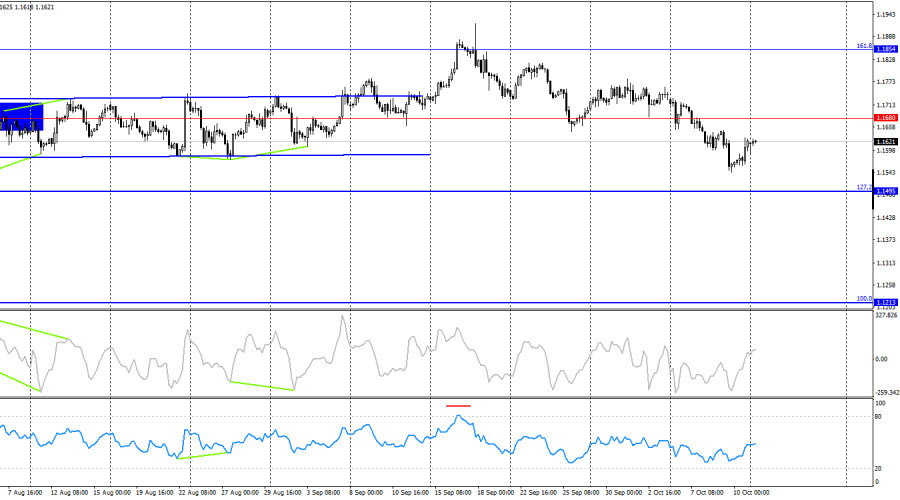

On Friday, the EUR/USD pair reversed in favor of the euro and consolidated above the Fibonacci level 61.8%– 1.1594. Thus, the upward movement may continue toward the resistance level 1.1645 – 1.1656. A rebound from this zone will favor the U.S. dollar and the resumption of a decline toward the corrective level 76.4% – 1.1517. Consolidation above the zone will increase the likelihood of further growth toward the 38.2% corrective level at 1.1718.

The wave situation on the hourly chart remains simple and clear. The last completed upward wave did not break the previous wave's peak, while the new downward wave broke the previous low. Thus, the trend remains "bearish" for now. Recent labor market data and the revised FOMC outlook support bullish traders, so I expect a trend reversal to "bullish." To end the bearish trend, the price must consolidate above the last peak – 1.1779.

On Friday, there were few interesting economic reports – only the University of Michigan Consumer Sentiment Index, which traders largely ignored. In the evening, however, Trump announced that starting November 1, tariffs on imports from China would rise by 100%. It is important to note that tariffs of 100%, on top of existing ones, effectively mean a halt in trade between China and the U.S. At a minimum, Chinese exports to the U.S. will drop almost to zero, similar to last summer when reciprocal tariffs between the two countries were in the triple digits.

A response from Beijing should be expected soon, but it is already clear that China will mirror all tariffs on U.S. imports. Thus, a new round of the global trade war begins, which does not favor the bears or the U.S. dollar. I continue to expect the resumption of the bullish trend.

On the 4-hour chart, the pair consolidated below 1.1680, allowing traders to anticipate a continuation of the decline toward the 127.2% corrective level at 1.1495. The CCI indicator is showing a developing bullish divergence, which may halt the current drop. A close above 1.1680 will favor the euro and resume the bullish trend toward the 161.8% corrective level at 1.1854.

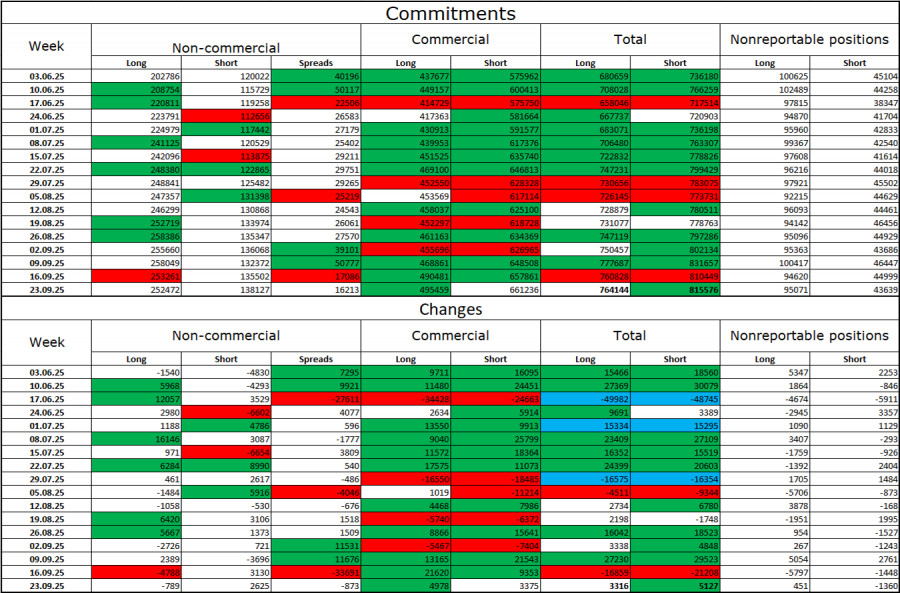

Commitments of Traders (COT) Report:

During the last reporting week, professional players closed 789 Long positions and opened 2,625 Short positions. Sentiment among the Non-commercial group remains bullish due to Donald Trump and has strengthened over time. The total number of Long positions held by speculators now stands at 252,000, while Short positions are 138,000. The gap is nearly twofold.

Additionally, note the number of green cells in the table above, which reflect a strong accumulation of positions in the euro. In most cases, interest in the euro continues to grow, while interest in the dollar is declining.

For 33 consecutive weeks, major players have been reducing Short positions and increasing Long positions. Donald Trump's policies remain the most significant factor for traders, as they could cause numerous problems with long-term and structural consequences for the U.S. Despite the signing of several important trade agreements, many key economic indicators continue to decline.

News Calendar for the U.S. and the Eurozone:

On October 13, the economic calendar contains no noteworthy entries. The news background will have no impact on market sentiment on Monday.

EUR/USD Forecast and Trader Recommendations:

Sales are possible today if the pair rebounds from the resistance level 1.1645 – 1.1656 on the hourly chart, with a target of 1.1594, or if it closes below 1.1594, with a target of 1.1517. Purchases could be considered if the pair closes above 1.1594, with a target of 1.1645 – 1.1656. These trades may be held open today.

Fibonacci grids are built from 1.1392 – 1.1919 on the hourly chart and from 1.1214 – 1.0179 on the 4-hour chart.

SZYBKIE LINKI