The US stock market is drawing investors like a magnet. It's hard to resist when, for the first time since November 2021, all four major indices—S&P 500, Nasdaq 100, Dow Jones, and Russell 2000—close at record highs. Such an event has happened only 25 times in the 21st century. Combined with record treasury holdings by non-residents, it's clear that American exceptionalism is alive and well—though with a new twist.

Foreign investors collectively own $20 trillion in US-issued stocks and $14 trillion in bonds, including Treasuries. Their exodus in response to Donald Trump's tariffs drove the S&P 500 down to a 15-month low in early April. Since then, the prevailing market narrative has shifted from "Sell America" to "Hedge America." Securities are being snapped up, risk hedging costs in various currencies are falling, and the US dollar is declining.

Deutsche Bank estimates that about 80% of non-resident ETF purchases in US equities are hedged. Ninety One Asset Management believes that purchasing flows into US-issued securities, coupled with risk hedging, could rise by $1 trillion—supporting further gains in the S&P 500 and weighing down the US dollar.

Another wave of hedging interest will be triggered if Donald Trump manages to seize control of the Fed. The more FOMC officials start acting like Stephen Miran did in September, the greater the risk the central bank will lose its independence and sharply slash the fed funds rate. Standard Bank argues that in such a scenario, investors will have every reason to fall in love with US stock indices and turn their backs on the greenback.

UBS Global Wealth Management notes that lower rates, solid profit growth, and the tailwinds from AI technology will support the S&P 500 rally through the end of next year. The futures market is pricing an 80% probability of two more rounds of Fed monetary easing by the end of 2025, while a $5 billion deal between NVIDIA and Intel sent the latter's stock to its best daily gain since October 1987.

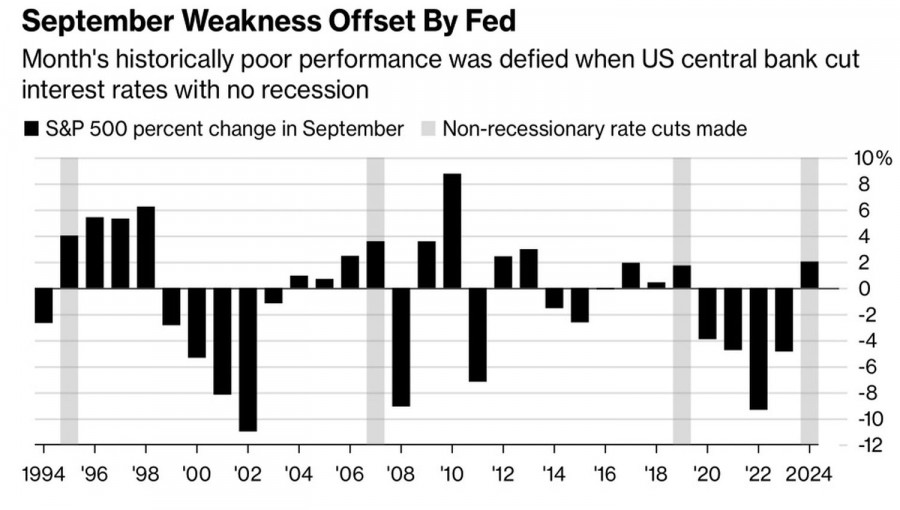

Despite September's historical reputation as the worst month for US stocks, in periods when the Fed has cut rates, everything changes. Since 1971, the S&P 500 has risen more often than it's fallen. This pattern was confirmed in 2024—and will, in all likelihood, be repeated in 2025.

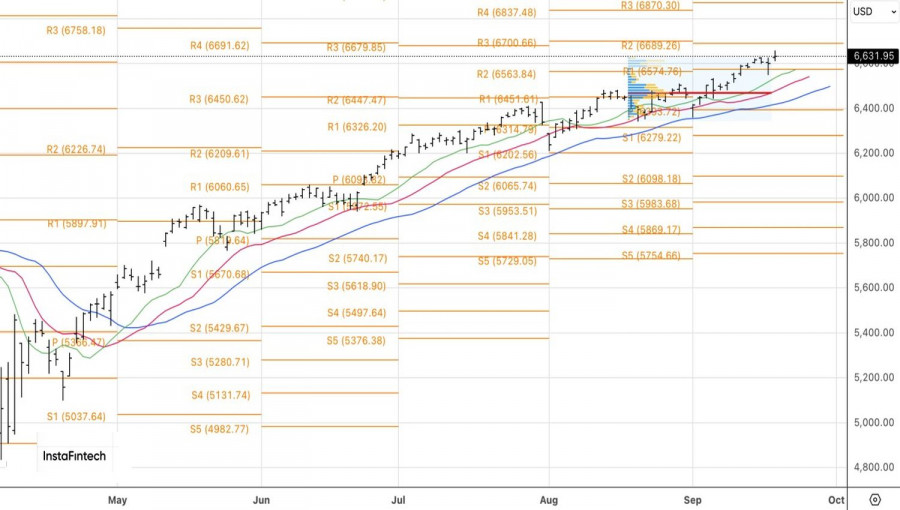

Technically, the S&P 500 on the daily chart reacted to a doji bar and set a new all-time high. Long positions initiated at 6570 and added at 6625 look solid, although the appearance of another doji bar is cause for concern. If its low at 6615 is broken, it might be time to lock in profits. Still, in such a strong bull trend, any pullbacks could provide new opportunities to buy the broad market index.

RÁPIDOS ENLACES