The European Union is accepting the U.S. proposal on import tariffs but is presenting several counterproposals. Let me remind you that Donald Trump introduced individual tariffs against each U.S. trade partner but then "froze" them for three months to give the parties time to negotiate favorable terms. In practice, these "favorable terms" apply only to the United States, as the tariffs will still be imposed. Still, one could say that Trump has given all countries a chance for "softer" deals.

The European Union spent two and a half months evaluating the U.S. president's "generous" offer and has finally agreed. However, it has put forward a number of its demands, and in my humble opinion, Trump will reject them, and no trade agreement will be signed by July 9. Brussels also wants important and large categories, such as steel, aluminum, and automobiles, to be subject to tariffs not exceeding 10%. Let me remind you that in addition to individual tariffs, Trump also introduced sectoral tariffs. For example, imports of aluminum and steel to the U.S. are now taxed at a rate of 50%. The European Union also wants these sectoral tariffs to be minimized. This issue may become the "sticking point."

There is simply no reason for Trump to meet these conditions, since he is the one running the show, not Brussels. The minimal tariffs are already in effect, plus the sectoral tariffs, which are significantly higher. Therefore, the EU is not trying to fulfill Trump's requests, but instead is attempting to reduce its own tariffs to current levels. The version of the agreement proposed by the EU offers the U.S. less benefit than the current arrangement. Of course, we don't know all the details, but the agreement, as presented in the media, doesn't seem beneficial for Trump.

There are only a few days left until July 9. If no progress has been made in 2.5 months, is there any hope of reaching an agreement within a week? Incidentally, the euro exchange rate is not affected by the high probability of the deal falling through. The market continues to interpret the trade war and any changes in it as negative for the dollar. If no agreement is reached between the U.S. and the EU, it will again be bad news for the U.S. dollar, not for the euro.

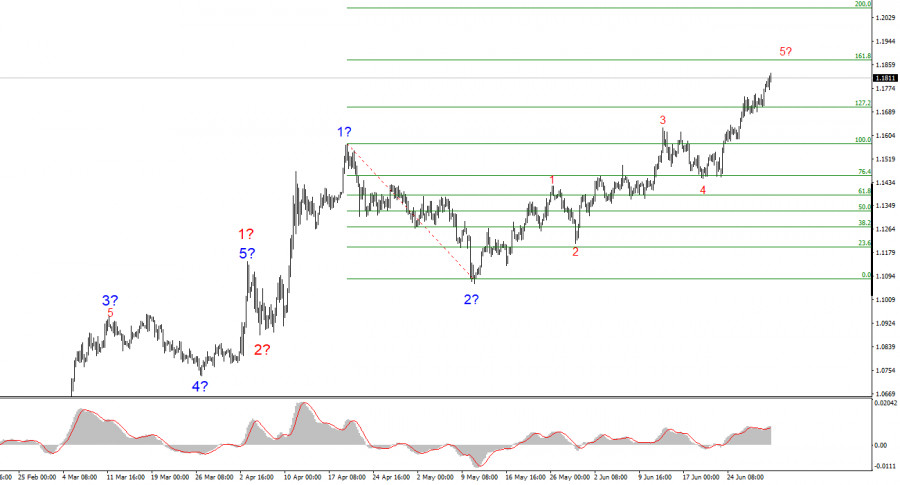

Based on the analysis of EUR/USD, I conclude that the instrument continues to build an upward wave structure. The wave marking still entirely depends on the news background related to Trump's decisions and U.S. foreign policy, with no positive changes so far. The targets for wave 3 may extend to the 1.25 level. Therefore, I continue to consider buying positions with targets around 1.1875, corresponding to the 161.8% Fibonacci level. A de-escalation of the trade war is capable of reversing the upward trend downwards, but there are currently no signs of a reversal or de-escalation.

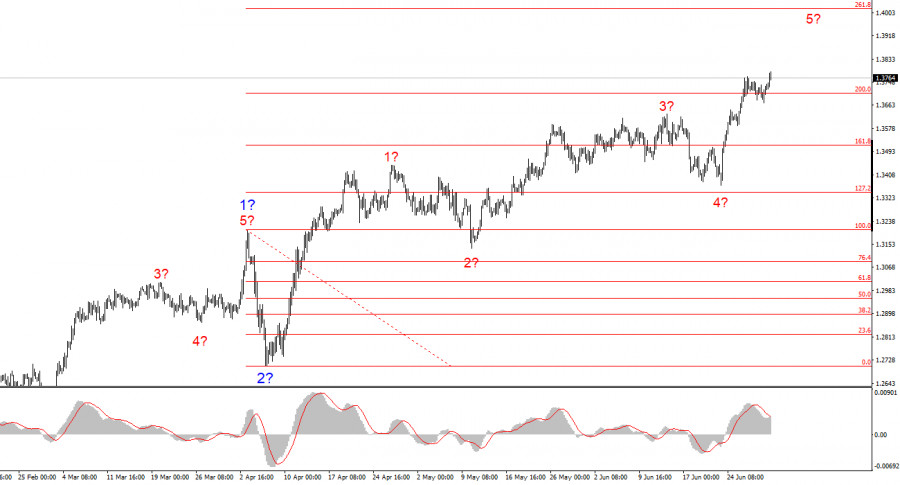

The wave structure of GBP/USD remains unchanged. We are dealing with an upward impulse segment of the trend. Under Trump, the markets may experience a significant number of shocks and reversals that could seriously affect the wave pattern, but at this time, the working scenario remains intact. Trump continues to take actions that drive demand for the dollar lower. The targets for wave 3 are now around 1.4017, corresponding to 261.8% of the Fibonacci level from the presumed global wave 2. Therefore, I continue to consider buying positions, as the market shows no intention of reversing the trend.

QUICK LINKS