The price test at 1.1773 coincided with the MACD indicator moving far above the zero mark, which limited the pair's upward potential. For this reason, I did not buy the euro.

Yesterday, the euro continued its rise, with weak U.S. data helping it break through to new monthly highs. This morning, business confidence indicators in the eurozone and Germany from the ZEW research center, the German current conditions index, and fresh eurozone industrial production figures will be released. These will serve as key markers of the region's economic health.

The ZEW Economic Sentiment Index will provide valuable information for assessing growth prospects in the eurozone and Germany. An increase would signal optimism among entrepreneurs and readiness to expand activity, potentially strengthening the euro. The German current conditions index, which reflects the economic climate, will add to the picture. However, given that things have not been running as smoothly since U.S. tariffs were imposed, it would not be surprising if the figure declines and comes in below economists' forecasts.

Industrial production data will reveal the actual state of the industrial sector, the main driver of the economy. Growth, though unlikely, would indicate stronger demand, efficient resource use, and competitiveness of European businesses. Conversely, weak figures would reduce the incentive to buy euros.

As for the intraday strategy, I will focus more on implementing scenarios #1 and #2.

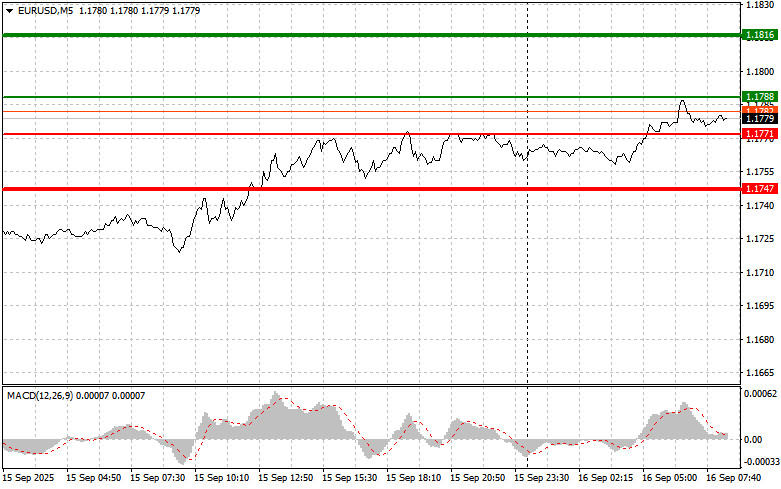

Thin green line – entry price at which the instrument can be bought.

Thick green line – suggested price for taking profit or manually securing profits, as further growth above this level is unlikely.

Thin red line – entry price at which the instrument can be sold.

Thick red line – suggested price for taking profit or manually securing profits, as further decline below this level is unlikely.

MACD indicator: When entering the market, it is important to refer to overbought and oversold areas.

Important. Beginner forex traders should exercise extreme caution when making entry decisions. Before important fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during the release of news, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you don't use money management and trade large volumes. And remember: for successful trading, you need a clear trading plan, as I described above. Making spontaneous trading decisions based on the current market situation from moment to moment is a losing strategy for an intraday trader.

RÁPIDOS ENLACES