participants will price in a significant degree of risk into any positive report from the U.S. The risk lies in the fact that many economists will question the numbers that suddenly begin to rise sharply. Trump will undoubtedly say the economy is booming, and therefore all other indicators are improving. But trust in the Bureau of Statistics will now decline sharply. This means that any positive economic report will be met with a great deal of skepticism.

By the way, in the coming months, it will be easy to tell whether Trump has begun to influence the economic data. If the majority of indicators start rising sharply, I will assume he has. In my opinion, such statistics are worthless, and demand for the U.S. dollar will fall even further amid recent developments. And let's not forget that Trump continues to do everything possible to change the composition of the FOMC so that the central bank adopts only dovish decisions.

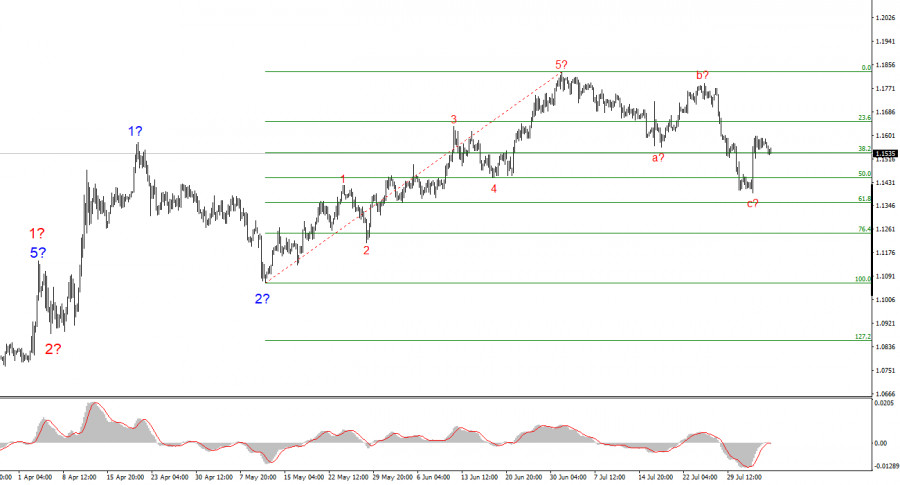

Based on the analysis of EUR/USD, I conclude that the instrument continues forming an upward trend segment. The wave structure still entirely depends on the news background related to Trump's decisions and U.S. foreign policy. The trend segment's targets may extend as far as the 1.25 area. Therefore, I continue to consider buying opportunities with targets around 1.1875 (which corresponds to 161.8% Fibonacci) and higher. Presumably, wave 4 has been completed. Thus, now is a good time to buy.

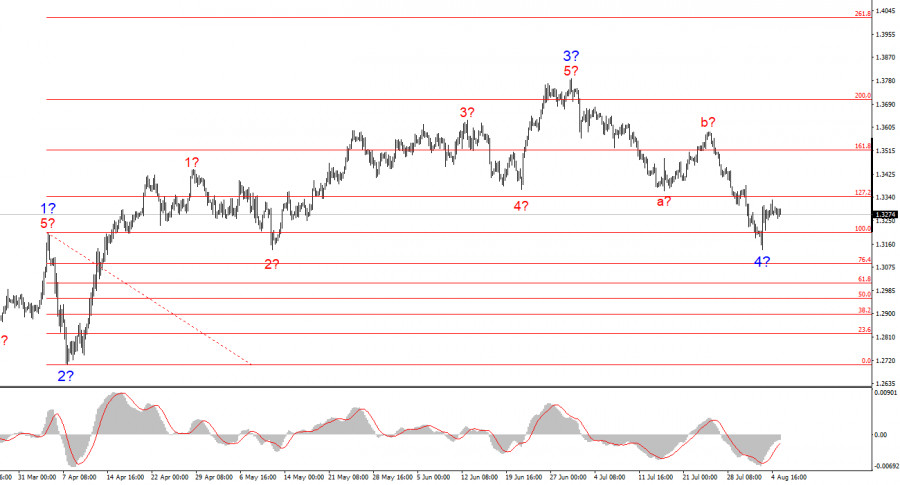

The wave pattern of GBP/USD remains unchanged. We are dealing with an upward impulsive trend segment. Under Trump, the markets may face many more shocks and reversals, which could significantly impact the wave picture, but for now, the working scenario remains intact. The upward trend segment's targets are now located around 1.4017. At the moment, I assume that the downward wave 4 has been completed. Therefore, I expect a resumption of the upward wave sequence and consider buying opportunities.

QUICK LINKS