On Sunday, the USD/JPY pair is trading around the round 158.00 level, as the Japanese yen is recouping losses against the US dollar. This reflects growing investor caution amid renewed risks of Japanese authorities intervening after a prolonged period of yen weakness.

The US dollar retains support from solid fundamentals. Recent macroeconomic data confirm the resilience of the American economy, especially in employment and consumer demand: weekly initial jobless claims from the Department of Labor fell to 198,000 for the week ending January 10, the lowest level since November. Retail sales rose by 0.6% month-on-month, beating market forecasts. These releases reinforce expectations that the Fed will keep rates unchanged in the coming months.

However, several Fed officials remain cautious. President of the Federal Reserve Bank of Chicago Austan Goolsbee noted that despite labor market resilience, the priority remains returning inflation to target. And, according to Mary Daly, President of the Federal Reserve Bank of San Francisco, monetary policy is currently well-positioned to respond to changes in economic conditions. Markets have fully priced in that the Fed will leave rates unchanged at the January meeting, and that only by the end of the year are two cuts likely.

Despite the dollar's strength, the yen is strengthening due to Japan-specific factors. Authorities are increasingly concerned about speculative and one-sided moves in the currency market.

Finance Minister Satsuki Katayama recently confirmed that all options to counter excessive volatility remain on the table, including direct interventions and even coordinated actions together with the US. These comments recall past intervention episodes and force traders to reduce short positions on the yen.

Political turbulence adds tension: rumors of a parliamentary dissolution by Prime Minister Sanae Takaichi with early elections in February increase uncertainty and yen volatility, raising the likelihood of a strong response from authorities to further depreciation. Market focus shifts to the Bank of Japan's January decision, where the policy rate is expected to remain at 0.75%, underscoring a gradual normalization.

Bank of Japan Governor Kazuo Ueda said he is ready to further tighten monetary policy if economic dynamics are favorable. A Reuters survey shows economists do not expect immediate moves but forecast tightening by the end of 2026, with a potential rise to 1% or higher by the end of summer.

As a result, the decline of USD/JPY to the round level of 158.00 records a temporary advantage for the yen, despite strong US fundamentals. Multiple warnings from authorities and expectations of monetary tightening by the Bank of Japan are sufficient to support the Japanese yen against the US dollar.

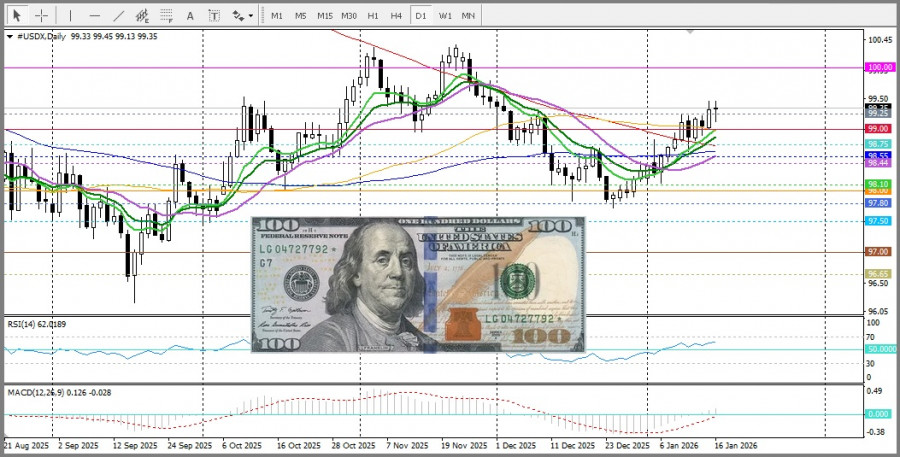

From a technical point of view, the pair trades above all moving averages, and the daily-chart oscillators are positive. All these factors point to a positive scenario for the pair.

HIZLI BAĞLANTILAR

show error

Unable to load the requested language file: language/turkish/cookies_lang.php

date: 2026-01-19 06:25:19 IP: 172.18.0.1