Immediately after the FOMC meeting, Donald Trump commented on the central bank's decision. The American leader once again demanded a more significant reduction in interest rates to support the economy, but recently, the occupant of the White House has somewhat eased his pressure on the Federal Reserve. This is easily explained. Throughout October, Trump was preoccupied with threats towards India and China. First, he demanded that the two countries cease purchasing Russian energy resources. Then he shifted from words to action, beginning to raise tariffs. New negotiations commenced, during which Trump managed to achieve a reduction in Russia's oil purchases by India—information that remains unspoken in India, or perhaps simply unknown. Trump also secured the restoration of rare-earth metal supplies from China for at least another year, and he lowered the total tariffs on Beijing to 47%.

As a result, Trump currently has little time to focus on Powell and the Fed, as he has negotiations and threats to handle, not to mention golf. Regarding the trade war, I maintain my opinion that the events of October are by no means the last in Trump's ongoing confrontation with the world aimed at filling the US Treasury. The market is currently in a state of euphoria, as it seems that an escalation of the trade war with China has been avoided, and under pressure from Washington, India may relent on at least some portion of its Russian oil, which could lower its export tariffs to the US.

However, in my view, there are not many grounds for optimism. How long will Trump refrain from imposing new tariffs when his latest decision was to tax all pharmaceuticals, furniture, and trucks? How long will the dollar remain strong, given the Fed's monetary easing? I won't hide it—I did not anticipate such significant strengthening of the US currency in October, but upon closer examination, it cannot be deemed "serious."

The US dollar is sitting fairly close to its annual lows, and in recent months, both EUR/USD and GBP/USD have been developing only corrective wave sets, representing a typical sideways trend. Based on this, I remain highly skeptical of the US dollar's growth. Let me remind you that inflation and unemployment in the US are rising, and the labor market is "cooling." Not exactly a favorable mix for prolonged strengthening of the national currency.

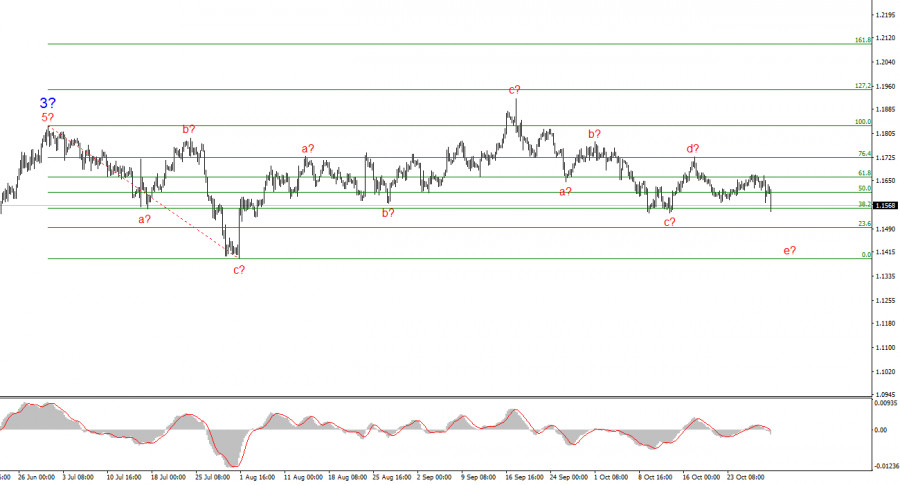

Based on the conducted analysis of EUR/USD, I conclude that the instrument continues to build an upward segment of the trend. Currently, the market is in a pause, but Donald Trump's policies and the Fed's remain significant factors in the decline of the US currency. The targets for the current segment of the trend could reach up to the 25 figure. At the moment, we can observe the formation of correction wave 4, which is taking on a very complex and elongated shape. Therefore, I continue to consider only buying in the near term. By the end of the year, I expect the euro currency to rise to 1.2245, which corresponds to 200.0% on the Fibonacci scale.

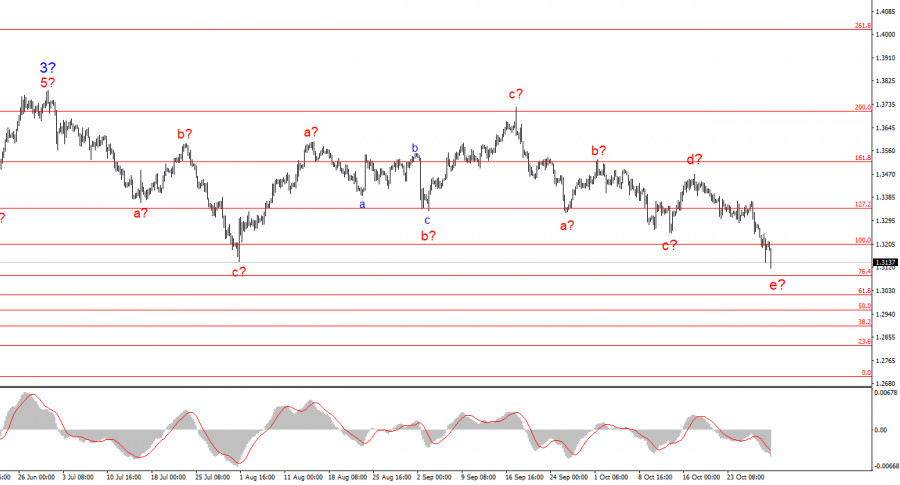

The wave picture for the GBP/USD instrument has changed. We continue to deal with an upward, impulsive segment of the trend, but its internal wave structure is becoming more complex. Wave 4 is taking on a three-wave form, and its structure is significantly more elongated than wave 2's. Another downward corrective structure is nearing completion, but it could complicate a few more times. If this indeed happens, the rise of the instrument within the global wave structure may resume with initial targets around the 38 and 40 figures. However, the correction is still ongoing at this time.

RÁPIDOS ENLACES