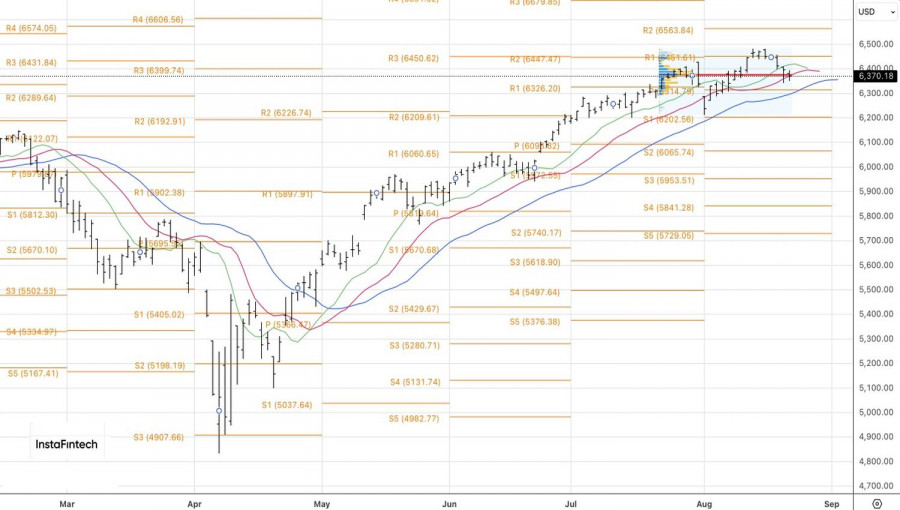

Good news is turning into bad news for the U.S. stock market. The strongest manufacturing activity in three years, combined with hawkish comments from FOMC officials, triggered the fifth consecutive close of the S&P 500 in negative territory. This is the worst losing streak for the broad index since the start of the year and raises troubling concerns.

When PMIs and inflation accelerate, conditions are set for raising rather than cutting the federal funds rate. Of course, this will not actually happen. But investors have become less confident in the Federal Reserve resuming its monetary easing cycle in September. The odds of such an outcome have fallen from over 90% to 74%. As a result, the U.S. dollar strengthened against major global currencies while the S&P 500 dropped.

Not everyone in the FOMC is convinced that a rate cut is necessary at the next meeting. Cleveland Fed President Beth Hammack said she would not vote for one if the meeting were held tomorrow. She is more concerned about inflation than labor market cooling. Kansas City Fed President Jeff Smith stated that borrowing costs are "in the right place." Atlanta Fed President Raphael Bostic continues to forecast just one rate cut in 2025. Markets had been expecting more.

Additional pressure on the S&P 500 came from Walmart's first disappointing earnings report in three years. The retailer's stock fell 4.5% after management warned that costs would rise due to higher supplier prices linked to tariffs. At the same time, Walmart intends to keep consumer prices below the national average, which will squeeze profits.

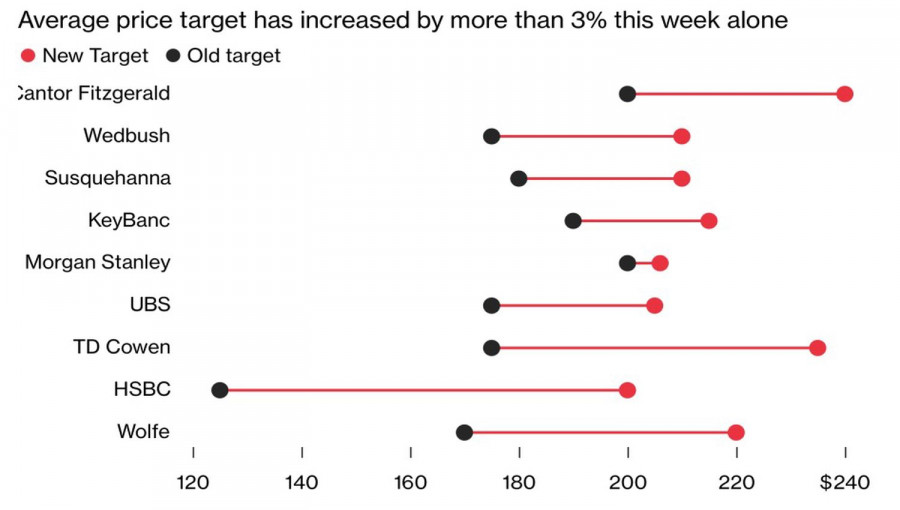

By contrast, NVIDIA's profit outlook is improving despite recent sell-offs. At least nine Wall Street analysts raised their forecasts, pushing the average price target up by 3% to 194 dollars—the highest in the company's history.

Thus, despite the tech giant's pullback, its long-term prospects remain bright. The same applies to Fed monetary easing. Perhaps the federal funds rate will only be cut by 25 basis points in 2025, but over a 12-month horizon, markets are pricing in 100 basis points of easing. Most likely, the S&P 500's difficulties are temporary. Belief in this is what allows retail investors to prepare for the next dip-buying opportunity.

Moreover, the April "sell all U.S. assets" idea has been laid to rest. Investors realized they cannot live without such a massive and liquid market as U.S. equities, even despite Donald Trump's attacks on the Fed.

From a technical perspective, the daily S&P 500 chart shows an inside bar following a pin bar. As a result, entry points for longs are 6393 and 6407. For shorts, a decline below 6350 would be suitable.

RÁPIDOS ENLACES