The test of the 1.1469 price level coincided with the MACD indicator starting to move down from the zero line, which confirmed the correct entry point for selling the euro. This resulted in the pair falling toward the target level of 1.1612.

Yesterday's release of impressive US PMI data, which significantly exceeded analysts' expectations, provided substantial support to the US currency. The Manufacturing PMI moved firmly above the 50.0 mark, while the Services PMI rose to 55.4, also surpassing forecasts. These results indicate that the US economy is showing resilience and continues to expand despite the Federal Reserve's tight stance. Against this backdrop, the dollar strengthened against most major world currencies, including the euro. The US Dollar Index (DXY), which reflects its value relative to a basket of six major currencies, also recorded a notable increase.

Today will bring the release of Germany's Q2 GDP data. Investors will pay particular attention to components such as consumer spending and capital investment. Export volumes, which have been affected by new US trade tariffs, will also be closely monitored. Rising consumer spending signals higher domestic demand, an important condition for stable economic growth. An increase in capital investment indicates companies' confidence in future prospects and their readiness to expand operations. If Germany's GDP figures exceed forecasts, the euro may strengthen. Conversely, weak results could fuel recession concerns and trigger a decline in EUR/USD.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

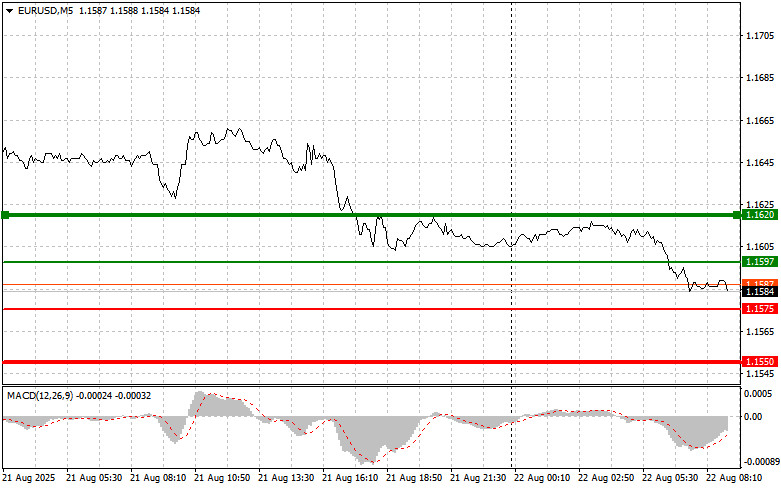

Scenario No. 1: Buy the euro today at around 1.1597 (green line on the chart) with the target of rising to 1.1620. At 1.1620, I plan to exit the market and sell the euro in the opposite direction, expecting a move of 30–35 points from the entry point. Euro growth can only be expected after very strong economic data. Important! Before buying, make sure the MACD indicator is above the zero line and only beginning its upward move.

Scenario No. 2: I also plan to buy the euro today if there are two consecutive tests of the 1.1575 price level while the MACD indicator is in oversold territory. This would limit the pair's downside potential and trigger a reversal upward. Growth can then be expected toward the opposite levels of 1.1597 and 1.1620.

Scenario No. 1: I plan to sell the euro after it reaches 1.1575 (red line on the chart). The target will be 1.1550, where I plan to exit the market and immediately buy in the opposite direction, expecting a move of 20–25 points upward from that level. Pressure on the pair will return today if the data is weak. Important! Before selling, ensure the MACD indicator is below the zero line and has just started its downward move.

Scenario No. 2: I also plan to sell the euro today if there are two consecutive tests of the 1.1597 price level while the MACD indicator is in overbought territory. This would limit the pair's upside potential and trigger a reversal downward. A decline can then be expected toward the opposite levels of 1.1575 and 1.1550.

LINKS RÁPIDOS