Very few macroeconomic reports are scheduled for Tuesday. Essentially, only the U.S. durable goods orders report stands out. Recall that this report reflects American consumers' willingness to make big-ticket purchases. Consequently, it indirectly indicates consumer confidence and readiness to spend rather than save money. Thus, an increase in orders is a positive sign for the economy and the dollar, while a decline is negative. Forecasts for the report are negative.

There is absolutely nothing noteworthy among Tuesday's fundamental events. On Monday evening, the U.S. dollar unexpectedly strengthened, and it is still difficult to find an explanation. In the best-case scenario for the dollar, the Federal Reserve will not cut the key rate in September. However, this is a very doubtful supportive factor for the U.S. currency, considering that monetary policy in this case remains unchanged. A key rate cut in the U.S. is looming. Donald Trump continues to pressure the FOMC and seeks to reshape its composition to make the central bank more controllable.

The trade war remains the top concern for traders. Since we see no signs of de-escalation, we also see no grounds for the market to take medium-term dollar buy positions. As before, the U.S. currency may count only on local growth based on technical factors or isolated events/reports, but nothing more.

During the second trading day of the week, both currency pairs will trade based on technical factors. An unexpected move is possible only at the start of the U.S. session, when the durable goods orders report is published. The euro formed two sell signals near the 1.1655–1.1666 area, so further local decline toward 1.1571 is possible. The British pound can be traded today from the 1.3466–1.3475 area.

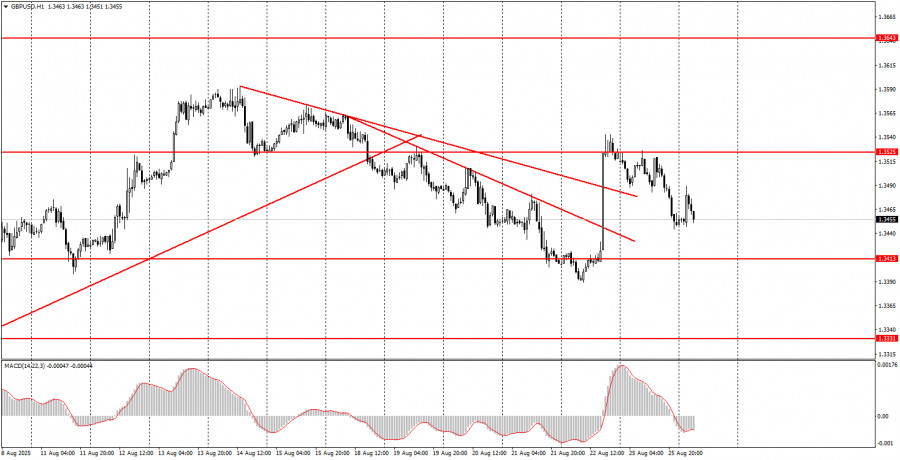

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important speeches and reports, which are consistently featured in the news calendar, can significantly influence the movement of a currency pair. Therefore, during their release, it is advisable to trade with caution or consider exiting the market to avoid potential sharp price reversals against the prior trend.

Beginners in the Forex market should understand that not every transaction will be profitable. Developing a clear trading strategy and practicing effective money management are crucial for achieving long-term success in trading.

RÁPIDOS ENLACES