At the close of yesterday's session, US stock indices ended lower. The S&P 500 fell by 0.40%, the Nasdaq 100 declined by 0.34%, and the Dow Jones Industrial Average dropped 0.34%.

Caution continues to dominate markets ahead of Federal Reserve Chair Jerome Powell's speech, as traders reassess expectations for a September rate cut.

The dollar rose 0.1% on the back of upbeat US manufacturing data and hawkish Fed commentary. Futures on both US and European equities slipped 0.1%, while Asian indices remained steady. Gold retreated 0.2%.

Shares of Nvidia Corp. slid about 1.9% following reports that the company instructed suppliers to halt production of its H20 AI chip. This supported gains in chipmakers across China and Hong Kong. Meanwhile, the S&P 500 has now declined for five consecutive sessions amid stronger US economic data and more aggressive Fed rhetoric, which prompted money markets to scale back expectations of a September rate cut to 70%, compared with 90% earlier in the week.

Attention now turns to the Federal Reserve's annual Jackson Hole symposium, where Powell is set to deliver remarks that could clarify the outlook for monetary policy. Will he maintain a hawkish stance, focused on quashing inflation regardless of growth risks? Or will he adopt a more measured approach, mindful of recession concerns? The answers will be pivotal for the future direction of financial assets. A hawkish tone from Powell could trigger another wave of equity selloffs and strengthen the dollar, while risk assets—including cryptocurrencies—would come under pressure. Conversely, a flexible stance acknowledging incoming data could revive market sentiment. Slowing, albeit persistent, inflation may allow the Fed to pivot toward a softer approach, which investors would welcome.

Bond traders are also bracing for Powell's remarks, largely anticipating that the Fed could announce the beginning of rate cuts next month. In recent years, Powell has used this platform to signal major policy shifts, and investors will be watching closely for any challenge to current market pricing for rate cuts.

For context, this year the Fed has kept rates unchanged, citing heightened uncertainty over the impact of tariffs on the economy. President Donald Trump, a frequent Fed critic, has demanded sharp rate reductions, with some officials in his administration calling for a half-point cut as early as next month.

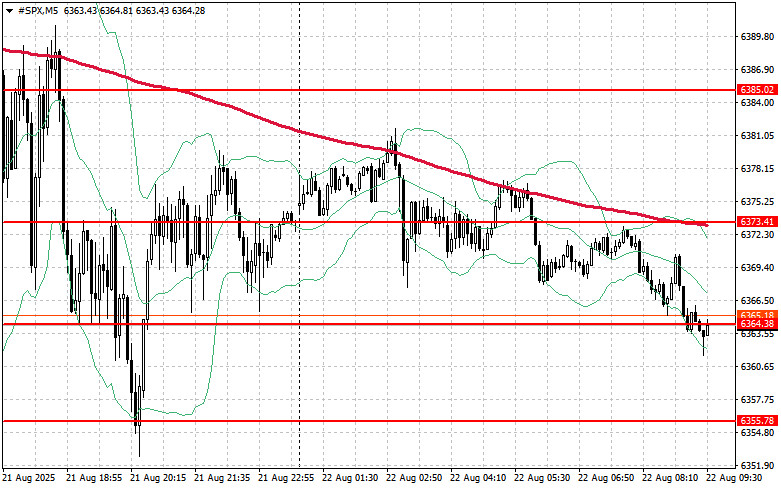

Technical picture for the S&P 500:

For buyers, the immediate task today is to break through the nearest resistance at $6,364, which would confirm upward momentum and open the way toward $6,373. Equally important for bulls is holding control above $6,385, which would further strengthen their position. On the downside, if risk appetite fades, buyers must step in near $6,355. A break below this level could quickly push the index back to $6,343 and then $6,331.

RÁPIDOS ENLACES