On Monday, the EUR/USD pair traded sideways after rebounding from the 61.8% Fibonacci retracement level at 1.1594. Thus, the decline in quotes may continue today toward the next retracement level at 76.4% – 1.1517. A rebound from this level would favor the euro and signal a new rise toward 1.1594, while a close above 1.1594 would increase the likelihood of further growth toward the resistance level of 1.1645–1.1656.

The wave structure on the hourly chart remains simple and clear. The new upward wave has not yet broken the previous peak, while the last downward wave did break the previous low. Thus, the trend is still bearish. The bulls are not using the opportunities for an advance, and the bears are attacking mostly out of enthusiasm, without fundamental support. For the current trend to be considered complete, the pair needs to rise above 1.1656 or form two consecutive bullish waves.

On Monday, traders only reacted to Donald Trump's announcement that the U.S. government shutdown could end soon. According to the president, Democrats and Republicans reached a temporary agreement in the Senate that will allow funding for government operations at least until November 30. However, the bill still needs to pass the House of Representatives, and any amendments by lawmakers must be considered. Therefore, government operations may remain on hold until the end of the week.

Traders reacted very weakly to this positive news — just as they barely reacted when the shutdown began. This suggests that the information background currently doesn't greatly influence the market, or that the market is simply not inclined to trade actively regardless of the news flow. Market movements remain sluggish, even though plenty of information has appeared in recent weeks.

On the 4-hour chart, the pair reversed in favor of the euro after a bullish divergence formed on the CCI indicator and consolidated above the 38.2% Fibonacci level at 1.1538. Thus, growth may continue toward the resistance level of 1.1649–1.1680. A close below 1.1538 would favor the U.S. dollar and signal a resumption of the decline toward the 50.0% retracement level at 1.1448. No emerging divergences are currently observed on any indicator.

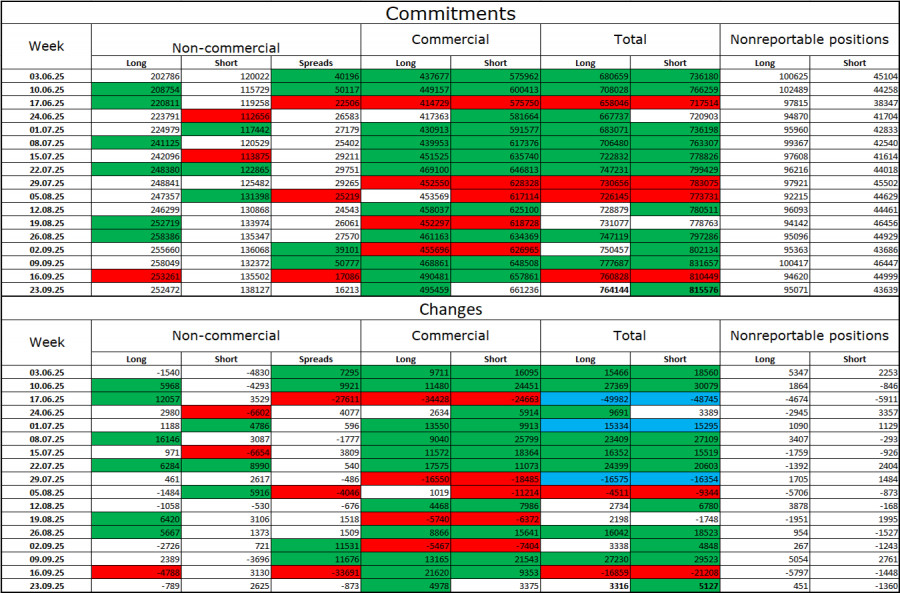

Commitments of Traders (COT) Report:

During the last reporting week, professional traders closed 789 long positions and opened 2,625 short positions. There have been no new COT reports for over a month. The sentiment of the non-commercial group remains bullish, thanks in large part to Donald Trump, and continues to strengthen over time. The total number of long positions held by speculators is now 252,000, compared to 138,000 short positions — nearly a two-to-one ratio. In addition, note the number of green cells in the table above — they indicate a strong increase in euro positions. In most cases, interest in the euro is growing, while interest in the dollar is declining.

For thirty-three consecutive weeks, major players have been reducing short positions and increasing long ones. Donald Trump's policies remain the main factor influencing traders, as they could lead to long-term, structural problems for the U.S. economy. Despite the signing of several major trade agreements, many key economic indicators continue to show weakness.

News Calendar for the U.S. and the Eurozone:

Eurozone:

The November 11 economic calendar includes three entries, though none of them seem particularly significant to me. Any impact of the news background on market sentiment on Tuesday is expected to be weak.

EUR/USD Forecast and Trader Recommendations:

At the moment, I do not recommend considering short positions, as I believe the bears have already exceeded their targets. Buy positions could have been considered upon a close above 1.1517, targeting 1.1594 — this target has already been met. New long positions can be considered after a rebound from 1.1517 or upon a close above 1.1594.

Fibonacci grids are built from 1.1392–1.1919 on the hourly chart and from 1.1066–1.1829 on the 4-hour chart.

RÁPIDOS ENLACES