Yesterday, stock indices closed with another advance. The S&P 500 rose by 0.62%, while the Nasdaq 100 added 0.65%. The Dow Jones Industrial Average strengthened by 0.99%.

The global equity markets index fell by 0.1% on Wednesday after four days of gains that had lifted it to a record high. Asian indices declined by 0.5% after a rally that delivered their best start to a year on record. Japanese indices slid by 1% after China imposed export restrictions. Against a backdrop of weak sentiment, futures on European and US stock indices showed modest declines after the opening bell. Treasury bonds gained slightly, with the yield on the benchmark 10?year note down one basis point to 4.16%.

Commodity prices also retreated: platinum fell by 7%, silver declined by 3.3%, and gold lost 1%. Oil dropped after US President Donald Trump said Venezuela would hand over up to 50 million barrels of oil to the US. Nickel gave back some gains after its largest rise in more than three years on the London exchange on Tuesday.

Tension in relations between China and Japan is now in focus. Despite optimism around artificial intelligence and expectations of Fed easing that pushed global equity markets to new highs, traders remain cautious. Economic reports from the US due this week will test the durability of this optimism.

Amova Asset Management said that the road ahead would be tougher than markets assumed, noting that strong geopolitical tensions worldwide were, in effect, being pushed to the background by the market.

As noted above, Beijing tightened controls on the export to Japan of goods that could potentially be used for military purposes, marking another escalation in diplomatic tensions between the two Asian countries over Taiwan. China made the announcement for both domestic and international audiences that it controls extraction rights for rare earths, and the fact that Beijing is signaling this to some extent before imposing actual sanctions means the market is unlikely to treat the move as a trigger for panic selling following the restrictions.

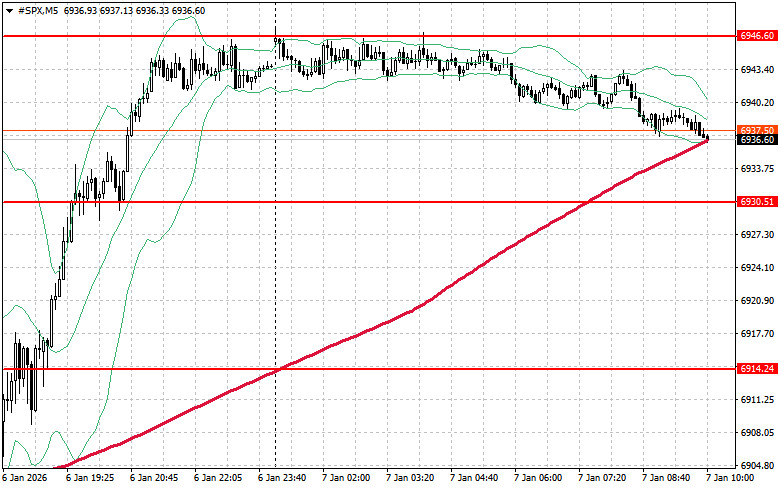

As for the technical outlook for the S&P 500, the immediate task for buyers today is to overcome the nearest resistance level of $6,946. Breaking above this level would signal further upside and open the path to $6,961. An equally important objective for bulls is to secure control above $6,975 to strengthen their positions. In case of a downside move amid waning risk appetite, buyers should assert themselves around $6,930. A break below this level could quickly push the index back to $6,914 and open the way to $6,896.

RÁPIDOS ENLACES