As of publication on Wednesday, the NZD/USD pair was trading around 0.5600, down 1.10% for the day. The currency reached an eight-month low amid disappointing New Zealand data and a general deterioration in market sentiment amid heightened risks.

The New Zealand dollar remains under pressure following the release of weak producer price index data. According to official statistics, purchase prices rose only 0.2% in the third quarter, significantly lower than the previous 0.6% and well below the expected 0.9%. The increase in finished goods prices was only 0.6%, falling short of expectations. These publications follow recent statements from the Reserve Bank of New Zealand (RBNZ), which noted that inflation expectations are currently around 2% and that the unemployment rate in the third quarter reached 5.3%, the highest level in the past 9 years. These factors heightened market expectations of a possible rate cut at next week's meeting.

Meanwhile, major macroeconomic indicators in the United States have not reached unequivocally positive conclusions; however, the U.S. dollar is supported by capital inflows into safe-haven assets amid rising global uncertainty. Recent data on initial jobless claims and the ADP employment report for the current week signal a slowdown in the U.S. labor market, heightening expectations that the Federal Reserve may commence rate cuts in December. Currently, the dollar retains solid support as investors remain cautious in anticipation of the delayed non-farm payroll (NFP) report for September, scheduled for release on Thursday.

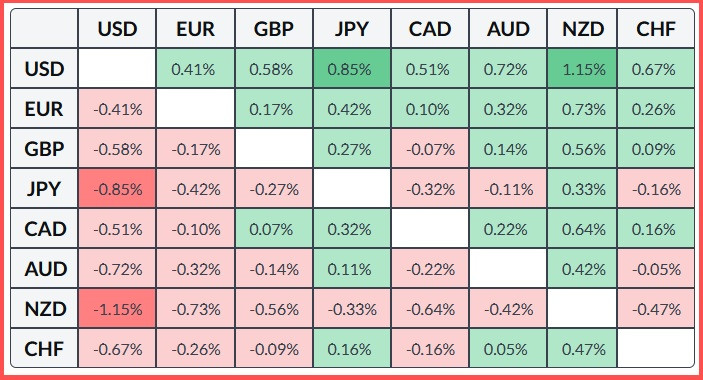

From a technical perspective, oscillators on the daily chart are negative, confirming a bearish outlook, but it is worth noting that the relative strength index is close to the oversold zone, indicating some consolidation before the next movement. Below is a table showing the percentage change of the NZD against major currencies. On Wednesday, the New Zealand dollar showed the greatest strength against the Japanese yen.

RÁPIDOS ENLACES