The wave situation remains unchanged. The last completed upward wave failed to break the peak of the previous wave (from March 21st), and the new downward wave broke the last low (from April 2nd). Thus, we are currently dealing with a "bearish" trend, and there is no sign of its completion. For such a sign to appear, the new upward wave (which has not even started forming yet) needs to break the peak of the previous wave (from April 9th). Or the new downward wave (which also has yet to start) fails to break the last low, which has yet to be formed.

The news background on Friday was smoother and calmer than in the previous one and a half weeks. The decline in the EUR/USD pair had been looming for one and a half weeks. First, the ECB meeting showed the regulator's readiness to lower rates in June, then the US labor market and unemployment economic statistics showed high results, and finally, inflation in the USA accelerated to 3.5%. The market held on with its last strength, but it couldn't take it anymore last Wednesday and began to get rid of the euro in favor of the dollar. The Fed will maintain its "hawkish" policy much longer than bullish traders expected, who were actively buying the euro, expecting the US regulator to start lowering rates in the near future. Thus, bears are now ruling the market. On Friday, the inflation report in Germany had no impact on traders' sentiment. Bears began attacking early morning and practically pushed the pair down all day.

On the 4-hour chart, the pair fell to the corrective level of 23.6% (1.0644). A rebound of quotes from this level will favor the euro and some growth towards the Fibonacci level of 38.2%-1.0765. A "bullish" divergence on the CCI indicator and the RSI indicator dropping below 20 increase the probability of the pair rebounding from the level of 1.0644 and starting to rise. Fixing quotes below the level of 1.0644 will increase the probability of further decline towards the corrective level of 0.0%-1.0450.

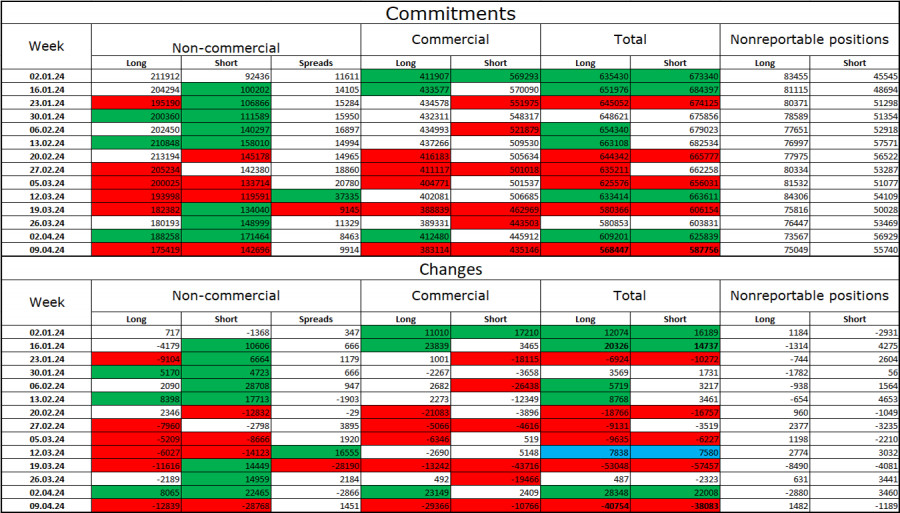

Commitments of Traders (COT) Report:

In the last reporting week, speculators closed 12839 long contracts and 28768 short contracts. The sentiment of the "Non-commercial" group remains "bullish" but continues to weaken rapidly. The total number of long contracts held by speculators now stands at 175 thousand, while short contracts amount to 142 thousand. The situation will continue to change in favor of the bears. The second column shows that the number of short positions increased from 92 thousand to 142 thousand over the past three months. Long positions decreased from 211 thousand to 175 thousand during the same period. Bulls have dominated the market for too long, and now they need a strong news background to resume the "bullish" trend. I don't see such a perspective in the near future.

News Calendar for the USA and the European Union:

European Union - Industrial Production (09:00 UTC).

USA - Retail Sales Volume Change (12:30 UTC).

On April 15th, the economic events calendar contains two entries that could be more important. The impact of the news background on traders' sentiment today may be weak.

Forecast for EUR/USD and trader advice:

Sales of the pair were possible when rebounding from the level of 1.0862 on the 4-hour chart. On Friday, selling could be resumed when closing below the level of 1.0696 with a target of 1.0644. Today, selling can be considered upon fixation below the level of 1.0644 with a target of 1.0519. Purchases can be considered on a rebound from the level of 1.0644 on the 4-hour chart with targets of 1.0696 and 1.0764.

RÁPIDOS ENLACES