The test of the 1.1580 price level occurred when the MACD indicator had already moved well below the zero line and remained in the oversold zone for a while. This allowed scenario #2 for euro buying to be fulfilled, resulting in the pair rising by more than 25 pips.

Yesterday's statements by Federal Reserve official Christopher Waller that he would support a more accommodative monetary policy put intense pressure on the U.S. dollar. Traders grew fearful that Waller's potential appointment as the next Fed Chair could lead to a longer-term dovish stance from the central bank.

This shift in tone sparked broad market discussion. Until now, Waller had been considered a proponent of tighter policy to contain inflation. His latest comments appeared to contradict that view, triggering broad dollar selling.

The Eurozone Consumer Confidence Index for October, scheduled for release during the first half of the day, is unlikely to significantly impact euro exchange rates. Forecasts pointing toward a further decline only reinforce pessimism among European consumers. That said, the indicator contributes to a broader picture of the eurozone economy—so it should not be disregarded entirely. A continued downward trend in confidence could become an additional argument for European Central Bank policy action. If no other notable reports emerge, the euro could continue its corrective upswing.

For intraday trading, I will rely on the execution of scenarios #1 and #2.

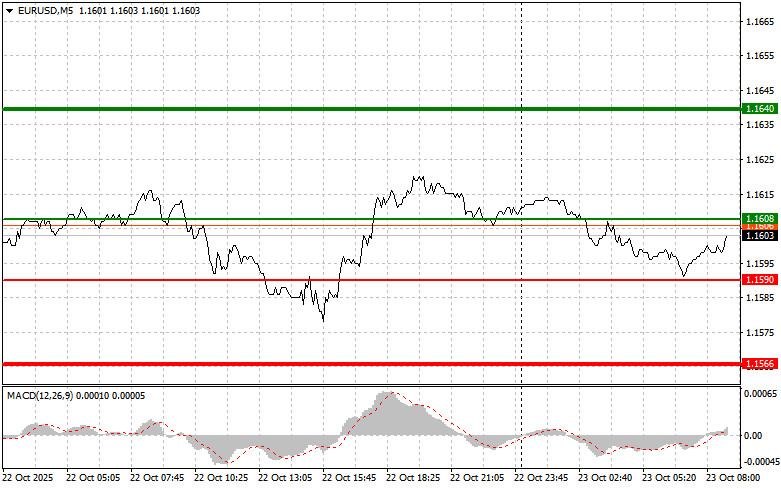

Scenario 1: Long positions may be considered at 1.1608 (thin green line) with a target at 1.1640 (thick green line). Upon reaching 1.1640, I plan to exit longs and sell on a pullback, targeting a 30–35 pip move from the entry level. Buying the euro today is only justified as part of a corrective move, relying on yesterday's USD weakness. Important: Confirm that the MACD indicator is above the zero line and only beginning to rise before buying.

Scenario 2: Long positions may also be considered after two consecutive tests of the 1.1590 level when the MACD is in the oversold zone. This will likely limit downside potential and create an upward reversal, with expected targets at 1.1608 and 1.1640.

Scenario 1: Short positions may be initiated after the price reaches 1.1590 (thin red line), targeting 1.1566 (thick red line). I plan to exit at 1.1566 and buy on a bounce for a 20–25 pip potential counter-move. Selling pressure may return today if incoming data disappoints. Important: Confirm that the MACD indicator is below the zero line and begins to decline before entering a short.

Scenario 2: Short positions may also be initiated after two consecutive tests of 1.1608 while MACD is in the overbought zone. This suggests limited bullish strength and a reversal lower, with expected target zones at 1.1590 and 1.1566.

Thin green line – price level used for potential buying opportunities

Thick green line – expected Take Profit area or manual exit level where further growth is unlikely

Thin red line – price level used for potential selling

Thick red line – expected Take Profit area or manual exit level where further decline is unlikely

MACD indicator – monitor for overbought/oversold conditions as confirmation for entry signals

Forex beginners must exercise caution when entering the market. Ahead of major fundamental releases, it's best to stay flat to avoid sudden price swings. If trading during high-impact events, always place stop-loss orders to minimize risk. Without stop-loss protection, especially when trading large positions without proper money management, your entire account can quickly be wiped out.

Remember: success in trading requires a clear plan—like the example provided above. Spontaneous decisions based on short-term price action alone are typically a losing strategy for intraday traders.

RÁPIDOS ENLACES