Gold set a new record this week as traders and investors anticipate more dovish actions from the Federal Reserve, including further rate cuts in the coming months.

On Tuesday, the price of gold surpassed Monday's all-time high of about $3,685 per ounce, also supported by the US dollar dropping to its lowest level in over seven weeks. While this week's rate cut is already priced in, the Fed will also release its quarterly economic and rate projections—known as the "dot plot"—and Fed Chair Jerome Powell will hold a press conference after the decision.

The latest surge in the precious metal indicates growing uncertainty about global economic stability and rising inflation expectations. Investors, fearing depreciation in fiat currencies, are seeking a safe haven in gold, which is traditionally regarded as a store of value during turbulent periods.

The upcoming Fed rate decision is the key event this week, closely watched by market participants. Expectations of a dovish monetary policy—including a rate cut tomorrow and likely more to come—are fueling gold demand, since lower interest rates make alternative investments like bonds less attractive.

Beyond Fed expectations, other factors are also supporting gold's price growth. Geopolitical tensions, renewed military escalation in Israel, trade wars, and political instability in various regions of the world are all driving demand for safe-haven assets. In addition, active gold purchases by central banks in several countries are also supporting the ongoing uptrend.

Meanwhile, growing pressure from US President Donald Trump on the Fed—including his attempts to force Governor Lisa Cook's resignation—has further fueled demand for gold.

This year, gold has already risen more than 40%, outperforming major assets such as the S&P 500, and it recently exceeded its inflation-adjusted peak reached in 1980. Goldman Sachs Group Inc. predicts that the price of gold could approach $5,000 per ounce if even 1% of private Treasury holdings shift into the precious metal.

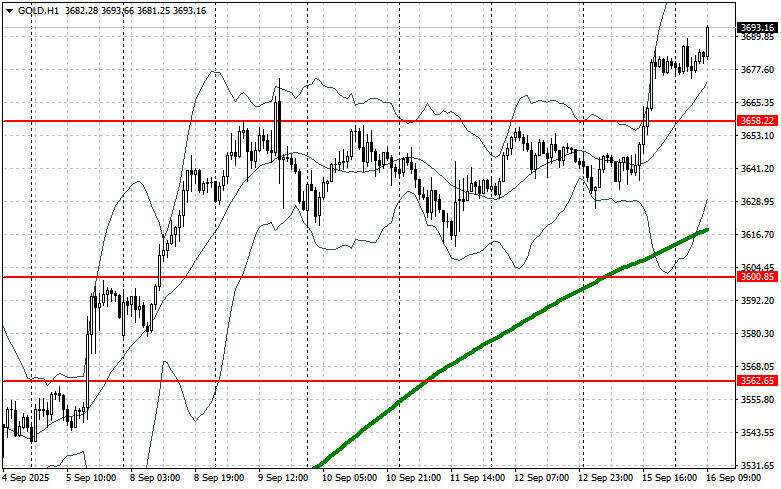

From a technical standpoint, buyers now need to overcome the nearest resistance at $3,705. This would open a path to $3,756, above which breaking higher will be quite challenging. The most distant target is the $3,813 area. If gold declines, bears will attempt to seize control at $3,658. If successful, a break below this range could deal a serious blow to the bulls and push gold to a low of $3,600 with the prospect of reaching $3,562.

RÁPIDOS ENLACES