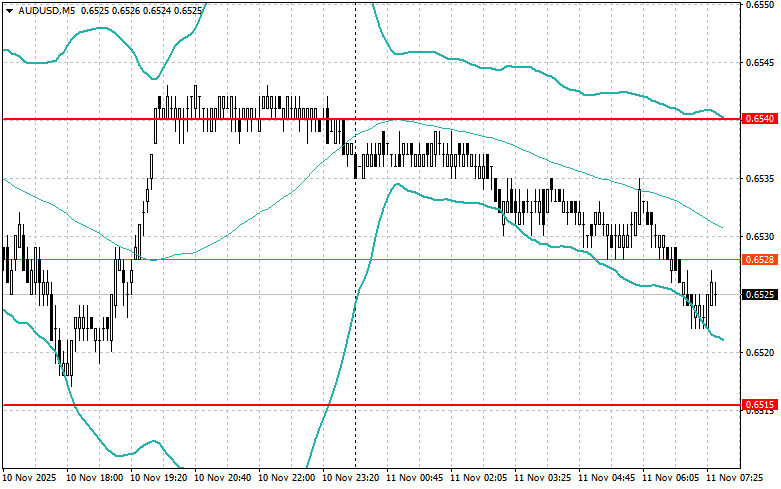

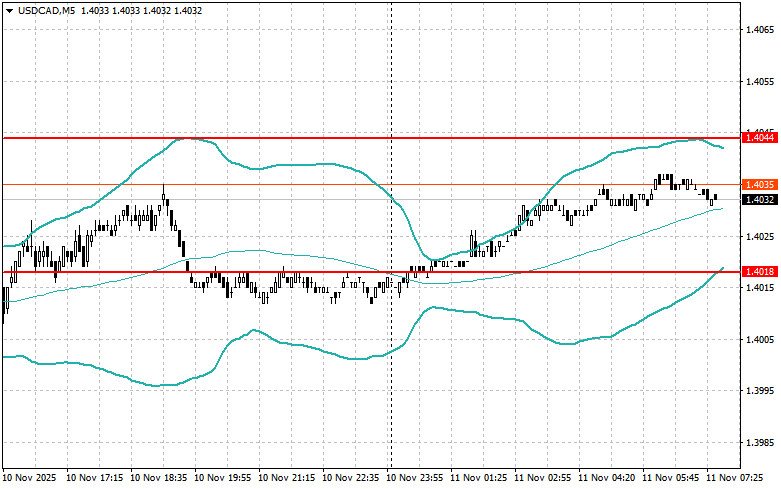

The U.S. dollar has failed to regain its leadership over several risk assets, which still have room to grow.

Yesterday, the U.S. Senate passed a bill to end the shutdown. Markets reacted with cautious optimism to this news. Traders, weary of uncertainty, perceived this as a first step toward restoring normal government operations. However, concerns about the long-term economic consequences of the shutdown persist. Before the bill takes effect, it must pass a vote in the Republican-controlled House of Representatives.

In the first half of the day, data are expected from the ZEW Institute on the business sentiment index for Germany, as well as the current situation index and the business sentiment index for the Eurozone as a whole. These indicators, published by ZEW, are traditionally viewed as leading economic indicators and serve as important barometers for assessing the prospects for the development of the German and European economies as a whole. Traders always closely monitor this data, as it can provide early signals about potential changes in economic activity and business sentiment. Special attention will be paid to the German business sentiment index. A decline in this index may signal growing concerns about the prospects of the largest economy in Europe, related to trade wars, slowing global growth, and other factors. Conversely, positive dynamics in the index will indicate sustained optimism among German entrepreneurs and investors.

The current situation index will provide insight into the Eurozone economy's current state, allowing an assessment of how well it is coping with current challenges.

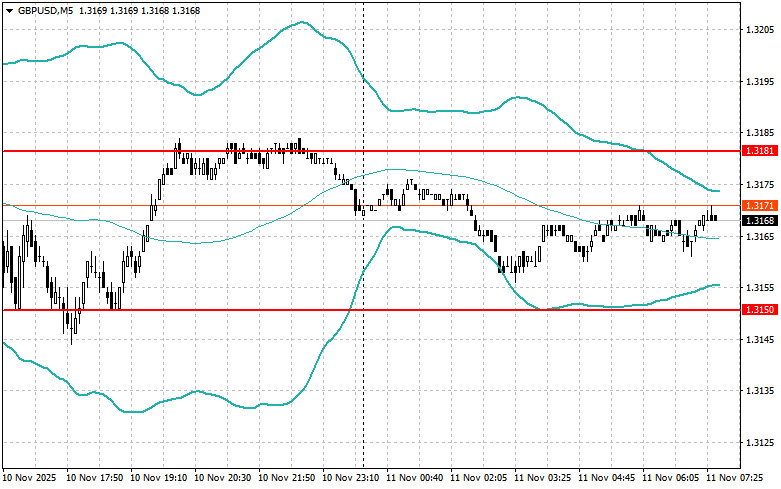

In terms of the pound, data are expected in the first half of the day regarding changes in the number of unemployment benefit claims in the UK, the unemployment rate, and changes in average earnings. This data traditionally exerts a significant influence on the British pound's exchange rate. A lower-than-expected number of unemployment benefit claims, combined with a low unemployment rate and growth in average wages, is usually seen as a positive signal for the UK economy. This strengthens optimism about the Bank of England's interest rate prospects and, consequently, increases the pound's attractiveness to investors. The market's attention will likely be on data on changes in average earnings. Steady wage growth can signal sustained inflationary pressure, which may force the BoE to continue an aggressive policy. This, in turn, could further strengthen the pound, though it poses risks to long-term economic growth.

If the data aligns with economists' expectations, it would be best to act using a Mean Reversion strategy. If the data is significantly above or below economists' expectations, it is best to use a Momentum strategy.

HIZLI BAĞLANTILAR

show error

Unable to load the requested language file: language/turkish/cookies_lang.php

date: 2025-11-11 08:04:45 IP: 216.73.216.166