Scheduled Maintenance

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

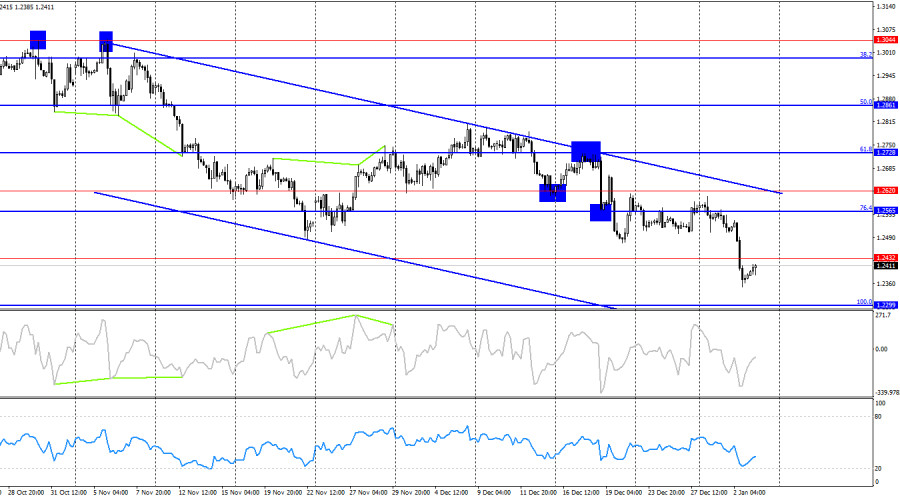

The wave structure raises no questions. The last completed upward wave did not break the previous peak, while the new downward wave broke the previous low. Thus, a new bearish trend is forming, and there is no doubt about it. For this trend to end, the pound would need to rise to the 1.2611–1.2622 zone and close firmly above it.

On Thursday, the economic data calendar contained a few entries, but they were of little importance to traders. Only the US manufacturing PMI report surprised slightly, falling from 49.7 to 49.4 points. However, this surprise was short-lived since traders had expected an even larger decline. Manufacturing sectors in many developed countries have shown disappointing results in recent years. Today, the US ISM Manufacturing Index will be released, giving traders a better understanding of what's happening.

On the 4-hour chart, the pair returned to the 76.4% corrective level at 1.2565 and rebounded from it. This resulted in a new reversal in favor of the US dollar, resuming the decline toward the 100.0% Fibonacci level at 1.2299. The downward trend channel indicates the dominance of bears, which they are unlikely to relinquish soon. Only a breakout above the channel would suggest strong growth for the pound.

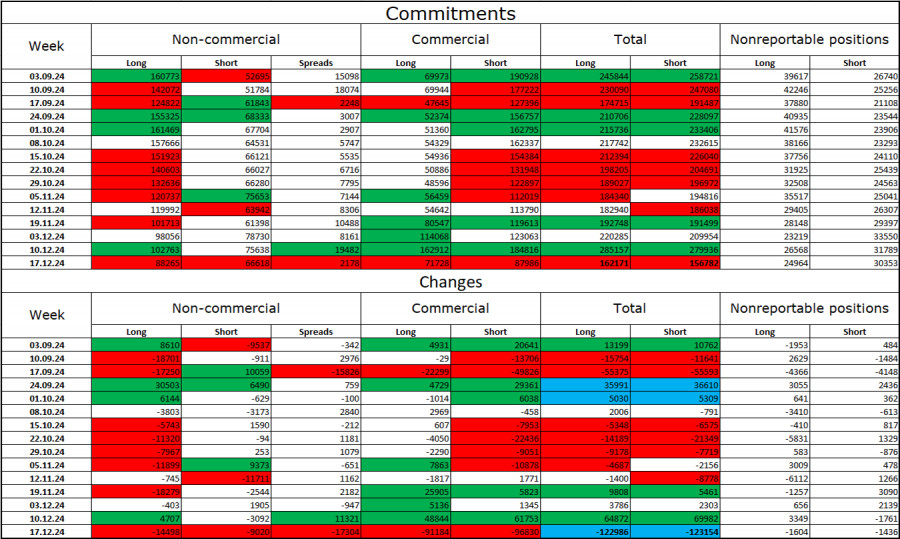

The sentiment among the "Non-commercial" category of traders remained almost unchanged in the last report week. The number of long positions held by speculators increased by 4,707, while the number of short positions decreased by 3,092. Bulls still hold an advantage, but it has been eroding in recent months. The gap between long and short positions now stands at just 27,000: 102,000 versus 75,000.

In my view, the pound still has downward potential, as the COT reports signal increasing bearish positions nearly every week. Over the past three months, the number of long positions has dropped from 160,000 to 102,000, while short positions have risen from 52,000 to 75,000. I believe professional players will continue shedding long positions or increasing shorts as all possible factors supporting the pound have already been priced in. Technical analysis also supports further declines for the pound.

On Friday, the economic calendar features just one significant entry. The impact of the news on market sentiment today may be moderate.

Sales were possible after a close below the 1.2488–1.2508 zone, targeting 1.2370. This target was achieved as expected. Purchases could be considered today after a rebound from the 1.2363–1.2370 zone on the hourly chart, targeting 1.2488. However, buys cannot be a priority at this time, and the pound may not even reach this target.

Fibonacci retracement levels are constructed based on 1.3000–1.3432 on the hourly chart and 1.2299–1.3432 on the 4-hour chart.

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

RÁPIDOS ENLACES