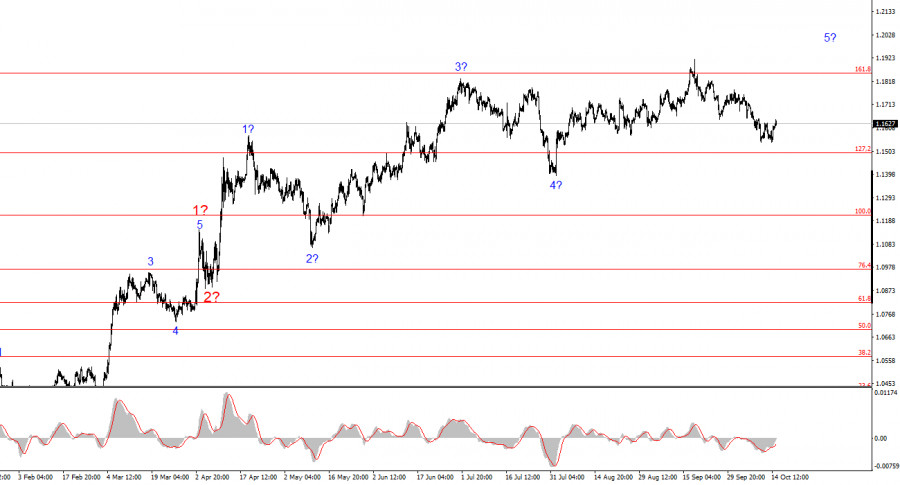

The wave pattern on the 4-hour EUR/USD chart has transformed. It is still too early to conclude that the upward trend segment has been canceled, but the recent decline of the European currency has made it necessary to clarify the wave count. Thus, we now see a series of three-wave structures labeled a-b-c. It can be assumed that they are part of the global wave 4 of the upward trend. In this case, wave 4 has taken on an unnaturally extended form, but overall the wave structure remains coherent.

The formation of the upward trend segment continues, while the news background remains generally unfavorable for the dollar. The trade war started by Donald Trump continues. The confrontation with the Federal Reserve continues. The market's "dovish" expectations regarding the Fed's rate are growing. The "shutdown" in the U.S. continues. The market rates the results of Donald Trump's first 7–8 months in office quite low, even though economic growth in the second quarter was nearly 4%.

In my view, the formation of the upward trend segment is not yet complete. Its targets extend up to the 1.25 level. Based on this, the European currency may still decline for some time, even without any fundamental reason for it (as has been the case over the past two weeks). However, the wave structure will still retain its integrity.

The EUR/USD exchange rate practically did not change during Wednesday. The news background today was almost nonexistent. In the morning, the Eurozone published a report on industrial production volumes, which, of course, was disappointing. However, the euro even received a small boost from this report. How can that be?

Industrial production volumes fell by 1.2% month-on-month in August. However, markets had expected a drop of 1.6–2.2%. As a result, the negative outcome for August turned out to be less pessimistic than the market had anticipated.

Still, this report is not significant enough for the euro to feel better compared to recent weeks. Even Jerome Powell's speech yesterday did not particularly help the buyers. The reason is that in Powell's recent statements it has become extremely difficult to extract anything concrete. In essence, everything boils down to the Fed's intention to make rate decisions solely based on economic data.

Consequently, the FOMC is shifting the responsibility for its decisions onto economic reports — that is, onto Donald Trump, who currently steers the U.S. economy. In simpler terms, Powell is saying: if the labor market continues to "cool," we may lower the interest rate; if inflation rises, we may refrain from cutting it. Such "specifics" are unlikely to satisfy market participants.

Based on the conducted EUR/USD analysis, I conclude that the pair continues to form an upward trend segment. The wave structure still entirely depends on the news background connected with Trump's decisions and the internal and external policies of the new White House administration. The targets of the current trend segment may extend up to the 1.25 level.

At the moment, we are observing the formation of corrective wave 4, which is nearing completion but is taking on a very complex and extended form. Therefore, in the near future, I continue to consider only buying positions. By the end of the year, I expect the euro to rise to 1.2245, which corresponds to 200.0% on the Fibonacci scale.

On a smaller scale, the entire upward segment of the trend is visible. The wave structure is not the most standard one, since the corrective waves differ in size. For example, the larger wave 2 is smaller in size than the internal wave 2 within wave 3. However, this can happen. I remind you that it is best to identify clear structures on the chart rather than trying to account for every single wave. The current upward structure raises almost no questions.

Basic Principles of My Analysis

RYCHLÉ ODKAZY