EUR/USD began the week with a recovery, rising above the important round level of 1.1600. The euro continues to receive support thanks to hopes that the European Central Bank has completed its rate-cutting cycle.

In the Friday minutes of the last ECB meeting, the unanimous decision to keep all key rates unchanged was highlighted, and the Governing Council described this policy as positive. Traders have almost fully priced in the likelihood of a possible rate cut in 2025 and currently assess the probability of such a scenario by the end of 2026 at around 40%.

These factors are helping to maintain and strengthen the EUR/USD pair, confirming the likelihood of further growth. A successful breakout above the 50-day SMA would confirm the positive momentum and open the way to new highs. Currently, the markets are focused on the release of key U.S. macroeconomic data scheduled for early this month, including the ISM manufacturing activity index, which is due later today.

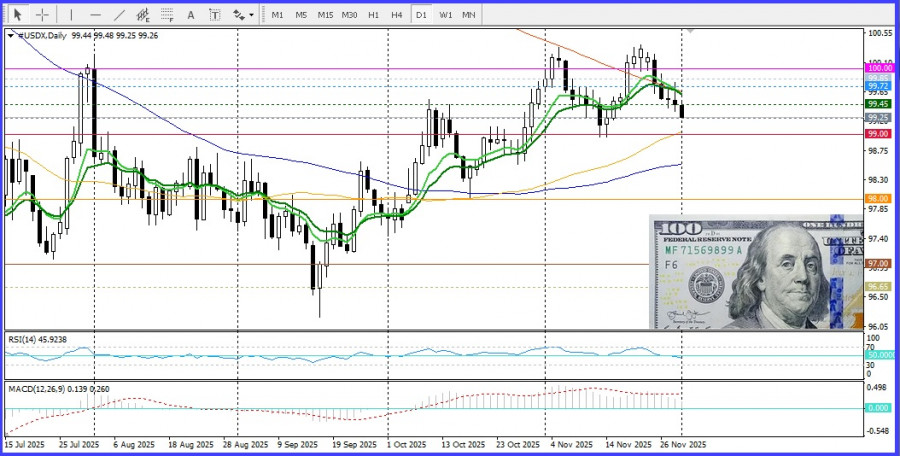

The U.S. Dollar Index (DXY), which measures the dollar's performance against a basket of global currencies, is hovering near two-week lows, supported by the Federal Reserve's "dovish" rhetoric. Moreover, analysts have increased the probability that the Fed will cut rates again in December based on recent comments from several officials. This, combined with positive sentiment in financial markets, weakens the dollar's position as a safe-haven currency and creates a favorable backdrop for EUR/USD growth. From a technical perspective, daily chart oscillators are mixed, but it is worth noting that the Relative Strength Index (RSI) has moved into positive territory, confirming the positive outlook. Bulls need to break above and hold above the 50-day SMA to secure better conditions for further growth.

From a technical perspective, daily chart oscillators are mixed, but it is worth noting that the Relative Strength Index (RSI) has moved into positive territory, confirming the positive outlook. Bulls need to break above and hold above the 50-day SMA to secure better conditions for further growth.

Above the 100-day SMA, bulls will have a greater chance of reaching the round level of 1.1700.

On the other hand, the nearest support is the round level of 1.1600, followed by 1.1585 — the 9-day EMA, and below that, 1.1570 — the 20-day SMA. Beyond that, prices could accelerate downward toward the psychological level of 1.1500.

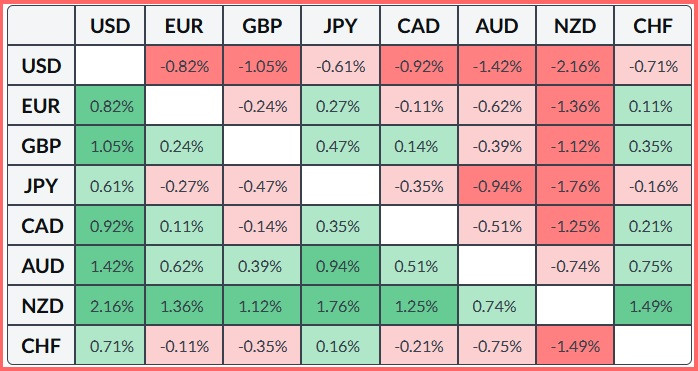

Below is the percentage change of the U.S. dollar against major currencies over the past seven days. The strongest performance was seen against the Japanese yen.

HIZLI BAĞLANTILAR

show error

Unable to load the requested language file: language/turkish/cookies_lang.php

date: 2025-12-01 03:19:49 IP: 216.73.216.158