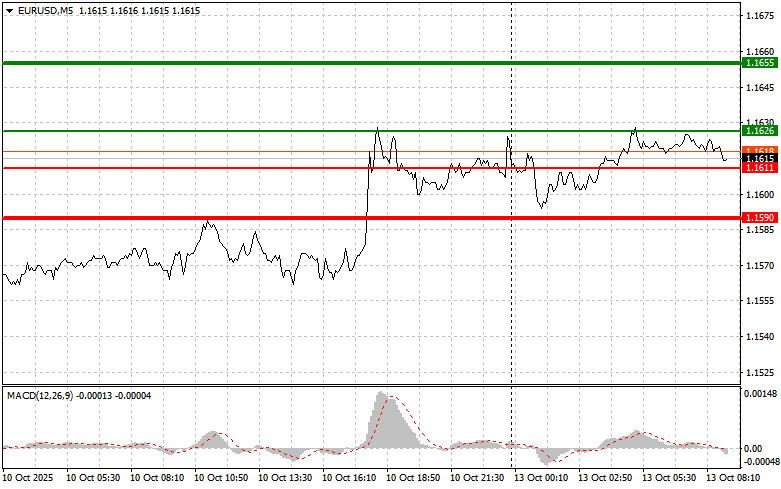

A test of the 1.1595 level occurred when the MACD indicator had just begun rising from the zero line, confirming a valid entry point for buying the euro. As a result, the pair moved up toward the target level of 1.1619.

News of declining inflation expectations in the U.S. exerted pressure on the dollar. Fresh data pointing to expected slower consumer price growth over the coming months led traders to revise their outlooks regarding the Federal Reserve's future monetary policy. The probability of a rate cut during the October FOMC meeting remains relatively high.

A swift reaction also followed after Trump announced potential 100% tariffs on all Chinese goods. The U.S. dollar dropped sharply as investors, troubled by the unpredictability of the trade confrontation, rushed to shift capital into safer currencies and precious metals.

The effects of these developments extend beyond the financial sector. Representatives of U.S. industry, dependent on Chinese components and raw materials, expressed concerns about a significant increase in production costs. Consumers, in turn, may again face rising prices for a wide range of Chinese-imported goods.

The future direction of the market will depend on how quickly U.S. and Chinese authorities can de-escalate the conflict.

This morning, unfortunately, the only macroeconomic report is Germany's Producer Price Index. No other important reports are expected today. Monitoring the dynamics of Germany's wholesale price index is crucial for assessing several processes, including inflation trends. A moderate increase in this figure could indicate potential deflation risks, which may lead the European Central Bank to consider further stimulus measures.

Moreover, the lack of significant economic data may shift investor focus toward alternative drivers, the primary one currently being the trade conflict.

As for the intraday strategy, I will focus mainly on implementing Scenarios 1 and 2.

Important: Beginner forex traders should be extremely cautious with entry decisions. Before major fundamental reports, it's best to remain out of the market to avoid exposure to abrupt price swings. If you do decide to trade during high-impact events, always place stop-loss orders to minimize losses. Without them, your account balance can deplete quickly, especially if you neglect proper money management and trade large volumes.

And remember, successful trading requires a clear plan—like the one presented above. Spontaneous decision-making based solely on the current market situation is an inherently losing strategy for intraday traders.

RÁPIDOS ENLACES