(Reuters) – Warner Bros Discovery (NASDAQ:WBD) směřuje k možnému rozdělení, informovala ve čtvrtek CNBC, protože mediální společnosti zkoumají možnosti pro své ztrátové kabelové televizní podnikání a soustředí se na rychleji rostoucí divize streamování a studia.

Akcie WBD na tuto zprávu vzrostly o více než 4 % a odrazily se tak od dřívějších ztrát téměř 6 %, které byly vyvolány nepříznivou čtvrtletní zprávou.

Společnost nesplnila odhady tržeb za první čtvrtletí a dříve v ten den oznámila vyšší než očekávanou ztrátu kvůli slabým výsledkům v kinech a pokračujícímu poklesu kabelové televize.

The GBP/USD pair showed a slight downward movement on Friday amidst easing tensions between China and the United States. It is also worth noting that over the weekend, the United States witnessed its third protest against Donald Trump's immigration and trade policies, with this one being the largest by far. Demonstrations took place in more than 2,600 cities across America, and not all of them were peaceful or orderly.

As we can see, America is rebelling against Donald Trump, which is quite logical considering both his foreign and domestic policies. Consequently, we continue to believe that with Trump at the helm, America is heading into decline. Many central banks are already moving away from using the U.S. dollar as a reserve currency. People are already leaving America. And it is already evident that doing business with the U.S. will become increasingly difficult in the coming years. Therefore, we foresee further decline for the dollar.

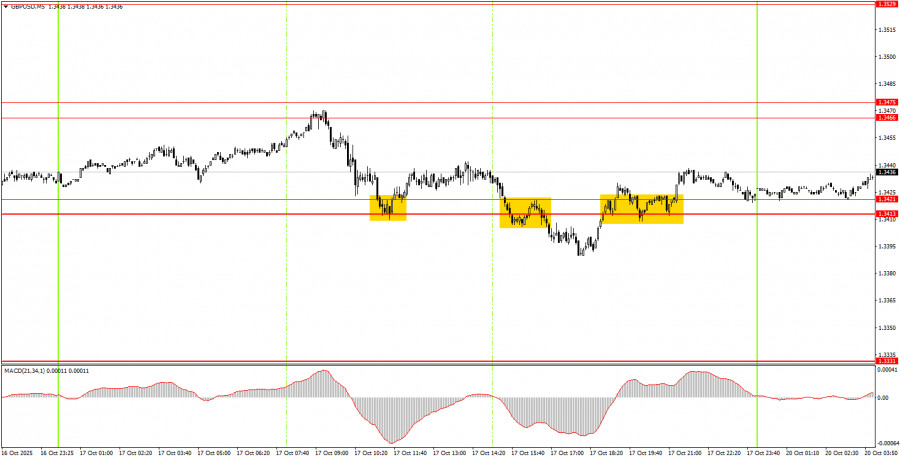

On the 5-minute timeframe, three trading signals were formed on Friday. All three were false, as the price movement throughout the day was very weak. The price generated signals three times in the 1.3413–1.3421 area but failed to move even 20 pips in the desired direction. As a reminder, no matter how good trading signals are, if volatility is near zero, making a profit is impossible.

On the hourly timeframe, the GBP/USD pair has finally begun forming a new bullish trend, which could mark the start of a new leg in the global uptrend. As previously mentioned, there are no fundamental reasons for a sustained dollar rally, so in the medium term, we expect the dollar to move only to the upside. Donald Trump's policy, which has sharply intensified regarding tariffs in recent weeks, will continue to drive the market away from the U.S. dollar.

On Monday, the GBP/USD pair may attempt to continue its upward movement, as the trend has shifted to bullish. A bounce from the 1.3413–1.3421 zone would allow for opening long positions with targets at 1.3466–1.3475. A consolidation of price below the 1.3413–1.3421 area would indicate a new phase of downward correction.

On the 5-minute timeframe, trading can now be conducted around the following levels: 1.3102–1.3107, 1.3203–1.3211, 1.3259, 1.3329–1.3331, 1.3413–1.3421, 1.3466–1.3475, 1.3529–1.3543, 1.3574–1.3590, 1.3643–1.3652, 1.3682, 1.3763. On Monday, no significant events or reports are scheduled in either the United Kingdom or the United States. As a result, there will be little for traders to respond to throughout the day, and volatility may once again remain low.

Important speeches and reports (always shown in the news calendar) can significantly impact currency pair movements. Therefore, during their release, it's best to trade with extreme caution or exit the market entirely to avoid sharp reversals against the preceding trend.

Beginner forex traders should remember that not every trade can be profitable. Developing a clear strategy and using proper money management are key to long-term trading success.

SZYBKIE LINKI