The American tariff dilemma continues and is only gaining momentum. Recall that several months ago, 12 Democratic governors filed a lawsuit in the International Trade Court against Donald Trump, stating that the US president does not have the authority to impose trade tariffs on entire industries or specific countries. The Trade Court granted the Democrats' claim, ruled Trump's actions illegal, and left the tariffs in place, transferring the responsibility for a decision on their repeal to the Appellate Court, where Trump immediately filed an appeal. After some time, the Appellate Court made the same decision—Trump's tariffs (except for some) are illegal, and the 1974 Emergency Powers Act contains no mention that the president can launch a trade war without Congress's approval. However, even after ruling the tariffs illegal, the Appellate Court did not overturn them. It postponed its decision until October 14 so that Trump could file another appeal, this time with the US Supreme Court.

Now the case over Trump's tariffs will be considered in Washington, and that's the final possible instance. If Trump loses there as well, then what happens if all US courts rule the tariffs illegal? I bet many people think the tariffs will simply disappear and that's it. But what about the funds already collected by the US government from Americans when they purchase foreign goods? Can you imagine the possible number of lawsuits against the US president if the Supreme Court deems all trade tariffs illegal?

In that case, virtually any American or American company involved in imports could claim compensation and a return of funds paid "in excess." As a result, all collected tariffs would need to be returned to their owners. Beyond this, companies could demand compensation for financial losses connected with reduced demand for their products due to higher prices from import tariffs.

US Treasury Secretary Scott Bessent confirmed that, if the Court finds the tariffs illegal, the US budget will have to return the money. "We will have to return roughly 50% of taxes, which would be a disaster for the treasury," Bessent said. Honestly, I don't quite understand what he means by "taxes," but a disaster is indeed possible.

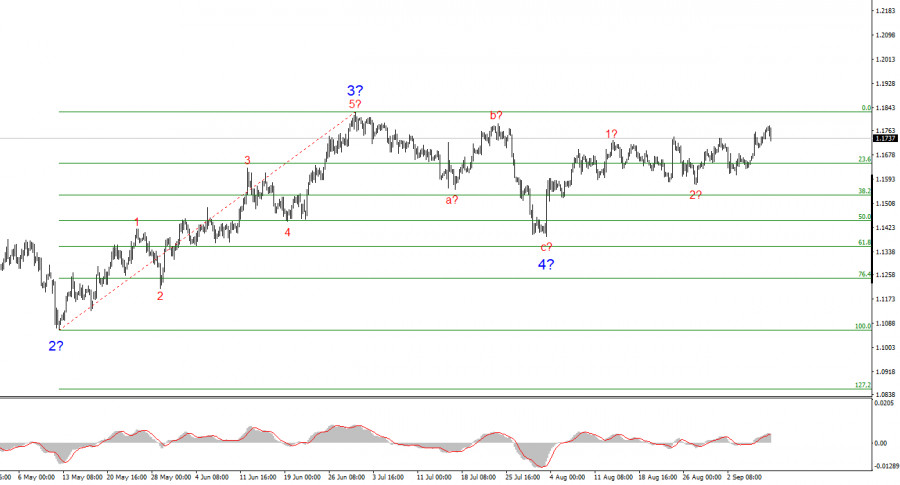

Based on my analysis of EUR/USD, I conclude that the instrument continues to develop an upward trend. The wave markup still depends entirely on the news background related to Trump's decisions and US foreign policy. The trend stretch targets can reach as high as the 1.25 area. Therefore, I continue to consider longs with targets around 1.1875, which corresponds to a 161.8% Fibonacci, and higher. I assume that wave 4 construction is complete; accordingly, now is still a good time to buy.

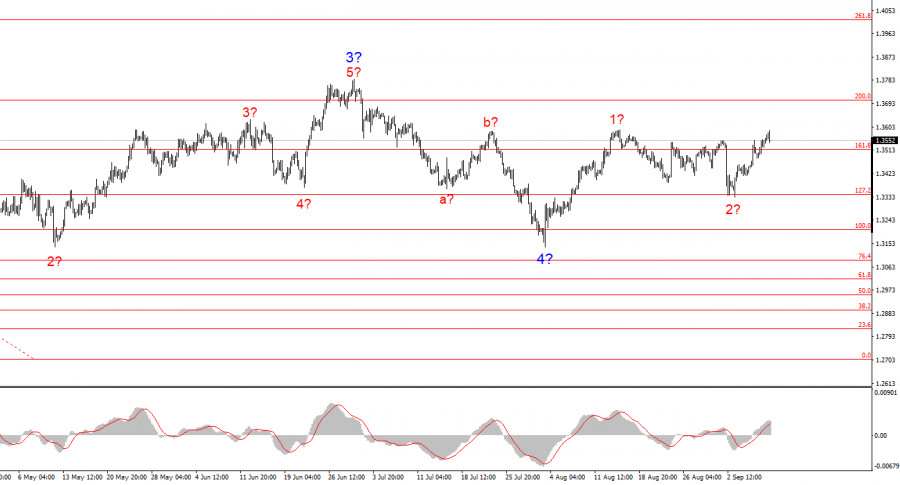

The wave markup for GBP/USD remains unchanged. We are dealing with a bullish, impulsive segment of a trend. With Trump, markets may experience a huge number of shocks and reversals, which could seriously affect the wave picture, but at the moment, the main scenario remains intact. The current upward segment of the trend now has its target near 1.4017. At this moment, I assume the corrective wave 4 is finished. Wave 2 within 5 may also be complete or close to completion. Accordingly, I recommend buying with a target of 1.4017.

RÁPIDOS ENLACES