Nu Holdings (NYSE:NU), která provozuje brazilskou digitální úvěrovou společnost Nubank, přivádí do svého vedení bývalého šéfa brazilské centrální banky Roberta Campose Neto jako místopředsedu, uvedla společnost v úterním prohlášení pro burzu.

Campos Neto byl také nabídnut post globálního ředitele pro veřejnou politiku a místo v představenstvu, uvedla společnost s tím, že Campos Neto vyjádřil záměr nabídku přijmout a ujmout se těchto funkcí po skončení karantény 1. července.

Campos Neto, který byl jmenován bývalým brazilským prezidentem Jairem Bolsonarem do čela centrální banky, opustil tento post na konci prosince a jeho nástupcem se stal současný guvernér Gabriel Galipolo.

Campos Neto bude přímo podřízený generálnímu řediteli Nubanku Davidu Velezovi, uvedla společnost v tiskovém prohlášení.

Podle prohlášení bude mít za úkol podporovat mezinárodní expanzi digitální banky, spolupracovat s globálními finančními regulátory, zlepšovat ekonomickou a rizikovou analýzu a podílet se na navrhování dlouhodobé obchodní strategie Nubanku.

When discussing the U.S. news landscape in mid-October 2025, it is more appropriate to list which reports will NOT be published this week — and there will be many. For example, it is unlikely that market participants will see any retail sales data or industrial production figures. The Consumer Price Index is also very likely to go unpublished.

So what remains? Only a speech by Jerome Powell. He could have provided the market with guidance last week on how the Federal Reserve plans to proceed at the end of the month, but opted not to do so.

It's important to remember that the FOMC Chair has historically been very cautious in his public statements. The longest government shutdown in U.S. history lasted 35 days. Therefore, there is still a good chance that the government will be operational again before October 29, when the Fed holds its next policy meeting.

Thus, there is little point in speculating on what data the FOMC will review or how it will act — the market has to wait. After all, no one can demand concrete answers from Powell ahead of the meeting.

Consequently, I think Powell will probably not provide anything significant to the markets in the upcoming week as well. So it appears that the leading newsmaker of the forthcoming week will once again be Donald Trump.

On Friday, the U.S. president announced additional tariffs against China in response to China's restrictions on the export of rare-earth metals — resources the U.S. critically depends on. China aims to respond to Trump in kind, but the U.S. president still has many cards up his sleeve.

It looks like the U.S.-China trade war is entering a new phase of escalation. In any case, both Trump and Xi Jinping can be expected to make further announcements that will impact the market.

At this point, I can say that renewed escalation in the trade war suggests that demand for the U.S. dollar will continue to decline.

Even over the past two weeks, there was ample reason for the market to sell the dollar: labor market and business activity data in the U.S. remained weak, and a government shutdown is not a routine event without economic consequences.

Now, a fresh deterioration in U.S.-China relations gets added to the "October list of reasons" to weaken the greenback.

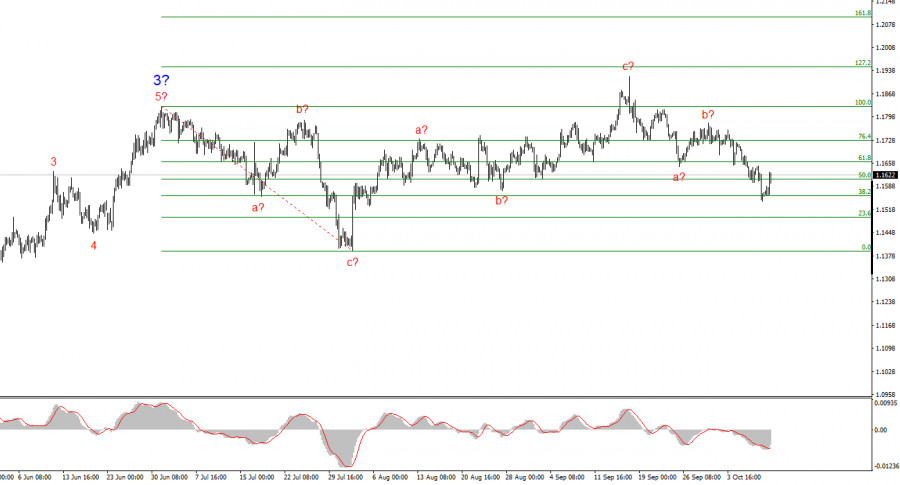

According to the analysis of EUR/USD, the instrument continues to form an upward segment of the trend. The wave structure still entirely depends on the news background, particularly the decisions made by Trump, as well as the domestic and foreign policy of the new White House administration. The targets of the current segment of the trend could reach the 1.2500 range. At present, a complex corrective wave 4 is forming and approaching completion. The bullish wave structure remains intact. Therefore, in the near term, I continue to consider only long positions. By year-end, I expect the euro to rise to the level of 1.2245, which corresponds to the 200.0% Fibonacci level.

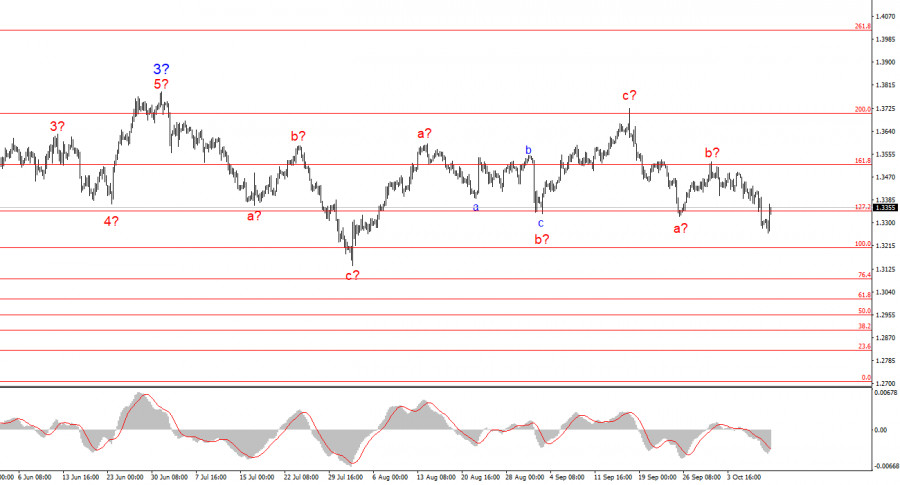

The wave structure of GBP/USD has changed. We are still dealing with an upward, impulsive segment of the trend, but its internal wave formation is becoming more complex. Wave 4 is taking the form of a complicated three-wave correction, and its length is significantly greater than that of wave 2. As we are currently observing the formation of a presumed wave within another corrective three-wave pattern, it may soon be completed. If this is confirmed, the upward movement of the instrument within the global wave framework could resume, with initial targets around the 1.3800 and 1.4000 levels..

1.Wave structures should be simple and easy to understand. Complex structures are difficult to trade and are prone to change.

2.If there is no confidence in the market situation, it is better not to enter the market.

3.One can never have complete certainty about market direction. Always use protective Stop Loss orders.

4.Wave analysis can be combined with other types of analysis and trading strategies.

LINKS RÁPIDOS