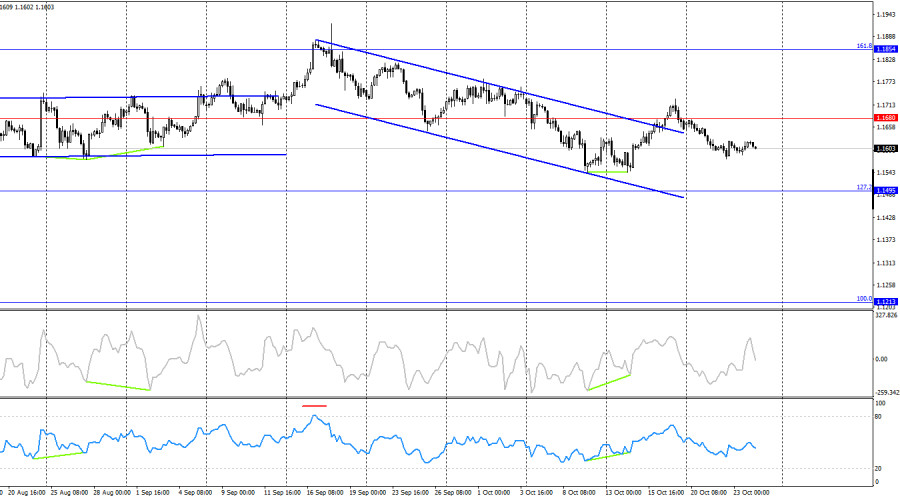

On Thursday, the EUR/USD pair made another rebound from the 61.8% Fibonacci retracement level at 1.1594, turning in favor of the European currency. Thus, the upward movement may continue today toward the resistance zone 1.1645–1.1656, either immediately or after another rebound from 1.1594. If the pair consolidates below 1.1594, traders can expect a further decline toward the next Fibonacci retracement level at 76.4% (1.1517).

The wave structure on the hourly chart remains simple and clear. The last upward wave broke the previous high, while the last completed downward wave did not break the previous low. Therefore, the trend has now shifted to bullish. Recent labor market data, changing Federal Reserve policy expectations, Trump's renewed aggression toward China, and the government shutdown all support the bulls. However, the bulls themselves continue to attack very sluggishly, as if they simply lack the will to do so for some unknown reason.

On Thursday, there was once again no significant news in either the EU or the U.S., except for a single U.S. home sales report, which drew little reaction from traders. Today promises to be far more interesting: traders will receive business activity (PMI) indices and inflation data from the U.S. Recall that the U.S. inflation report remains extremely important for shaping FOMC monetary policy, while PMI indices are, to some extent, leading indicators of the economy's condition. Thus, Friday's data releases could strongly influence traders' decisions throughout the day. At the very least, market activity is expected to increase compared to earlier in the week.

In my opinion, the bulls still have favorable prospects, as most global developments are working against the dollar. However, in recent weeks, the market has been stagnant, and traders are reluctant to open large positions that could significantly move the exchange rate.

On the 4-hour chart, the pair turned in favor of the U.S. dollar and consolidated below 1.1680, which allows for some downward movement. However, earlier there was also a break above the descending trend channel following the formation of a bullish divergence on the CCI indicator. Thus, the upward process may resume toward the next Fibonacci level at 161.8% (1.1854). Since market movements are currently weak, analyzing the hourly chart is more relevant.

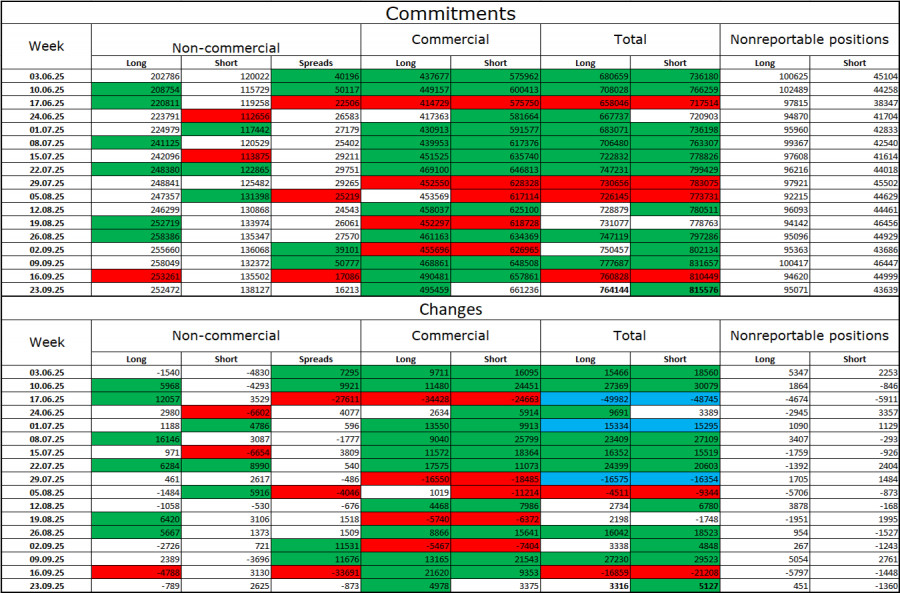

Commitments of Traders (COT) Report

During the latest reporting week, professional traders closed 789 long positions and opened 2,625 short positions. The sentiment of the "non-commercial" category remains bullish, thanks to Donald Trump's policies — and continues to strengthen over time. The total number of long positions held by speculators now stands at 252,000, while short positions total 138,000 — a nearly twofold difference.

Additionally, note the large number of green cells in the data table, indicating a strong increase in euro positions. In most cases, interest in the euro continues to grow, while interest in the dollar declines.

For thirty-three consecutive weeks, large traders have been reducing short positions and building up longs. Donald Trump's policies remain the most significant factor for traders, as they may create numerous long-term structural problems for the U.S. economy. Despite several important trade agreements being signed, many key economic indicators continue to show weakness.

Economic Calendar for the U.S. and the Eurozone

Eurozone / Germany:

United States:

The October 24 economic calendar includes a large number of key events, each of which could influence the market. The fundamental background will have a strong impact on market sentiment throughout Friday.

EUR/USD Forecast and Trading Recommendations

Sell positions were possible on a rebound from 1.1718 on the hourly chart and on a close below the 1.1645–1.1656 level, targeting 1.1594 — this target has already been met. New sell trades can be opened if the pair closes below 1.1594, with a target of 1.1517. Buy positions can be considered today on a rebound from 1.1594, targeting 1.1645–1.1656.

Fibonacci grids are built:

RÁPIDOS ENLACES