Bitcoin se ve středu posunul níže a smazal mírné zisky z tohoto týdne, protože investoři hledali jasno ohledně celní politiky amerického prezidenta Donalda Trumpa, která otřásla globálními trhy.

Největší světová kryptoměna do 15:54 SEČ klesla o 2,1 % na 83 811,0 USD.

V úterý token vzrostl na více než 86 000 dolarů, ale tyto zisky nedokázal udržet.

While the U.S. president continues to impose new rounds of excessive tariffs routinely, market participants are listening closely to Federal Reserve officials to determine whether interest rates might be cut next month.

Recently, San Francisco Fed President Mary Daly stated that the central bank will likely have to lower interest rates in the near future, despite the potential acceleration in inflation due to Donald Trump's tariff policy. According to her, the main reason for this is a sharp weakening in the labor market, with prospects for further deterioration.

For investors in U.S. and global equities, this is a positive signal, as rate cuts increase the attractiveness of stock investments over fixed-income instruments. Another useful takeaway from Daly's comments was her view that any inflationary surge is likely to be short-lived, and therefore does not warrant raising interest rates in response.

It's worth noting that Daly is currently a voting member of the Federal Reserve, so her opinion on monetary policy carries weight in the Fed's decision-making on rates.

Despite Trump's tariff policy, markets continue to edge higher—likely because investors expect a change in Fed leadership (previously signaled by the president) and further labor market weakness to push the central bank toward rate cuts in September. Moreover, if the August jobs report turns out to be as weak as the previous ones, the Fed could cut rates not by 0.25%, but by a full 0.50%. This has precedent—even recently. For example, during the 2020 COVID-19 pandemic, the Fed made back-to-back cuts of 0.50% and then 1.00%, taking rates from 1.75% down to 0.25%.

Of course, that five-year-old example is not a mirror image of the current situation, but it does show that the Fed can act decisively when needed.

All eyes will be on Donald Trump's anticipated speech at 9:00 PM London time. In the economic portion of his address, he will likely not only discuss tariffs but also touch on high interest rates and the need to cut them—possibly down to 1%—to stimulate domestic manufacturers.

While markets have become somewhat accustomed to his tariff policies, any additional pressure on interest rates—combined with the prospect of replacing Fed Chair Jerome Powell with a more compliant candidate—is likely to be received positively by investors. This could spark increased demand for stocks, a decline in the dollar against major Forex currencies (though likely not a sharp one), as those currencies are already under severe pressure due to high U.S. tariffs and obligations to invest in the American economy—undermining the economic development potential of those countries and the EU.

In summary, I believe that the current wave of market optimism amid heightened volatility will likely persist through the end of the week.

Gold

Gold is receiving support amid expectations of a Fed rate cut at the September meeting, reinforced by Trump's increasingly aggressive rhetoric. Against this backdrop, the "yellow metal" could rise toward 3434.00, with 3397.49 serving as a potential buy level.

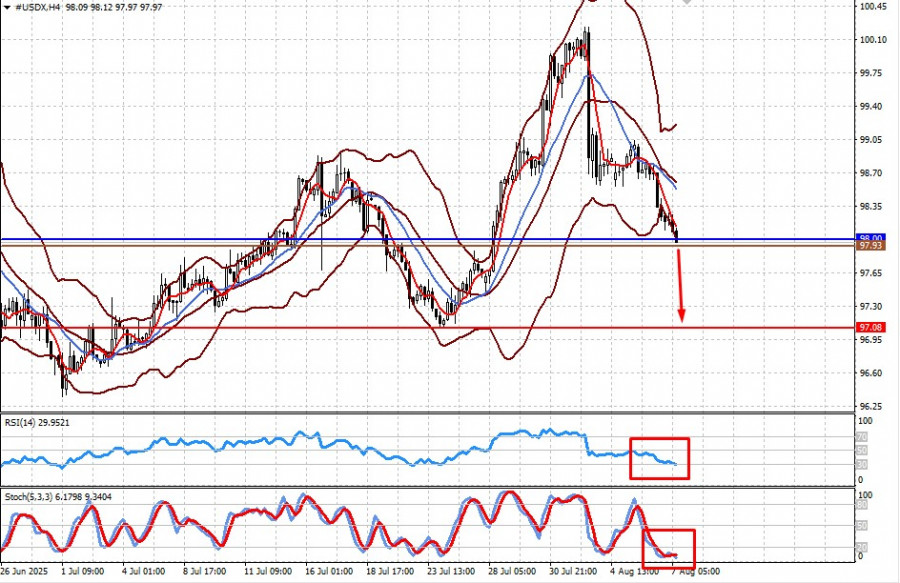

#USDX

The U.S. Dollar Index is declining due to expectations that the Fed will lower interest rates at the September meeting, coupled with Trump's pressure to make that happen. Based on this, a decline toward 97.08 can be expected, with 97.93 serving as a potential sell level.

RÁPIDOS ENLACES