Very few macroeconomic reports are scheduled for Thursday, and all of them are secondary in nature. In Germany, import, export, and trade balance data will be released; however, these figures are unlikely to have a meaningful impact on trader sentiment.

It may seem like yesterday's disappointing industrial production report from Germany triggered the euro's decline, but in reality, the euro stopped falling right after that data was published. Economic calendars for the UK, the Eurozone, and the U.S. remain largely empty today.

There is only one major fundamental event on Thursday — but it is a significant one. Jerome Powell's speech always carries weight in the market, and under current conditions, it becomes particularly meaningful.

The market is eagerly awaiting some clarity on how the Federal Reserve intends to assess the economic outlook and decide on interest rates at the end-of-month meeting. Yesterday, the minutes from the September FOMC meeting were released, where many officials expressed support for further monetary easing.

But in September, the United States was not in a government shutdown. Now, even core economic indicators are not being published. Under such circumstances, the Fed may very well take a wait-and-see approach: "no data — no decision."

In short, there are many questions for Powell, and his remarks are essentially the only high-impact event of the trading week.

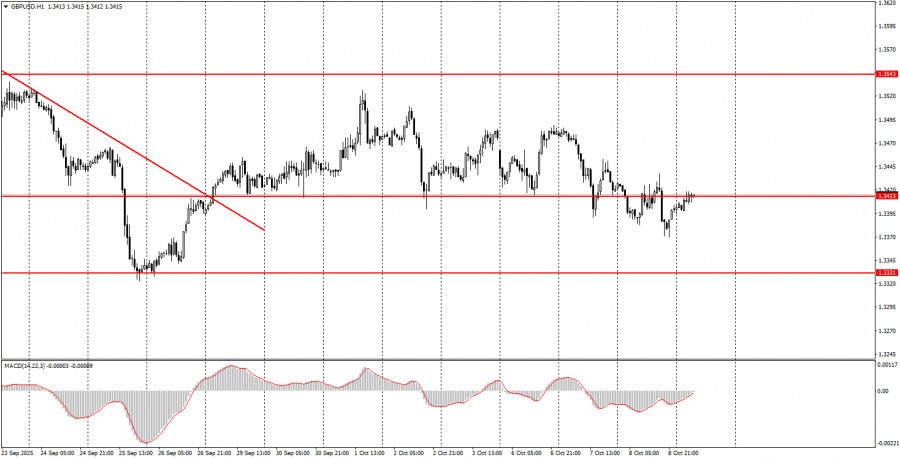

As we approach the latter part of the trading week, both EUR/USD and GBP/USD may continue to trade erratically and illogically. Price movements have been chaotic throughout the week, and Powell's speech may only intensify the uncertainty.

For novice traders, it is still possible to trade from the nearest key levels or zones; however, it's essential to keep in mind that current market conditions are not ideal for clean or consistent setups. Caution and proper risk management are advised.

Important speeches and reports (always listed in the economic calendar) can heavily influence currency pair movement. During their release, you should trade with extra caution or exit the market entirely to avoid sharp price swings against your position.

For beginners in forex trading: remember that not every trade will be profitable. Developing a clear strategy and effective money management are essential for long-term success in trading.

RÁPIDOS ENLACES